Electronic Arts (EA) Unveils Epic Battlefield 6 Trailer With Stunning Gameplay Features

Electronic Arts (EA) recently unveiled the reveal trailer for *Battlefield 6*, highlighting its features and storyline, which has sparked significant interest in the gaming community. In the last quarter, EA experienced a 5% increase in its share price, in line with broader market movements that rose 2% in the past seven days and 18% over the last year. Alongside this excitement surrounding *Battlefield 6*, EA also launched *EA SPORTS College Football 26*, adding weight to the upward price movement over the quarter. These developments may have complemented Electronic Arts’ alignment with the overall market trend.

Buy, Hold or Sell Electronic Arts? View our complete analysis and fair value estimate and you decide.

This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

The excitement surrounding Electronic Arts' recent releases, *Battlefield 6* and *EA SPORTS College Football 26*, could positively influence its strategic goals of boosting player engagement and revenue through new games and live services. With the share price increasing 5% in the last quarter, it aligns with the company's focus on leveraging live events and game launches to drive growth. Analysts see these developments as potential catalysts for revenue increases and enhanced profitability, particularly with the integration of AI improving operational efficiencies. However, the impact on earnings is contingent on the success of these new titles in engaging players and maintaining consumer interest.

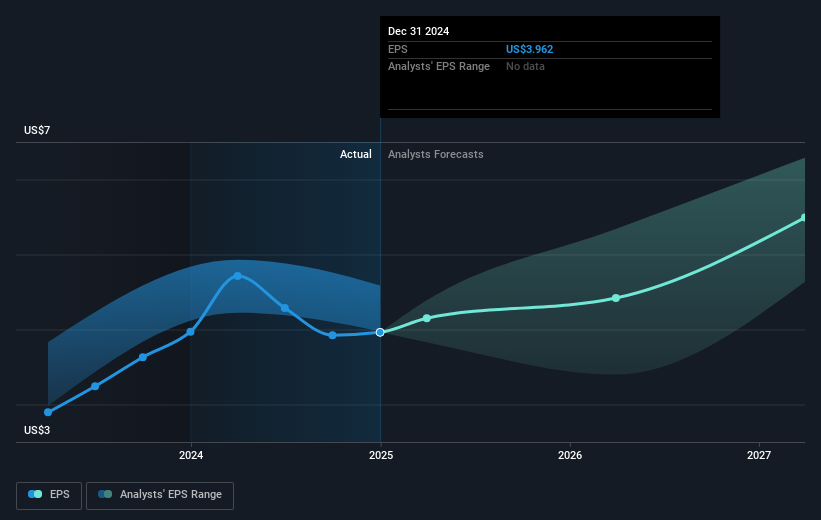

Over the longer-term, Electronic Arts' total shareholder return, including dividends, was 18.3% over three years, which slightly underperforms one-year returns where the broader US market gained 14.6%, and the US Entertainment industry grew significantly. The current share price of US$153.73 reflects a cautious enthusiasm by investors as it remains slightly below the analyst consensus price target of US$168.36. This moderate disparity suggests room for growth if projected revenue gains and earnings enhancements, driven by new game launches and live services, materialize. Ultimately, EA's price movement remains closely watched, aligning market performance against its revenue and earnings forecasts while signaling potential value appreciation if bullish projections are met.

Explore historical data to track Electronic Arts' performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electronic Arts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10