Goldman Sachs Group Inc. (NYSE:GS) reported second-quarter results that beat analyst expectations on Wednesday, boosted by robust gains in its global banking and trading divisions.

Net revenue rose 15% year over year to $14.58 billion, topping the consensus estimate of $13.36 billion, though it declined 3% from the prior quarter.

GAAP earnings came in at $10.91 per share, up from $8.62 a year ago and above the $9.48 consensus. First-half EPS rose to $25.07 from $20.21 a year earlier.

David Solomon, Chairman and CEO of Goldman Sachs, commented, “At this time, the economy and markets are generally responding positively to the evolving policy environment. But as developments rarely unfold in a straight line, we remain very focused on risk management. Given the strategic decisions and investments we’ve made, we continue to believe that the firm is well-positioned to perform for our shareholders.”

Goldman Sachs shares slipped 0.2% to trade at $706.80 on Thursday.

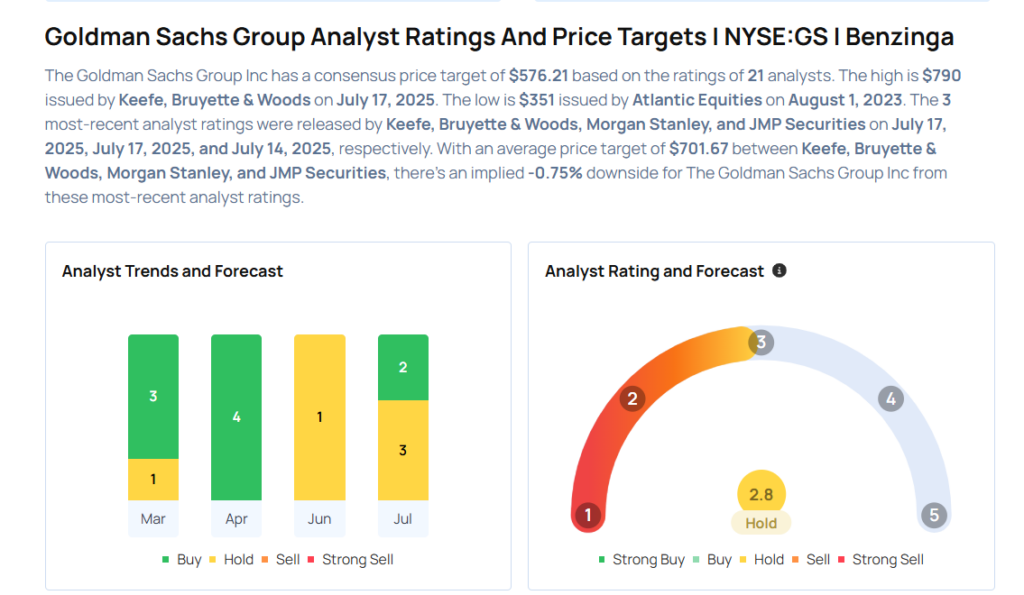

These analysts made changes to their price targets on Goldman Sachs following earnings announcement.

- Keefe, Bruyette & Woods analyst David Konrad maintained Goldman Sachs Group with a Market Perform and raised the price target from $771 to $790.

- Morgan Stanley analyst Betsy Graseck maintained the stock with an Equal-Weight rating and raised the price target from $680 to $715.

Considering buying GS stock? Here’s what analysts think:

Read This Next:

- Jim Cramer ‘Takes A Pass’ On This Money-Losing Utilities Stock

Photo via Shutterstock