JPMorgan Chase (JPM) Launches Solo 401(k) for Self-Employed Entrepreneurs Seeking Retirement Solutions

JPMorgan Chase (JPM) has recently made headlines with the launch of the Solo 401(k), reflecting its dedication to small business retirement planning, amid findings that a significant number of business owners seek individual 401(k) options. Over the last quarter, JPMorgan's share price rose 23%, bolstered potentially by product initiatives like the Solo 401(k) and steady share buybacks amounting to $7.1 billion. While JPM's quarterly earnings showed a decrease in net income from the previous year, these internal developments added weight to broader market upward trends, with major indexes also reaching record highs.

We've identified 1 risk for JPMorgan Chase that you should be aware of.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

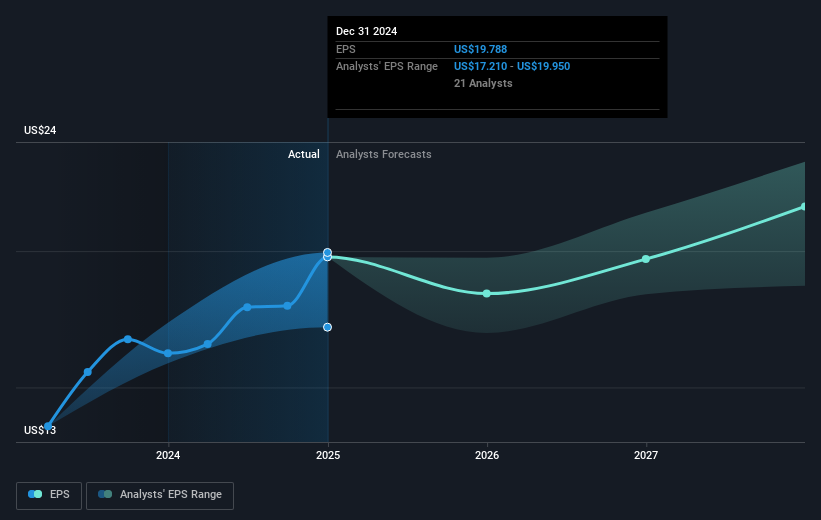

JPMorgan Chase's recent announcement about the Solo 401(k) could have significant implications for its long-term strategy, possibly enhancing its offerings in the retirement planning market. While recent share price growth of 23% in the last quarter reflects positive investor sentiment, particularly due to product initiatives and consistent share buybacks, investors should be aware of the company's substantial five-year total return of 231.20%, underscoring its resilience and long-term value appreciation potential. This longer-term performance provides a broader context that complements recent quarterly performance, indicating a robust historical trajectory.

Looking at company performance relative to the market, JPMorgan's one-year returns have surpassed both the broader US market, which returned 12.4%, and the US Banks industry, which returned 18.4%. Such outperformances highlight its competitive edge over major benchmarks in the recent past. However, despite the solid short-term gains, the current share price of US$285.82 holds a small discount to the consensus price target of US$300.45, suggesting there is potential value that could be realized if forecasts align with market expectations.

The introduction of the Solo 401(k) and ongoing internal initiatives, while contributing to recent price gains, will need to drive substantial revenue and earnings growth to meet optimistic forecasts or exceed bearish analyst concerns. Current analyst sentiment indicates possible challenges, pointing to rising expenses and possible net interest income declines. The company must navigate these hurdles effectively to align with its estimated fair value and maintain its growth trajectory amidst uncertain economic conditions.

Gain insights into JPMorgan Chase's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10