Weekly Picks: 📈 MSTR's Leveraged Bitcoin Exposure, QS' Breakthrough Battery Tech, and BBWI's Turnaround Potential

Each week our analysts hand pick their favourite Narratives from the community ( what is a Narrative? ).

This week’s picks cover:

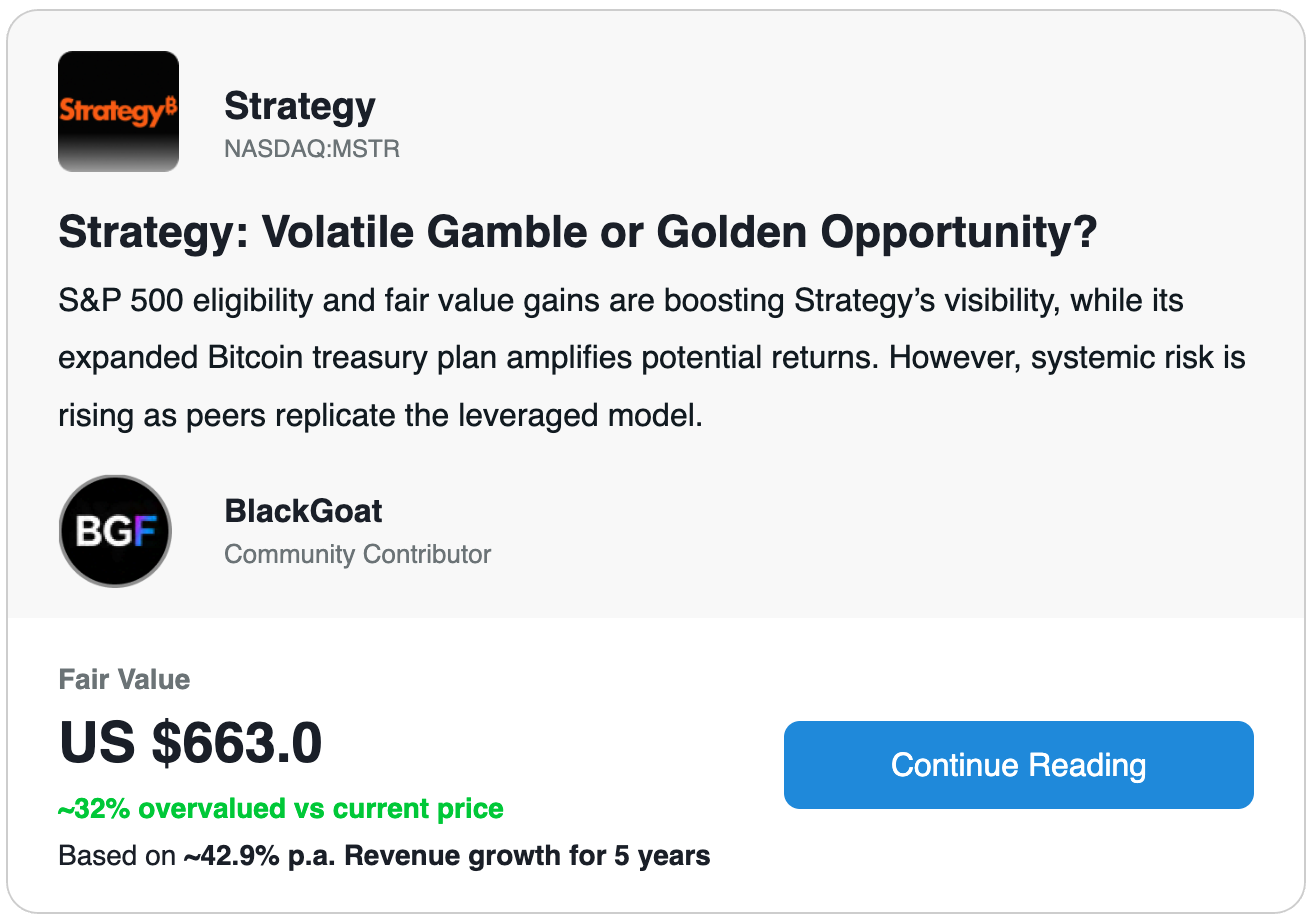

- 📈 Why Strategy is a compelling vehicle to gain leveraged Bitcoin exposure.

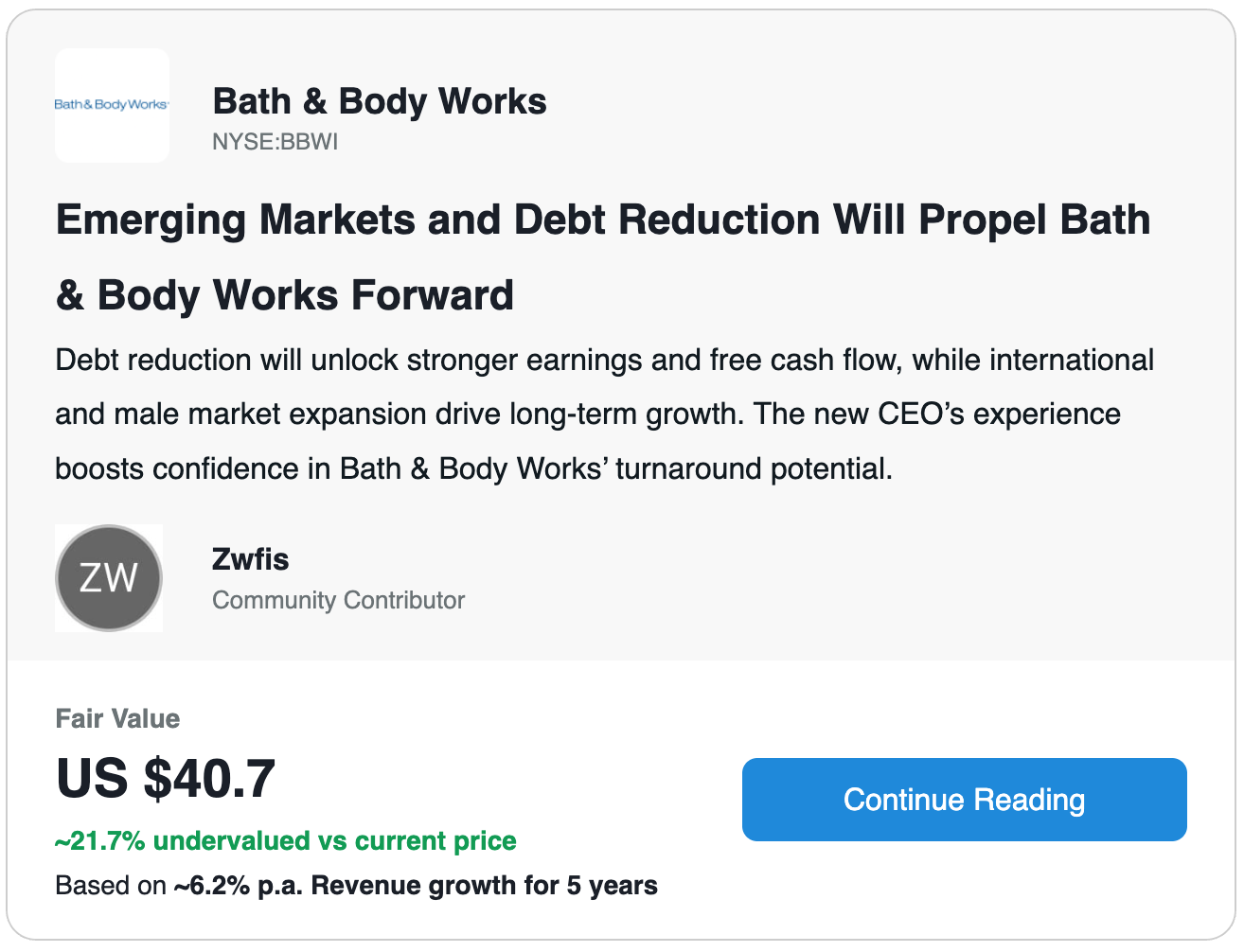

- 💰 How debt reduction is a key driver to Bath & Body Works' success.

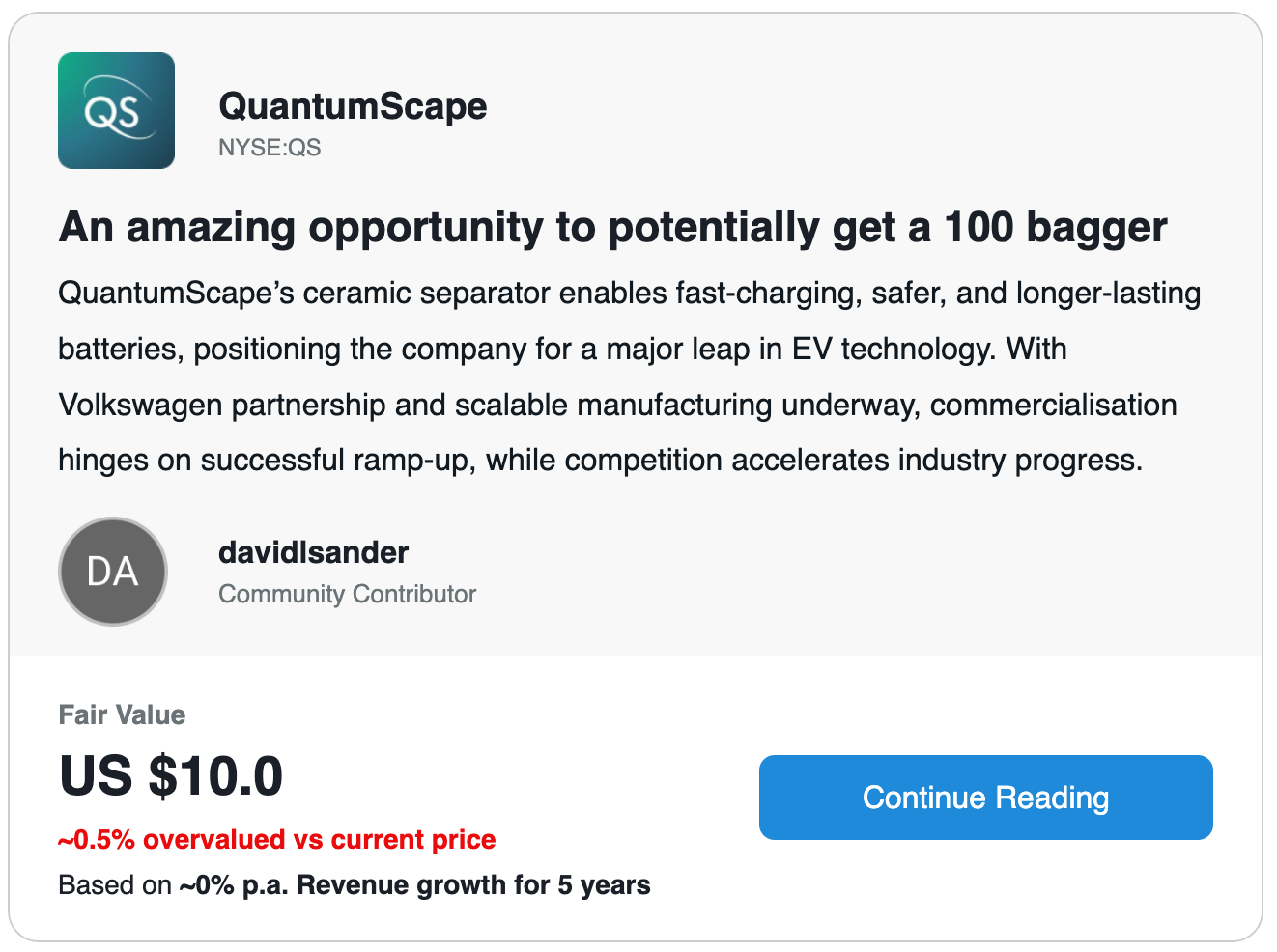

- 🔋 Why QuantumScape’s technology could solve all current EV problems.

💡 Why we like it: This narrative nails the bull and bear case balance for one of the market’s most volatile Bitcoin plays. It lays out Strategy’s evolution into a Bitcoin-native financial platform well, detailing catalysts like S&P 500 inclusion, regulatory tailwinds, and the ambitious 42 42 Plan. The base/bull/bear scenario framing makes the asymmetric risk/reward pretty clear for investors debating if this is a leveraged bet or a generational opportunity.

💡 Why we like it: This is a thoughtful deep-dive into Bath & Body Works’ turnaround potential, blending clear-eyed analysis of its debt drag with optimism for growth under new leadership. Zwfis connects the dots between Heaf’s Nike experience, international expansion, and untapped male-market demand while showing how deleveraging could unlock significant shareholder value. Like the MSTR narrative, the bear/base/bull projections give a grounded but ambitious framework for assessing the upside.

💡 Why we like it: This narrative is a masterclass in battery science. The deep dive into QuantumScape’s ceramic separator, Cobra process, and “and problem” solutions reads like a rare glimpse under the hood of a potentially world-changing technology. While the science is compelling, it’s not commercial yet. An estimate of its future revenue and earnings potential would help justify the valuation estimate.

What's next?

-

🔔 Know when to act: Set the narrative valuations as your own fair value to know when to buy, hold or sell the stock.

-

🤔 Get answers: Ask the author any questions in the comments section. Feel free to like as well to support their work.

-

✨ Discover more Narratives: There are hundreds of other insightful stock narratives on our Community page .

-

✍️ Build an audience: Have your narrative seen by millions of investors, simply meet our Featuring criteria to go into the running!

Disclaimer

BlackGoat is an employee of Simply Wall St, but has written a narrative in their capacity as an individual investor. Simply Wall St analyst Michael Paige has a position in NASDAQ:MSTR. Simply Wall St have no position in any of the companies mentioned. These narratives are general in nature and explore scenarios and estimates created by the authors. These narratives do not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company’s future performance and are exploratory in the ideas they cover. The fair value estimate’s are estimations only, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Michael Paige and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10