Norfolk Southern (NSC) In Merger Talks With Union Pacific For Historic Rail Deal

Norfolk Southern (NSC) has experienced a noticeable price increase of 25% over the last quarter. This robust upward movement is largely linked to the ongoing merger discussions with Union Pacific Corporation, which if realized, could become the largest deal in railroad history, significantly influencing the industry's landscape. Additionally, the strategic announcement of maintaining a quarterly dividend of $1.35 per share and significant board changes, along with being added to the Russell indexes, likely bolstered investor confidence. The broader market conditions, marked by repeated record highs in major indices like the S&P 500, also provided a fundamentally supportive backdrop for NSC's gain.

You should learn about the 1 possible red flag we've spotted with Norfolk Southern.

Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

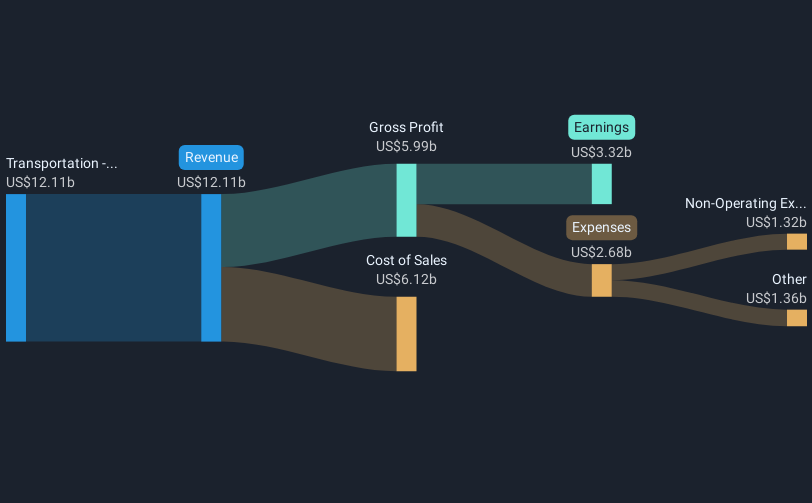

The discussions of a potential merger between Norfolk Southern (NSC) and Union Pacific could significantly reshape the rail industry and unlock substantial operational synergies mentioned in the company's PSR 2.0 transformation narrative. This promising development aligns with NSC's efforts to enhance its efficiency and margin growth. Over a five-year period, NSC achieved a total shareholder return of 63.23%, indicating strong long-term performance. Comparatively, over the last year, NSC outperformed the US Transportation industry, which returned 12.7%.

The short-term boost in share price and recent analyst activities suggest varying expectations regarding NSC's future revenue and earnings growth. While NSC's current share price at US$278 is marginally below the consensus price target of US$281.13, the close proximity underscores that analysts generally perceive the stock as fairly valued. However, the ongoing merger discussions may lead analysts to revise NSC's revenue forecasts upwards due to potential increased market share and operational benefits.

In light of our recent valuation report, it seems possible that Norfolk Southern is trading beyond its estimated value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norfolk Southern might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10