Shareholders Will Probably Not Have Any Issues With General Capital Limited's (NZSE:GEN) CEO Compensation

Key Insights

- General Capital's Annual General Meeting to take place on 25th of July

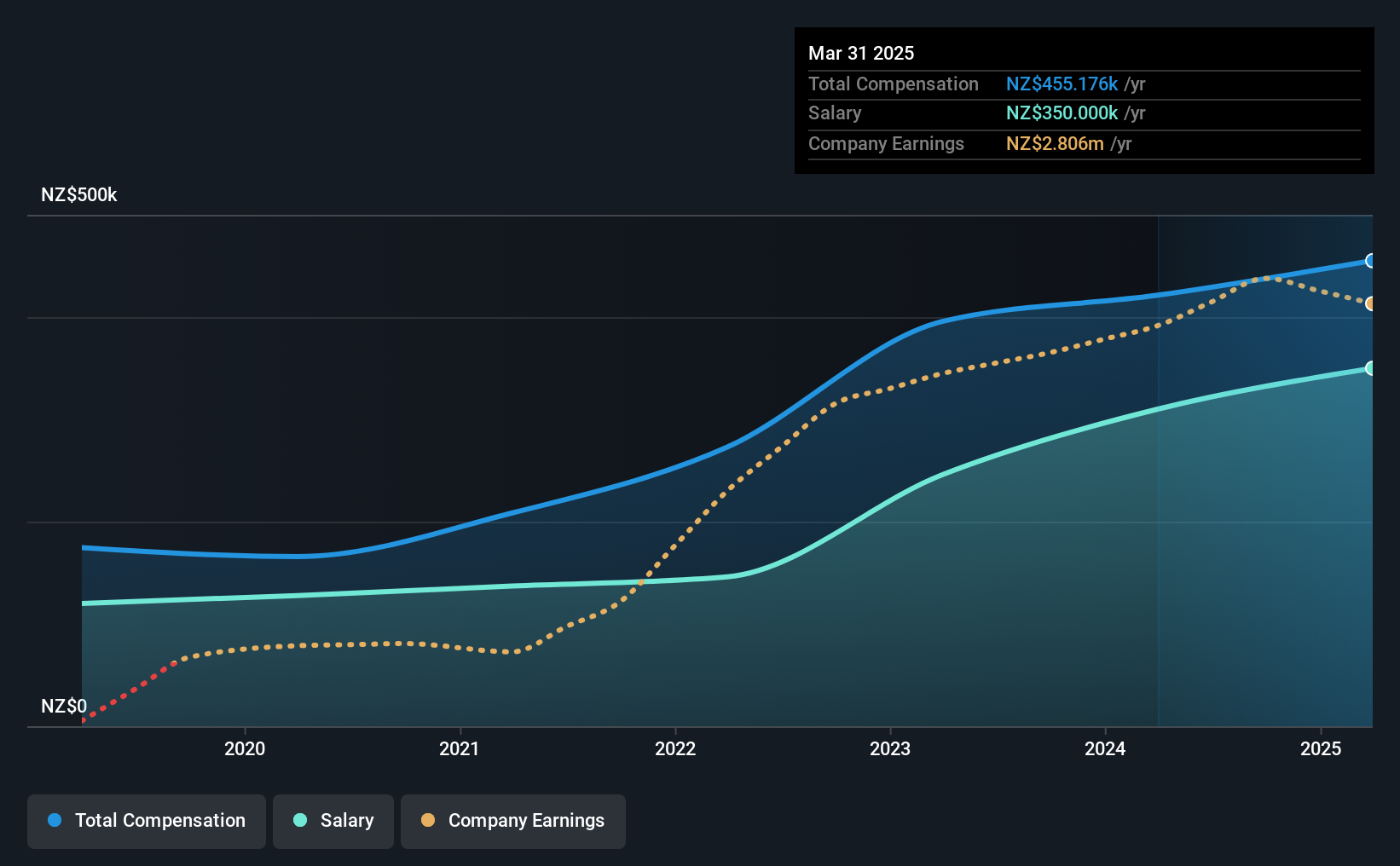

- Salary of NZ$350.0k is part of CEO Brent King's total remuneration

- The total compensation is similar to the average for the industry

- General Capital's total shareholder return over the past three years was 43% while its EPS was down 0.6% over the past three years

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

Under the guidance of CEO Brent King, General Capital Limited (NZSE:GEN) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 25th of July. Here is our take on why we think the CEO compensation looks appropriate.

View our latest analysis for General Capital

Comparing General Capital Limited's CEO Compensation With The Industry

Our data indicates that General Capital Limited has a market capitalization of NZ$28m, and total annual CEO compensation was reported as NZ$455k for the year to March 2025. That's a notable increase of 8.0% on last year. Notably, the salary which is NZ$350.0k, represents most of the total compensation being paid.

In comparison with other companies in the New Zealand Diversified Financial industry with market capitalizations under NZ$335m, the reported median total CEO compensation was NZ$522k. From this we gather that Brent King is paid around the median for CEOs in the industry. Moreover, Brent King also holds NZ$1.8m worth of General Capital stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | NZ$350k | NZ$310k | 77% |

| Other | NZ$105k | NZ$111k | 23% |

| Total Compensation | NZ$455k | NZ$421k | 100% |

Speaking on an industry level, nearly 72% of total compensation represents salary, while the remainder of 28% is other remuneration. There isn't a significant difference between General Capital and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at General Capital Limited's Growth Numbers

Over the last three years, General Capital Limited has not seen its earnings per share change much, though they have deteriorated slightly. In the last year, its revenue is up 17%.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has General Capital Limited Been A Good Investment?

Boasting a total shareholder return of 43% over three years, General Capital Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 2 warning signs for General Capital that investors should look into moving forward.

Switching gears from General Capital, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10