Think SoFi Stock Is Expensive? This Chart Might Change Your Mind.

-

SoFi stock is expensive according to traditional valuation metrics.

-

It's growing much faster than similar banks.

-

It aims to become a top-10 bank.

Determining what constitutes a cheap or expensive stock is anything but simple. Even the king of value investing, Warren Buffett, recently bought several stocks that don't look cheap according to traditional metrics. That's because any valuation needs to be understood in context with other factors.

SoFi Technologies (SOFI -3.07%) is a great example. Its stock is definitely expensive-looking based on several traditional valuation metrics as well as specific bank valuation metrics. But a chart below might change your viewpoint on SoFi.

Image source: Getty Images.

Priced for growth

SoFi stock trades at a P/E ratio of 51, a price-to-sales ratio of 8.6, and a price-to-book ratio of 3.5. The price-to-book ratio is the more common valuation metric for banks, and a ratio higher than 1 is considered expensive. To be fair, many of the big banks have P/B ratios above 1, but SoFi is still much higher.

SoFi is a young bank stock that's just getting started. Its roots are in lending, and that's its largest segment. But it got a bank charter in 2022 when it acquired Golden Pacific Bancorp, and that has opened its business to offering a large suite of banking services. Its non-lending financial services segment is growing fast, more than doubling in the 2025 first quarter, and driving total company adjusted net revenue increase of 33%.

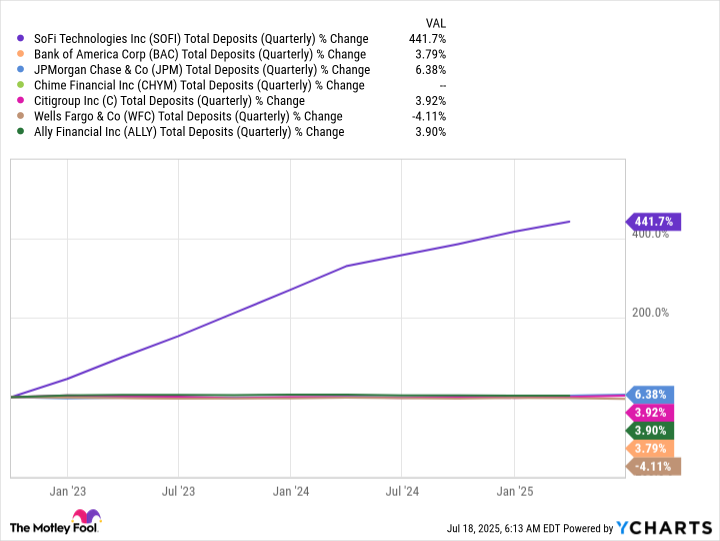

These are increases that other banks can't match. Not only does this include the large banks, like Bank of America, JPMorgan Chase, Citibank, and Wells Fargo, but consider how fast its deposits are growing compared to newcomer Chime and all-digital bank Ally.

Data by YCharts.

SoFi is more expensive than most of the stocks on almost every basis, but it deserves a premium for its incredible performance and growth prospects. CEO Anthony Noto has repeated several times that he envisions becoming a top-10 financial services company. If SoFi can keep this growth pace up, that could become a reality.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10