The Sherwin-Williams Company (NYSE:SHW) reported worse-than-expected second-quarter earnings results and cut its FY25 EPS and adjusted EPS guidance below estimates on Tuesday.

The American paints and coatings company reported quarterly adjusted earnings per share of $3.38, below the Wall Street view of $3.81. Quarterly revenue of $6.31 billion beat the analyst consensus of $6.30 billion.

Sherwin-Williams expects third-quarter revenue to be up or down a low-single-digit percentage compared to the third quarter of 2024.

The company lowered its 2025 adjusted EPS guidance to $11.20-$11.50 (prior $11.65-$12.05), compared to the $11.88 analyst consensus estimate. It expects consolidated net sales to be up or down by a low single-digit percentage compared to full-year 2024 (prior low single-digit percentage range).

Sherwin-Williams lowered 2025 GAAP EPS guidance to $10.11-$10.41 (prior $10.70-$11.10) versus $11.09 analyst consensus estimate.

Sherwin-Williams shares gained 1% to trade at $343.45 on Wednesday.

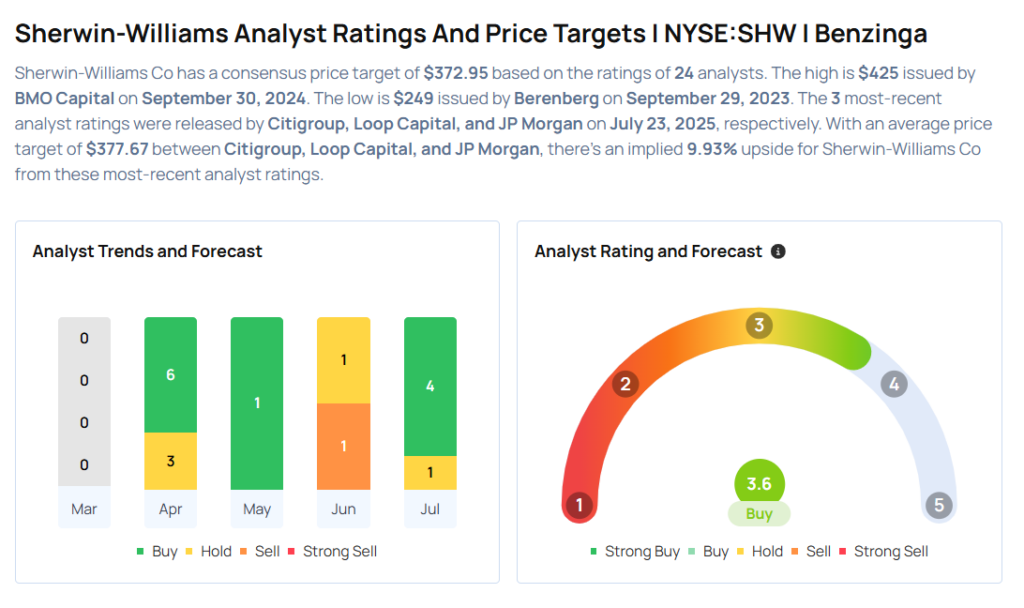

These analysts made changes to their price targets on Sherwin-Williams following earnings announcement.

- Wells Fargo analyst Michael Sison maintained Sherwin-Williams with an Overweight rating and lowered the price target from $420 to $400.

- JP Morgan analyst Jeffrey Zekauskas maintained the stock with an Overweight rating and lowered the price target from $390 to $378.

- Citigroup analyst Patrick Cunningham maintained Sherwin-Williams with a Neutral and lowered the price target from $385 to $375.

Considering buying SHW stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Weigh In On 3 Industrials Stocks With Over 5% Dividend Yields

Photo via Shutterstock