JPMorgan Chase (JPM) Expands Solo 401(k) Amid Buyback and Earnings Updates

JPMorgan Chase (JPM) recently launched the Solo 401(k) and expanded its Everyday 401(k), reflecting its focus on retirement solutions for small business owners. Additionally, the company's share repurchase program saw significant activity, totaling $7.1 billion in the last quarter. These initiatives occurred alongside volatile stock trading amid criticism of Federal Reserve Chair Jerome Powell by former President Trump. JPM's share price increased by 25% this quarter as the market digested mixed earnings from financial institutions and broader market trends, suggesting these efforts added momentum to the company's performance.

We've discovered 1 possible red flag for JPMorgan Chase that you should be aware of before investing here.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

The recent introduction of JPMorgan Chase's Solo 401(k) and expansion of its Everyday 401(k), along with the active share repurchase program, could influence the narrative by potentially boosting future revenue through a more robust retirement solutions offering. Despite higher credit loss allowances and expenses, these initiatives suggest an ongoing commitment to growing key business segments, which might cushion the impact on future earnings. Share repurchases further indicate confidence in capital allocation, potentially enhancing shareholder value while stabilizing earnings.

Over the past five years, JPMorgan Chase shares have delivered a substantial total return of 229.64%, highlighting strong long-term performance. This period of growth contrasts with the recent focus on credit loss provisions and expense increases, raising questions about the sustainability of such returns if profitability pressures persist.

In the past year, JPMorgan Chase has outperformed both the US market, which returned 10%, and the US Banks industry, which returned 18.6%, showing its relative resilience. However, the projected challenges, such as reduced net interest income due to expected rate cuts, could exert pressure on revenue and earnings forecasts.

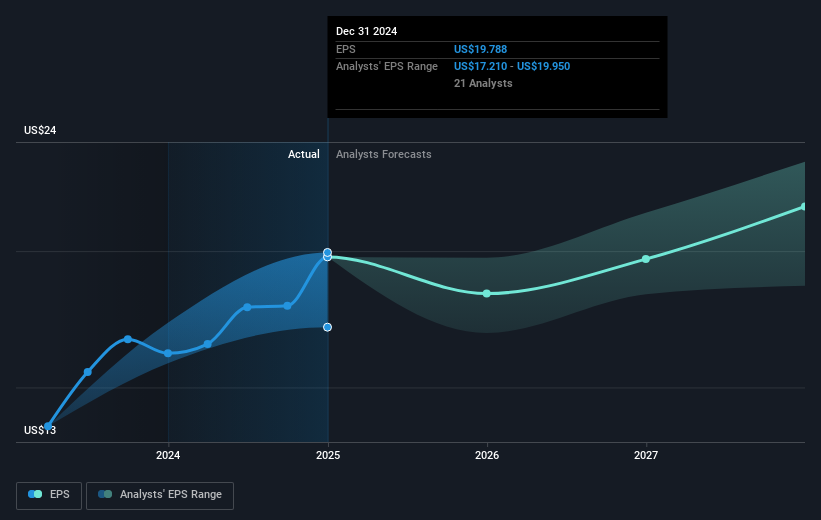

The current share price of US$286.55 shows a marginal discount of approximately 2.36% to the consensus analyst price target of US$293.32. Given varied analyst perspectives, with price targets ranging from a bearish US$195.37 to a bullish US$330.00, assessing the impact of recent developments and external conditions on the company's future performance remains pivotal. These factors would influence consensus forecasts for revenue and earnings as analysts weigh recent strategic moves against macroeconomic headwinds.

Upon reviewing our latest valuation report, JPMorgan Chase's share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10