Riot Platforms (RIOT) Sees 115% Stock Price Surge Over Last Quarter

Riot Platforms (RIOT) recently announced a June 2025 production increase to 450 Bitcoin, a significant jump from 255 Bitcoin the previous year. Despite this operational success, the company faced challenges with removal from various Russell indices by the end of June. Over the last quarter, RIOT's stock exhibited a remarkable 115% price increase, contrasting the flat market performance in the last week and a 15% rise over the past year. While Riot's operational achievements supported growth, index removals might have tempered gains, contributing to a complex relationship between company performance and broader market trends.

You should learn about the 3 weaknesses we've spotted with Riot Platforms (including 1 which is a bit concerning).

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

The recent announcement of Riot Platforms' operational success in boosting Bitcoin production to 450 units by mid-2025 marks a pivotal moment for the company. This development aligns with Riot's broader strategy of leveraging its Corsicana and Rockdale facilities to enhance mining capacity and explore AI/HPC opportunities. However, the removal from several Russell indices could temper market enthusiasm and underscore how external factors, like index inclusions, can impact stock performance despite improving operational metrics.

Over the past five years, Riot Platforms' shares exhibited a very large total return of 524.32%, underscoring significant long-term value creation amidst a challenging landscape. In comparison, the stock's performance matched the US market's 15% return over the past year. This long-term growth contextualizes the 115% price increase over the recent quarter, although market dynamics, like fluctuations in Bitcoin prices and competitive pressures, remain influential.

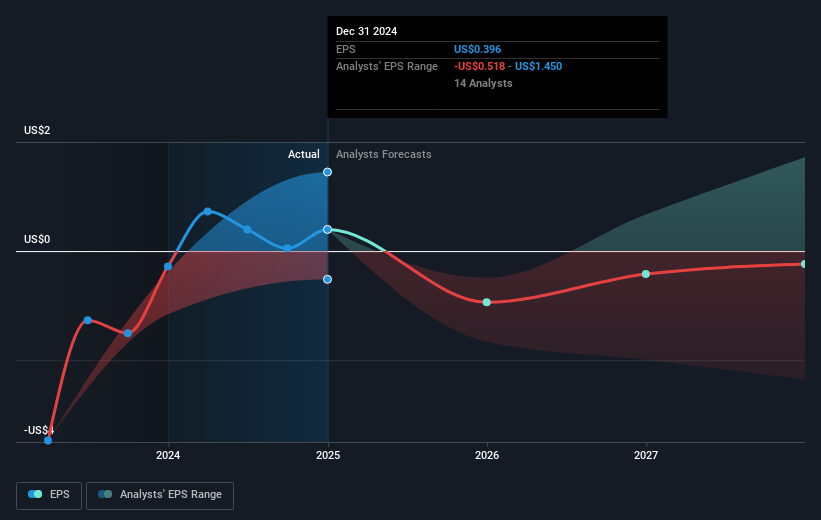

The price surge highlights investor optimism, contrasting the market's relatively flat recent performance. With a current share price of US$13.86, Riot is trading at a 17.36% discount to the consensus analyst price target of US$16.27. Analysts anticipate annual revenue growth of 20%, yet profitability remains a distant goal as earnings forecasts continue to project a loss. The company's focus on increasing Bitcoin holdings and expanding its hash rate suggests potential for revenue and asset value growth, although inherent risks like Bitcoin volatility and capital expenditure demands persist.

Learn about Riot Platforms' future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10