Kratos Defense & Security Solutions (NasdaqGS:KTOS) Expands With New Oklahoma Facility

Kratos Defense & Security Solutions (NasdaqGS:KTOS) recently saw pivotal changes as it was dropped from several indexes in June 2025 and completed a $500 million follow-on equity offering. The establishment of a new manufacturing facility in Oklahoma is set to enhance production capacity and create new jobs. During the past quarter, the stock price moved up 56%, standing out against a year-long market rise of 13%. The company's business expansion, particularly in the turbojet segment, and notable contracts with entities like the U.S. Space Force, collectively contributed positively amidst a generally flat market trend.

Be aware that Kratos Defense & Security Solutions is showing 1 weakness in our investment analysis.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

The recent developments at Kratos Defense & Security Solutions could significantly influence the company's trajectory. The establishment of a new facility in Oklahoma aims to expand production capacity for the company's turbojet segment and secure new industry contracts, which may boost revenue streams in the long term. Although the company's stock was dropped from several indexes, completing a US$500 million follow-on equity offering provides newfound capital that could be channeled into strategic projects. This aligns with existing catalysts, such as defense budget increases and strategic contracts, which already position Kratos for potential growth in earnings and revenue.

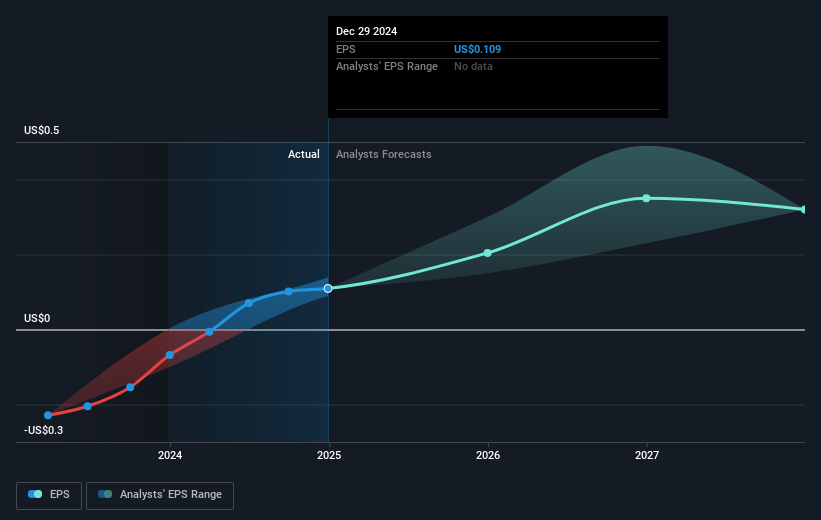

Over a three-year period, Kratos shares achieved a total return of 296.25%. In the last year alone, the shares outperformed the US Aerospace & Defense industry, which returned 40.8%. The company's recent 56% share price uptick contrasts with the consensus price target of US$34.82, which is slightly lower than the current share price of US$36.23. Analysts forecast a potential revenue rise to US$1.7 billion by 2028, with earnings increasing to US$53.9 million. Although the recent developments are generally positive, industry-specific risks, such as supply chain issues and potential contract delays, could impact these forecasts. Nevertheless, the recent corporate activities, including new contracts and capital investment opportunities, could enhance Kratos' operating leverage and benefit future earnings.

Click here to discover the nuances of Kratos Defense & Security Solutions with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kratos Defense & Security Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10