XinKong International Capital Holdings Limited's (HKG:993) market cap surged HK$270m last week, public companies who have a lot riding on the company were rewarded

Key Insights

- The considerable ownership by public companies in XinKong International Capital Holdings indicates that they collectively have a greater say in management and business strategy

- A total of 2 investors have a majority stake in the company with 54% ownership

- Ownership research, combined with past performance data can help provide a good understanding of opportunities in a stock

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

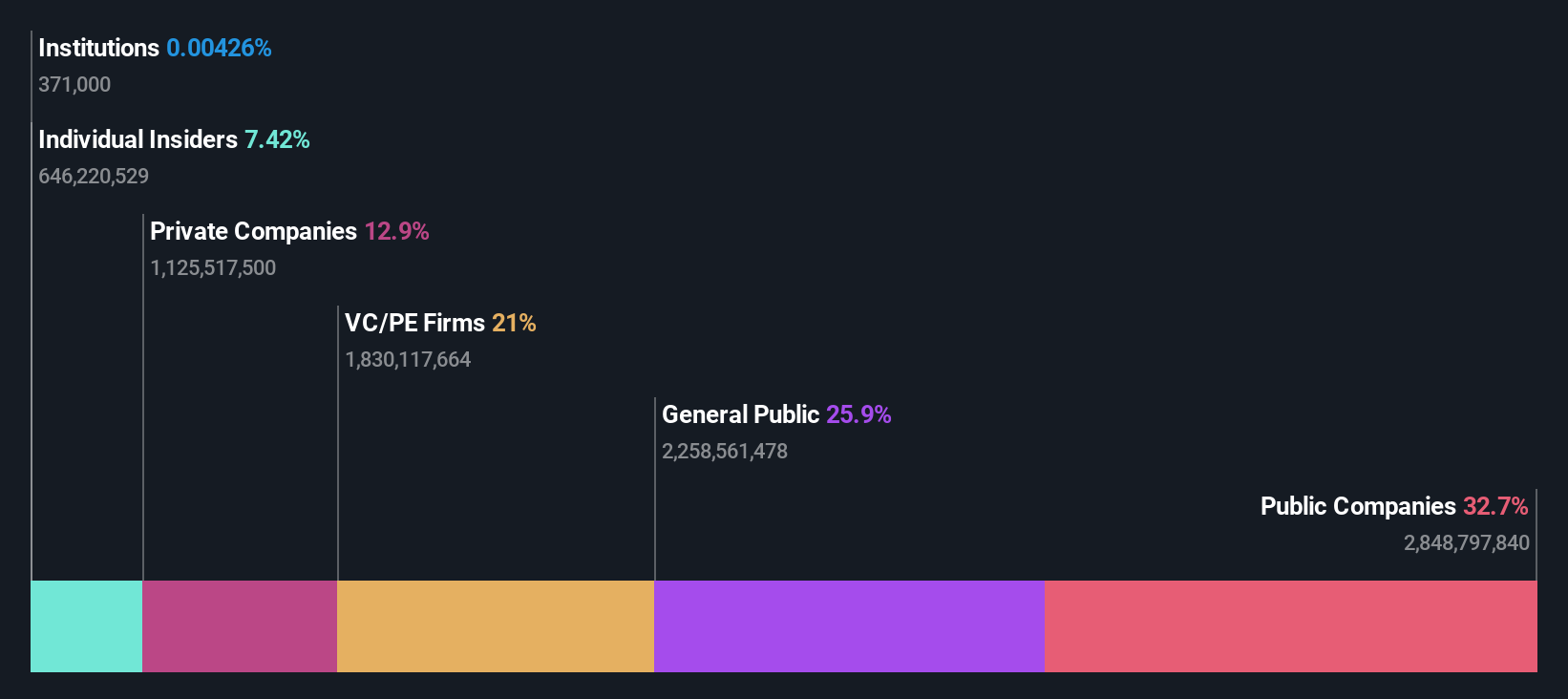

A look at the shareholders of XinKong International Capital Holdings Limited (HKG:993) can tell us which group is most powerful. With 33% stake, public companies possess the maximum shares in the company. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

As a result, public companies collectively scored the highest last week as the company hit HK$2.4b market cap following a 12% gain in the stock.

Let's delve deeper into each type of owner of XinKong International Capital Holdings, beginning with the chart below.

See our latest analysis for XinKong International Capital Holdings

What Does The Lack Of Institutional Ownership Tell Us About XinKong International Capital Holdings?

Small companies that are not very actively traded often lack institutional investors, but it's less common to see large companies without them.

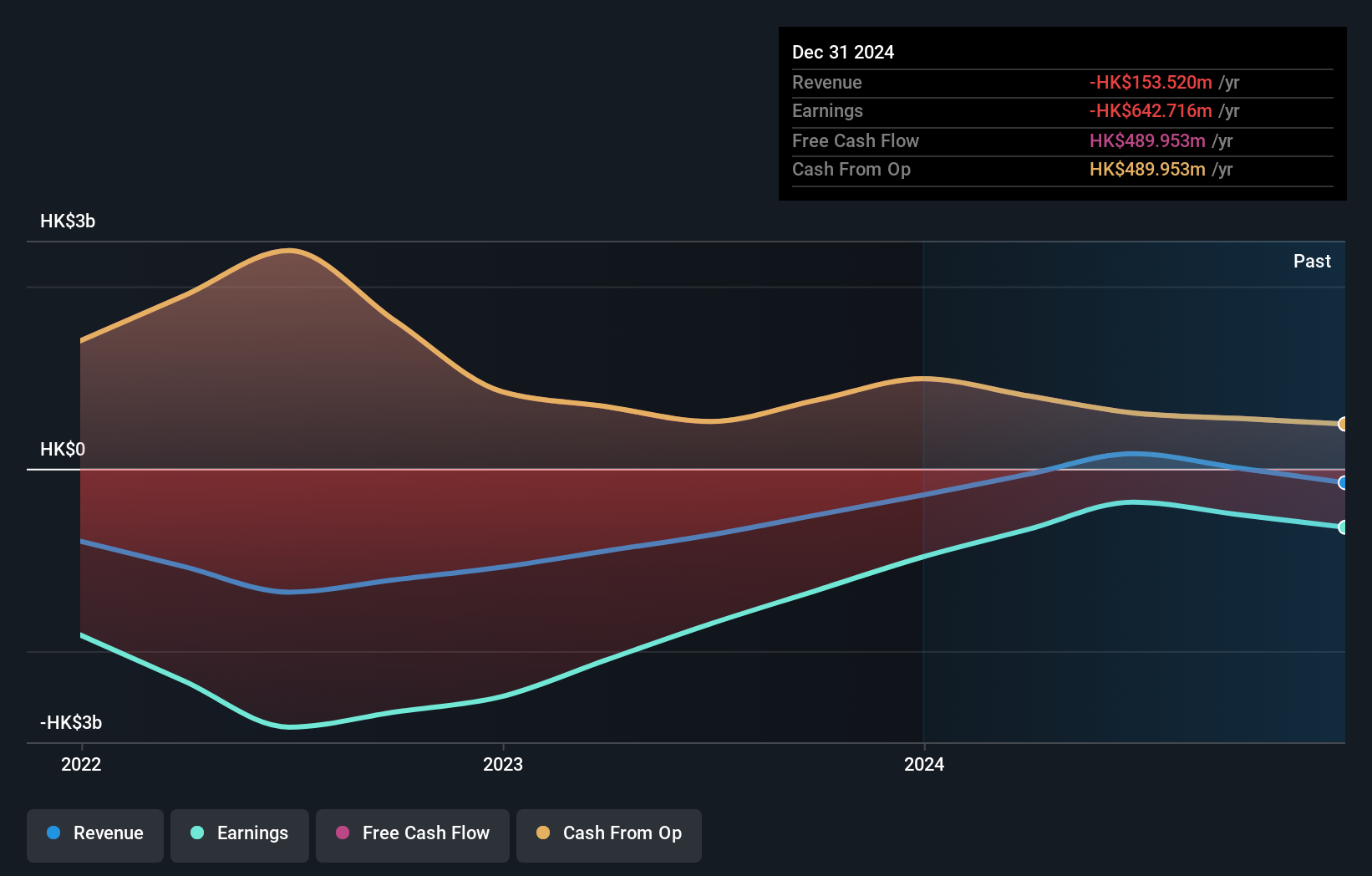

There could be various reasons why no institutions own shares in a company. Typically, small, newly listed companies don't attract much attention from fund managers, because it would not be possible for large fund managers to build a meaningful position in the company. Alternatively, there might be something about the company that has kept institutional investors away. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of XinKong International Capital Holdings, for yourself, below.

XinKong International Capital Holdings is not owned by hedge funds. China CITIC Financial Asset Management Co., Ltd. is currently the company's largest shareholder with 33% of shares outstanding. With 21% and 11% of the shares outstanding respectively, China CITIC Financial AMC International Holdings Limited and Ningxia Tianyuan Manganese Industry Co. Ltd are the second and third largest shareholders.

To make our study more interesting, we found that the top 2 shareholders have a majority ownership in the company, meaning that they are powerful enough to influence the decisions of the company.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of XinKong International Capital Holdings

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

We can report that insiders do own shares in XinKong International Capital Holdings Limited. In their own names, insiders own HK$181m worth of stock in the HK$2.4b company. It is good to see some investment by insiders, but it might be worth checking if those insiders have been buying.

General Public Ownership

With a 26% ownership, the general public, mostly comprising of individual investors, have some degree of sway over XinKong International Capital Holdings. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Equity Ownership

Private equity firms hold a 21% stake in XinKong International Capital Holdings. This suggests they can be influential in key policy decisions. Some might like this, because private equity are sometimes activists who hold management accountable. But other times, private equity is selling out, having taking the company public.

Private Company Ownership

We can see that Private Companies own 13%, of the shares on issue. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Public Company Ownership

It appears to us that public companies own 33% of XinKong International Capital Holdings. It's hard to say for sure but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Be aware that XinKong International Capital Holdings is showing 3 warning signs in our investment analysis , you should know about...

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10