With 85% ownership of the shares, DraftKings Inc. (NASDAQ:DKNG) is heavily dominated by institutional owners

Key Insights

- Given the large stake in the stock by institutions, DraftKings' stock price might be vulnerable to their trading decisions

- A total of 21 investors have a majority stake in the company with 50% ownership

- Ownership research along with analyst forecasts data help provide a good understanding of opportunities in a stock

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

To get a sense of who is truly in control of DraftKings Inc. (NASDAQ:DKNG), it is important to understand the ownership structure of the business. The group holding the most number of shares in the company, around 85% to be precise, is institutions. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

Since institutional have access to huge amounts of capital, their market moves tend to receive a lot of scrutiny by retail or individual investors. Therefore, a good portion of institutional money invested in the company is usually a huge vote of confidence on its future.

Let's delve deeper into each type of owner of DraftKings, beginning with the chart below.

View our latest analysis for DraftKings

What Does The Institutional Ownership Tell Us About DraftKings?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

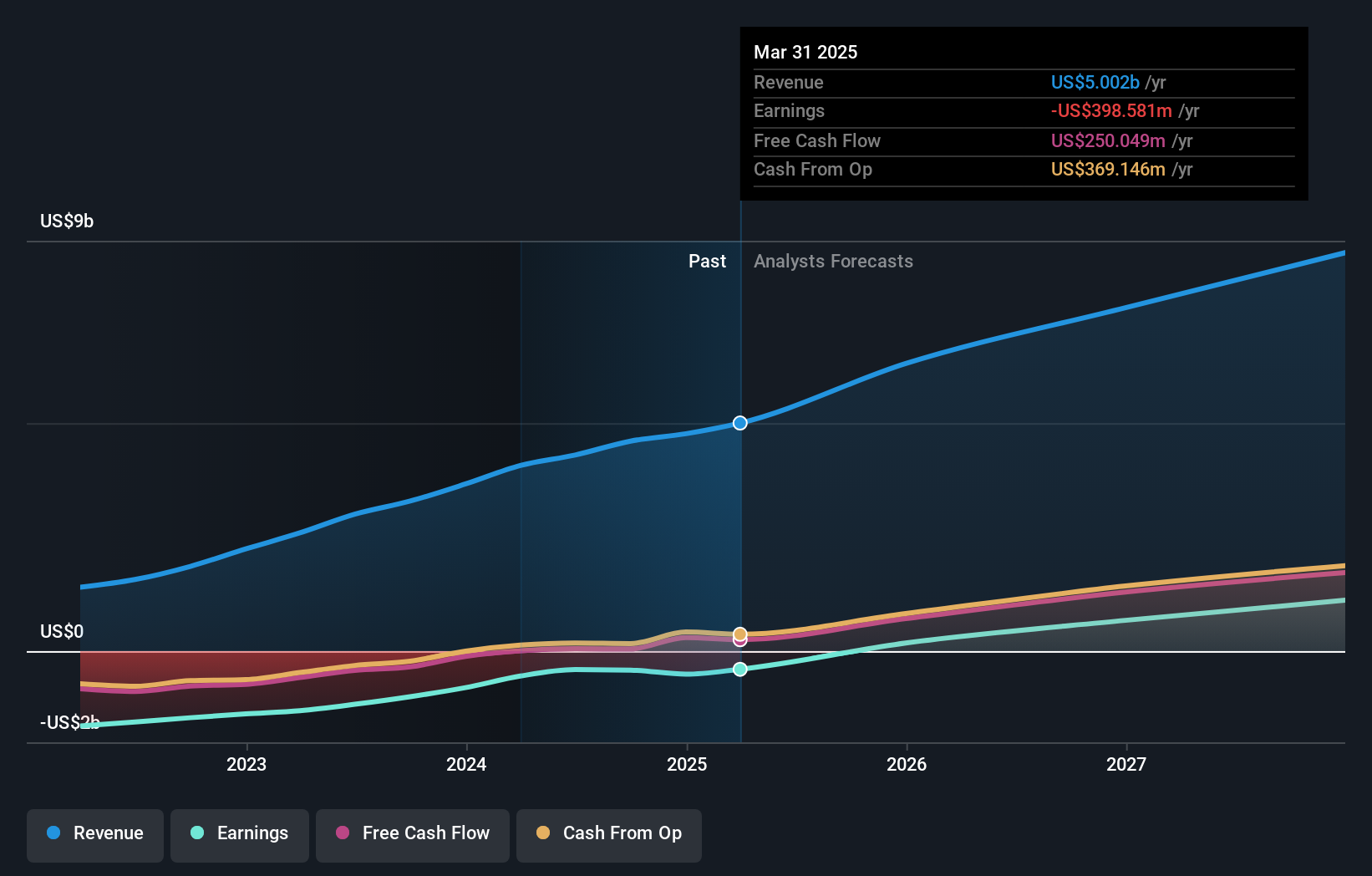

As you can see, institutional investors have a fair amount of stake in DraftKings. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at DraftKings' earnings history below. Of course, the future is what really matters.

Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences. We note that hedge funds don't have a meaningful investment in DraftKings. Our data shows that The Vanguard Group, Inc. is the largest shareholder with 8.7% of shares outstanding. In comparison, the second and third largest shareholders hold about 6.0% and 4.2% of the stock. In addition, we found that Jason Robins, the CEO has 0.7% of the shares allocated to their name.

Looking at the shareholder registry, we can see that 50% of the ownership is controlled by the top 21 shareholders, meaning that no single shareholder has a majority interest in the ownership.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of DraftKings

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

We can report that insiders do own shares in DraftKings Inc.. The insiders have a meaningful stake worth US$508m. we sometimes take an interest in whether they have been buying or selling.

General Public Ownership

With a 13% ownership, the general public, mostly comprising of individual investors, have some degree of sway over DraftKings. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too.

I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10