Roper Technologies (NASDAQ:ROP) reported upbeat second-quarter results on Monday.

It clocked quarterly adjusted earnings per share of $4.87, beating the street view of $4.83. Quarterly sales of $1.94 billion outpaced the analyst consensus estimate of $1.92 billion.

Roper Technologies expects fiscal 2025 adjusted earnings per share of $19.90-$20.05 (up from the prior $19.80-$20.05), versus the $19.92 analyst consensus estimates. It also raised its full-year total revenue growth outlook to ~13% or $7.95 billion (compared to a previous outlook of ~12% or $7.88 billion and an analyst consensus estimate of $7.86 billion). It reiterated organic revenue growth of +6-7%.

The company anticipates adjusted EPS of $5.08-$5.12 for the third quarter, compared to the $5.08 analyst consensus estimate.

“We delivered another strong quarter, highlighted by 13% total revenue growth, 7% organic revenue growth, and 10% free cash flow growth,” said Neil Hunn, Roper Technologies’ President and CEO. “Our businesses continued to execute at a high level, while further innovating and investing to drive durable, long-term growth. We are particularly excited about how AI capabilities are enhancing our solutions and creating new opportunities, broadly, across our portfolio. Our second quarter growth was balanced across all three segments, as expected, and positions us well for a strong second half.”

Roper Technologies shares gained 0.6% to trade at $97.60 on Tuesday.

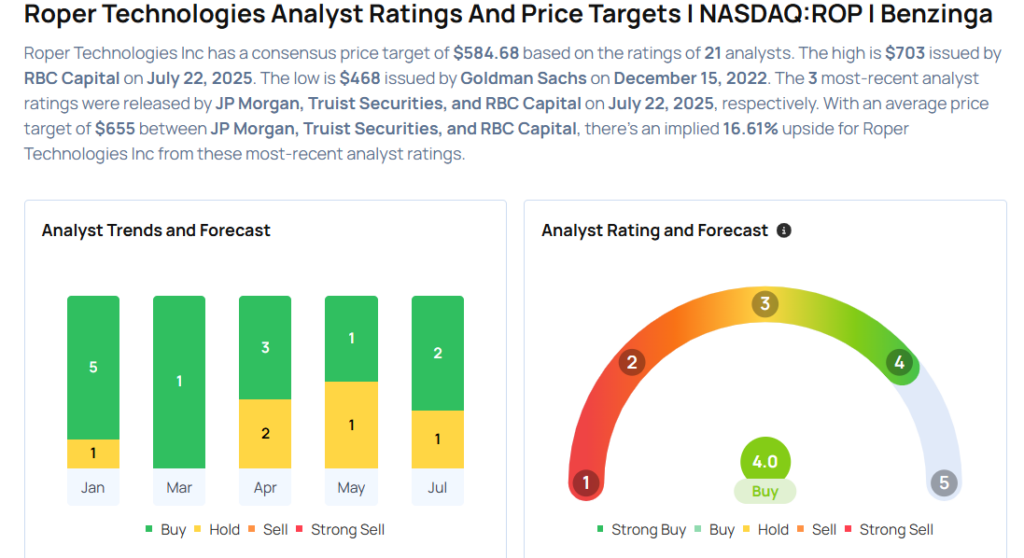

These analysts made changes to their price targets on Roper Technologies following earnings announcement.

- RBC Capital analyst Deane Dray maintained Roper Technologies with an Outperform and raised the price target from $695 to $703.

- Truist Securities analyst Terry Tillman maintained the stock with a Buy and raised the price target from $675 to $685.

Considering buying ROP stock? Here’s what analysts think:

Read This Next:

- Jim Cramer: This Coffee Chain Is ‘The Way To Go’ But General Mills? ‘That’s A Tough One’

Photo via Shutterstock