Shopify (NasdaqGS:SHOP) Enhances ECommerce With AI-Powered Integration And Real-Time Protocol

Shopify (NasdaqGS:SHOP) recently experienced a noteworthy price increase of 23%, aligning with several significant enhancements in their business operations. The integration of ai12z's AI-powered eCommerce functionality and real-time data connectivity aimed at enhancing user engagement likely supported a positive market sentiment. These developments came amid Shopify's inclusion in the NASDAQ-100 Index and various strategic partnerships, such as with Akeneo and Sovos, which strengthened its platform and global reach. While these events provided some momentum, the stock's movement is generally consistent with broader market gains, which have also been positive over the past year.

We've identified 2 risks with Shopify and understanding the impact should be part of your investment process.

Find companies with promising cash flow potential yet trading below their fair value.

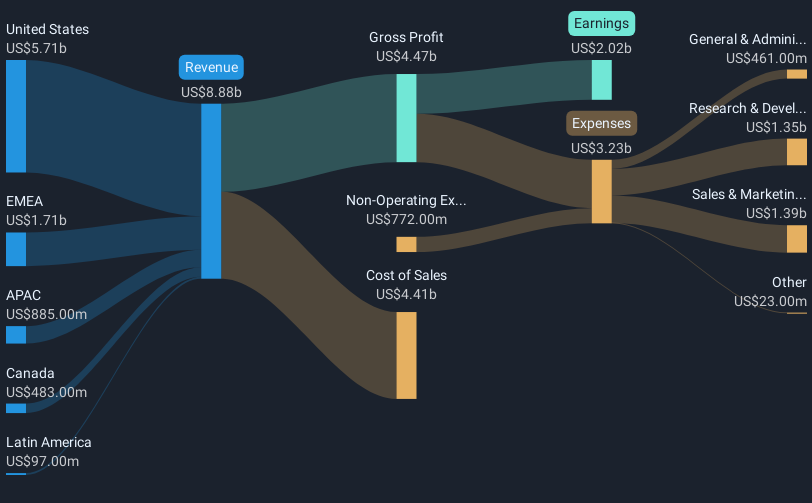

The recent developments at Shopify, including the integration of AI-powered eCommerce features and strategic partnerships, are expected to bolster the company's operational capabilities. This aligns with Shopify's focus on expanding its global reach and advancing its technology to enhance merchant efficiency. These enhancements potentially support revenue growth and could lead to improved earnings and operational margins. Over a longer-term horizon, Shopify's total returns, including share price appreciation and dividends, have been substantial, achieving a 247.37% increase over the past three years. This robust growth suggests strong market support and reflects the company's strategic initiatives.

When comparing the company's recent one-year return to the broader market, Shopify has experienced superior performance, surpassing the US market's 12.6% return and the US IT industry's 36.9% gain within the same timeframe. This outperformance highlights the positive reception of Shopify's recent business enhancements and strategic decisions. The consensus analyst price target for Shopify stands at US$115.18, with the current share price slightly below this at US$109.82, indicating a relatively small discount to the expected valuation. However, analysts have set a higher consensus price target of US$134.54, suggesting potential upside if Shopify continues to meet growth expectations in revenue and earnings, especially as they aim for an annual revenue growth of 17.3%.

According our valuation report, there's an indication that Shopify's share price might be on the expensive side.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10