3 Cheap Tech Stocks to Buy Right Now

-

-

All three companies feature cloud-based business models with dependable recurring revenues.

-

Investors looking for value in tech may want to give these overlooked stocks a closer look today.

The stock market is thriving in the summer of 2025. Despite an uncertain economy, the leading stock indexes are setting new highs on a regular basis. The S&P 500 (SNPINDEX: ^GSPC) index has gained 19% in the last quarter, while the more volatile Nasdaq-100 rose 26%.

But there are still some great values hiding in plain sight, even in the tech sector. Some incredible growth stocks never got the memo about soaring in 2025. When the modest stock charts combine with great long-term business prospects and modest valuations, it's time to take a second look at these undervalued growth stocks.

Let me introduce you to Nice Systems (NICE -0.67%), Alarm.com (ALRM -0.34%), and GoDaddy (GDDY 0.18%). These three innovative tech stocks are some of the fastest-growing companies you can buy at a reasonable price today.

What these tech stocks have in common (besides being a bargain)

These stocks have a few things in common:

- They have cloud-based business models, selling software and services with long-term contracts or monthly subscription plans.

- Client lists are primarily in the business world, ranging from GoDaddy's 20 million small businesses to NICE's nearly exclusive focus on enterprise-scale clients.

- Many of their products are mission-critical tools for data security or physical safety monitoring. Once your company signs a deal with one of these companies, you're pretty likely to stay committed for the long haul.

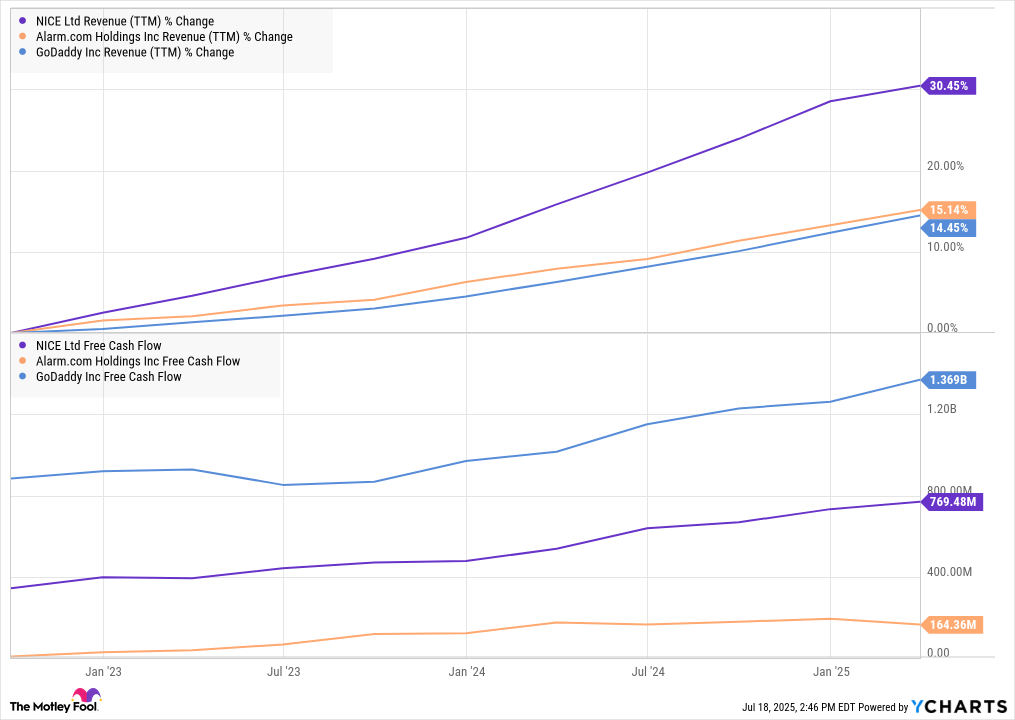

- Their lucrative business models have driven strong revenue growth and robust free cash flows in the last three years:

NICE Revenue (TTM) data by YCharts. TTM = trailing 12 months.

...and here are the bargains

With business descriptions and financial results of this caliber, you probably expect Nice, Alarm.com, and GoDaddy shares to trade at sky-high valuation ratios. But all three stocks are down year to date and don't look expensive at all. In a world where the "Magnificent Seven" stocks trade for more than 50 times free cash flow and double-digit price-to-sales ratios, this trio is a breath of affordable air:

Stock | Price to Free Cash Flow (TTM) | Price to Sales (TTM) | Market Cap |

|---|---|---|---|

GoDaddy | 17.5 | 5.2 | $24.0 billion |

Nice | 11.6 | 3.5 | $9.7 billion |

Alarm.com | 16.4 | 2.9 | $2.8 billion |

Data collected from Finviz.com on 7/18/2025. TTM = trailing 12 months.

Why I'm excited about these tech stocks right now

So, I'm talking about three high-octane growth stocks trading at modest valuation ratios. All of them target very large global markets, yielding excellent business results.

These stocks could double or triple in value and still appear inexpensive compared to the Magnificent Seven club. I'm not saying that any of them will make that kind of jump anytime soon, as it often takes some time before market makers catch up on the brilliant results of a fast-growing software stock. But investing is more of a marathon than a sprint, so I don't mind waiting around for a solid long-term return.

As a tech nerd with a long-standing history of cloud-based side gigs, I've used GoDaddy's security and data management services for years. I don't have a personal connection to Nice or Alarm.com, but both are award-winning providers of leading-edge services. I would probably be a happy customer if I ran a large business with a significant need for call center and security monitoring services.

Image source: Getty Images.

That's the secret sauce for building shareholder value over the long haul -- build great solutions, and the financial results will come. One of these days, the stocks should follow suit.

Until then, you should consider grabbing a few shares of Alarm.com, GoDaddy, and/or Nice Systems. These tech stocks are downright cheap in July 2025.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10