AST SpaceMobile (ASTS) Is Up 23.8% After Google Joins $203M Funding and ETF Launch News

- AST SpaceMobile recently completed a private placement of 8,900,000 shares at US$22.84 each, raising over US$203 million with participation from Google and announced a new US$100 million equipment financing facility led by Trinity Capital.

- Increased visibility for AST SpaceMobile comes as Tradr launched a leveraged ETF tied to the company, signaling growing interest from institutional investors in satellite and advanced connectivity solutions.

- We’ll explore how Google’s involvement in the capital raise influences AST SpaceMobile’s investment narrative and potential industry positioning.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is AST SpaceMobile's Investment Narrative?

To be a shareholder in AST SpaceMobile right now, you need to believe the company can convert technological novelty and global telecom partnerships into meaningful top-line growth, while managing persistent losses and cash burn. The influx of capital from Google and institutional financing by Trinity Capital is timely, strengthening AST SpaceMobile’s liquidity and potentially reducing concerns about near-term funding for its ambitious satellite rollout and European joint venture with Vodafone. Google’s involvement and the addition of a leveraged ETF tied to the stock likely boost AST SpaceMobile’s industry profile and could serve as short-term catalysts, particularly with heightened institutional attention. However, these developments do not directly address ongoing risks around dilution, lack of meaningful revenue, and the company’s continued unprofitability. While the capital raise eases immediate financial pressure, fundamentals like losses and execution still remain front and center. Yet even with this new injection, share dilution is an issue every investor should be aware of.

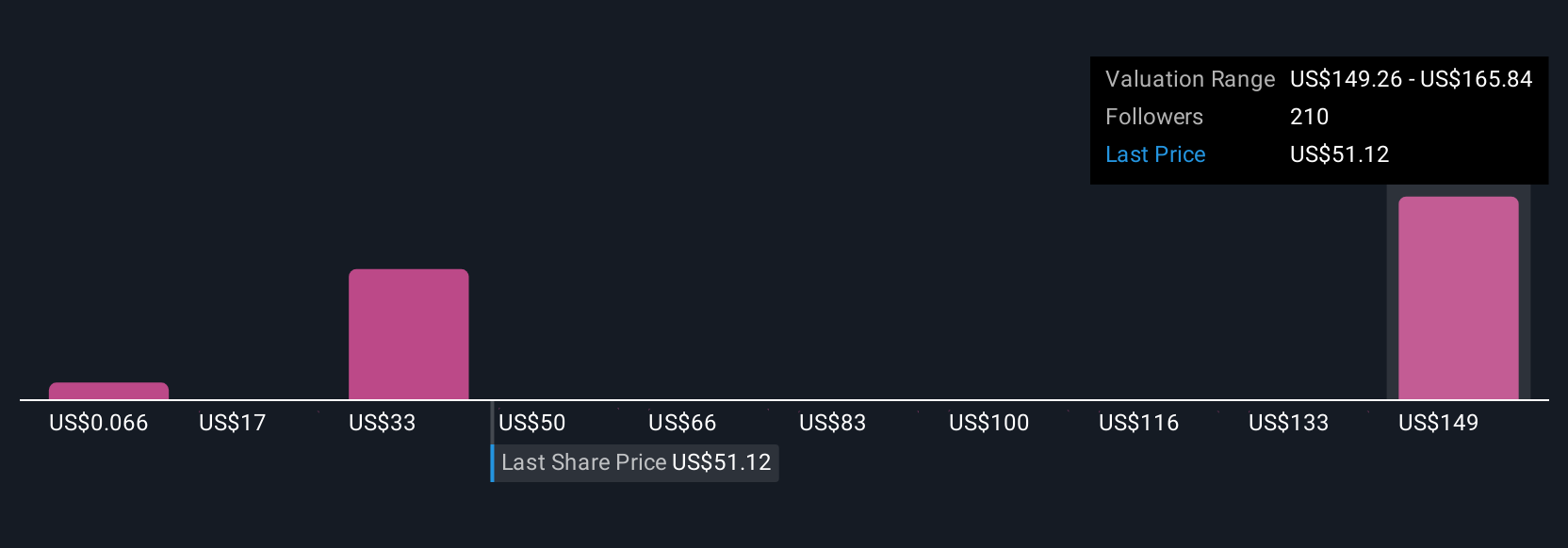

AST SpaceMobile's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 43 other fair value estimates on AST SpaceMobile - why the stock might be worth over 3x more than the current price!

Build Your Own AST SpaceMobile Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AST SpaceMobile research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free AST SpaceMobile research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AST SpaceMobile's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10