ASX Penny Stocks Spotlight Delta Lithium And Two Others

Australian shares are set to open slightly higher, with the ASX 200 futures showing resilience amid global trade discussions, particularly between the U.S. and EU. In this context of international negotiations and market fluctuations, investors may find value in exploring smaller or newer companies that fall under the category of penny stocks—a term that might seem outdated but remains relevant for those seeking unique investment opportunities. These stocks can offer a blend of potential growth and financial stability, making them intriguing options for investors looking to uncover hidden value within the Australian market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$114.64M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.25 | A$106.14M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.615 | A$117.26M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.05 | A$470.25M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.42 | A$2.76B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.81 | A$478.58M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.64 | A$887.63M | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.80 | A$882.14M | ✅ 5 ⚠️ 3 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.915 | A$154.24M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 464 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Delta Lithium (ASX:DLI)

Simply Wall St Financial Health Rating: ★★★★★★

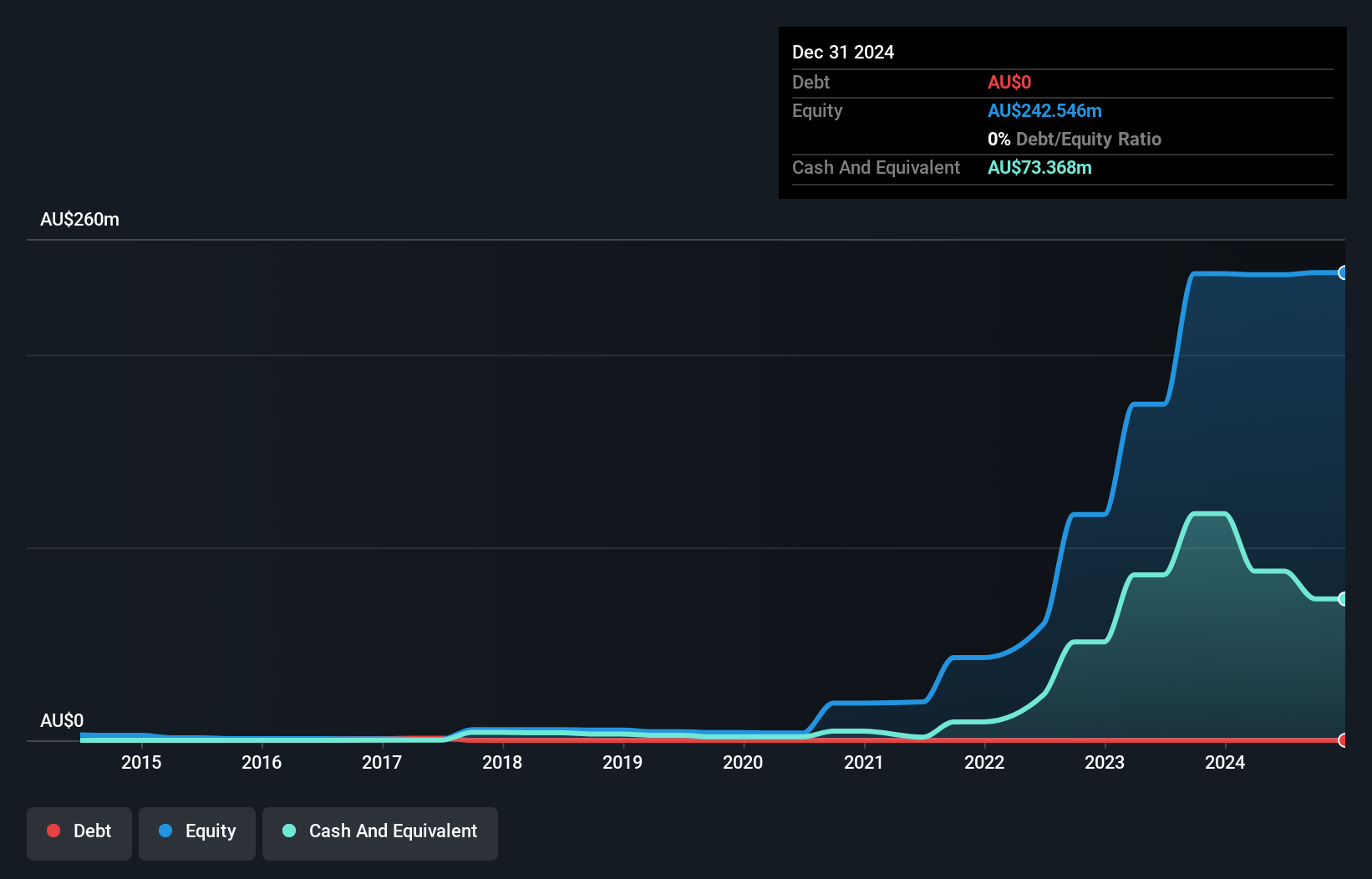

Overview: Delta Lithium Limited engages in the exploration and development of lithium and gold properties in Western Australia, with a market capitalization of A$121.81 million.

Operations: Delta Lithium Limited has not reported any revenue segments.

Market Cap: A$121.81M

Delta Lithium Limited, with a market cap of A$121.81 million, is pre-revenue and currently unprofitable. Despite this, it maintains a sufficient cash runway for over a year based on current free cash flow. The company has seen no significant shareholder dilution recently and remains debt-free with short-term assets exceeding both short-term and long-term liabilities. However, earnings are forecast to decline by 42.5% annually over the next three years. Recent board changes include the resignation of Director Tim Manners, but the board composition is deemed appropriate without an immediate replacement needed.

- Jump into the full analysis health report here for a deeper understanding of Delta Lithium.

- Learn about Delta Lithium's future growth trajectory here.

LaserBond (ASX:LBL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LaserBond Limited is a surface engineering company in Australia that focuses on improving the performance and longevity of machinery components, with a market cap of A$56.47 million.

Operations: The company generates revenue through three primary segments: Products (A$14.17 million), Services (A$25.27 million), and Technology (A$2.56 million).

Market Cap: A$56.47M

LaserBond Limited, with a market cap of A$56.47 million, operates across Products, Services, and Technology segments. The company is debt-free and has a seasoned management team with an average tenure of 4.7 years. Short-term assets (A$22.6M) exceed both short-term (A$9.6M) and long-term liabilities (A$12M), indicating financial stability despite recent negative earnings growth (-35.4%). Profit margins have declined from 11.1% to 6.8%, yet high-quality earnings are maintained with no significant shareholder dilution over the past year. Earnings are projected to grow by 48% annually, suggesting potential for future profitability improvements in this volatile sector.

- Navigate through the intricacies of LaserBond with our comprehensive balance sheet health report here.

- Explore LaserBond's analyst forecasts in our growth report.

Mach7 Technologies (ASX:M7T)

Simply Wall St Financial Health Rating: ★★★★★☆

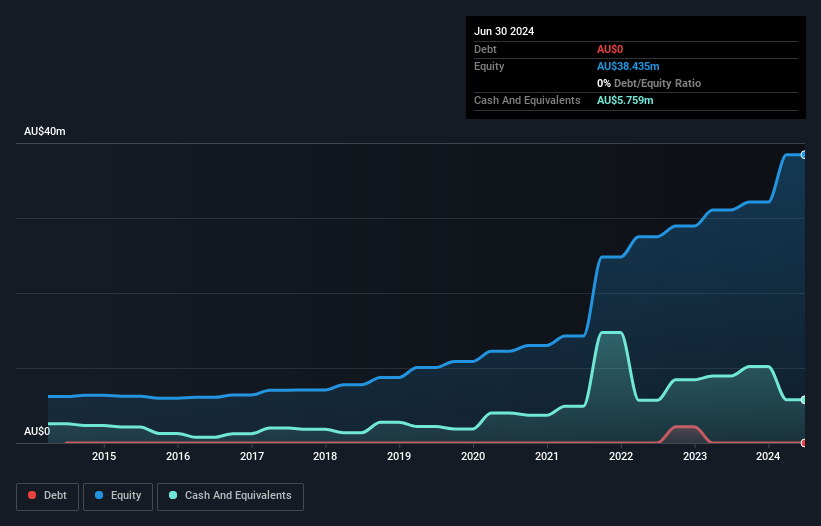

Overview: Mach7 Technologies Limited offers enterprise imaging data sharing, storage, and interoperability solutions for healthcare enterprises globally, with a market cap of A$101.04 million.

Operations: The company's revenue is derived from Software Licenses (A$17.32 million), Professional Services (A$3.92 million), and Maintenance and Support (A$12.28 million).

Market Cap: A$101.04M

Mach7 Technologies Limited, with a market cap of A$101.04 million, focuses on healthcare imaging solutions and expects revenue between A$33 million and A$34 million for the fiscal year ending June 2025. Despite being unprofitable with negative return on equity (-9.98%), the company maintains financial stability with short-term assets (A$34.9M) exceeding both short-term (A$14.8M) and long-term liabilities (A$5.3M). Mach7 is debt-free but has an inexperienced management team averaging 0.1 years in tenure, while its board is more seasoned at 5.5 years average tenure, suggesting potential governance strength amidst operational challenges.

- Unlock comprehensive insights into our analysis of Mach7 Technologies stock in this financial health report.

- Examine Mach7 Technologies' earnings growth report to understand how analysts expect it to perform.

Next Steps

- Unlock our comprehensive list of 464 ASX Penny Stocks by clicking here.

- Curious About Other Options? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10