Goldman Sachs Group (GS) Reports Increased Q2 Net Income of US$3,723 Million

Goldman Sachs Group (GS) recently reported strong financial results for the second quarter and the first half of 2025, with net income and earnings per share showing significant year-on-year growth. This robust performance aligns with a 39% rise in its share price over the last quarter. The company's inclusion in the Russell Top 50 Index and high-profile executive appointments, such as Raghav Maliah's new role in investment banking, further reflect strategic refinements aimed at enhancing its market position. Meanwhile, broader market trends, including record highs for major indices, provided a favorable backdrop for this price movement.

We've discovered 2 weaknesses for Goldman Sachs Group that you should be aware of before investing here.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Goldman Sachs Group's recent financial results and strategic developments reflect a concerted effort to enhance its market position, with a strong 39% rise in its share price over the last quarter. This aligns with a longer-term total shareholder return of 287.95% over the past five years, underscoring a robust performance trajectory. Against a backdrop of broader market gains, GS not only outpaced the Capital Markets industry, which returned 32% over the past year, but also exceeded the general US market return of 12.4%.

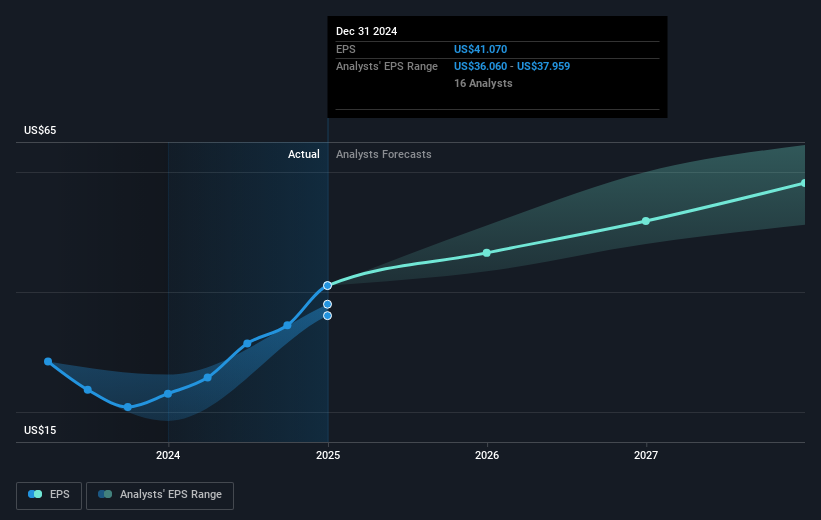

The company's continued growth in advisory and asset management—bolstered by M&A activity and high client demand—is poised to shift revenues toward more stable, high-margin streams. Strategic adoption of AI and digital transformation projects are expected to further enhance efficiency and drive earnings higher. These initiatives could augment the revenue and earnings forecasts, which currently project revenues at US$53 billion and earnings at US$14.13 billion. However, potential risks such as geopolitical uncertainties and regulatory changes could impact these projections.

Despite the current share price of US$708.82, which is above the analyst consensus target of US$670.4, the slight price target discount indicates the expectation of moderate returns aligned with the fair valuation analysis. Investors are encouraged to assess these targets in line with their expectations of future performance, considering that GS is trading below industry price-to-earnings ratios, suggesting it may offer good relative value.

Dive into the specifics of Goldman Sachs Group here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10