Palantir Technologies (PLTR) Advances Federal And Clinical AI Solutions With New Collaborations

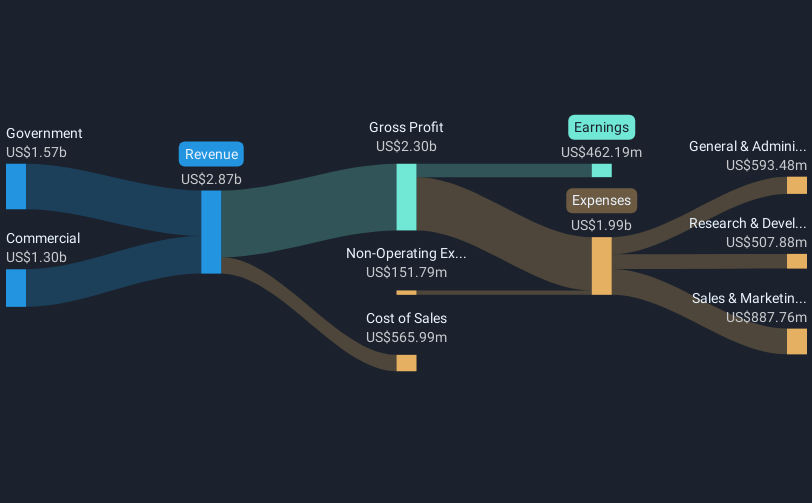

Palantir Technologies (PLTR) has recently forged partnerships with Knightscope Inc. for entry into the U.S. federal marketplace and with Velocity Clinical Research to enhance clinical trial efficiency. These collaborations coincide with the company's 61% share price increase over the past quarter. This rise aligns with Palantir's heightened revenue growth guidance and positive earnings report, which showed increased sales and net income. Amid a generally buoyant stock market, where the Nasdaq reached record highs, Palantir's performance was further buoyed by its inclusion in prominent indexes and strategic alliances, reinforcing its growth trajectory amid a favorable market environment.

We've identified 1 weakness for Palantir Technologies that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

Over a three-year period, Palantir Technologies' shares have witnessed a very large total return of 1392.68%. Over the past year alone, the company's performance was strong compared to the U.S. Software industry, which returned 23.1%. This substantial growth trajectory indicates robust market confidence in Palantir's prospects and strategic developments.

The company's recent partnerships, index inclusions, and revenue growth projections could continue to influence revenue and earnings forecasts positively. Palantir's positive earnings report, alongside its expanded guidance, aligns with broader market optimism and potentially strengthens future performance expectations. However, current market prices, being above the $67.25 fair value estimate and consensus price target of $104.96, suggest a possible pricing premium that investors might need to scrutinize in the context of valuation analysis and future financial outcomes.

Our valuation report here indicates Palantir Technologies may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10