Deckers Outdoor Corporation (NYSE:DECK) will release earnings results for the first quarter, after the closing bell on Thursday, July 24.

Analysts expect the Goleta, California-based company to report quarterly earnings at 68 cents per share, down from 75 cents per share in the year-ago period. Deckers Outdoor projects to report quarterly revenue at $900.39 million, compared to $825.35 million a year earlier, according to data from Benzinga Pro.

On May 22, Deckers reported fourth-quarter revenue of $1.02 billion, beating analyst estimates of $1.01 billion. The casual footwear and apparel company reported fourth-quarter earnings of $1 per share, beating analyst estimates of 59 cents per share, according to Benzinga Pro.

Deckers Outdoor shares gained 2.3% to close at $108.09 on Wednesday.

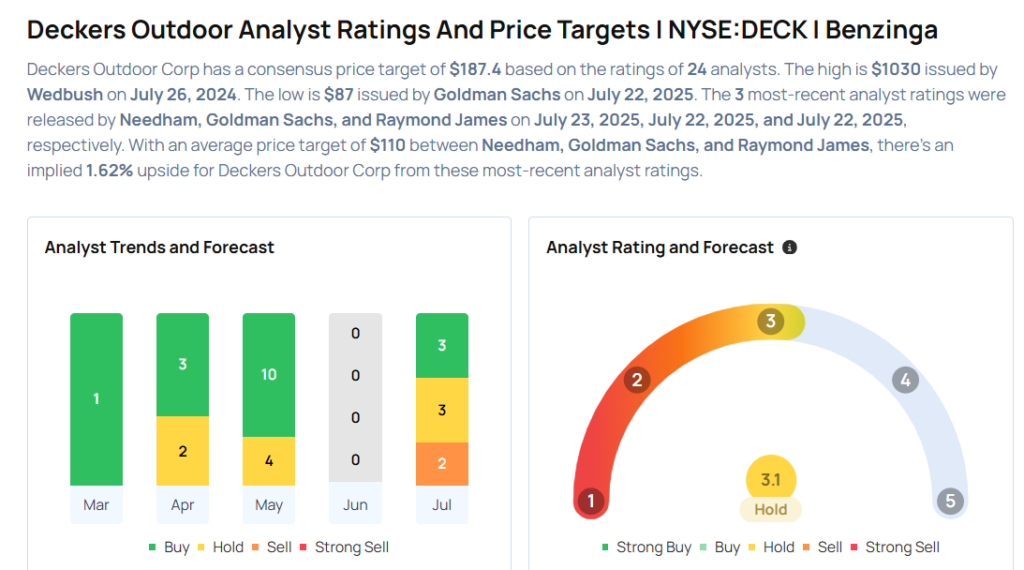

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Needham analyst Tom Nikic reiterated a Buy rating and a price target of $120 on July 23, 2025. This analyst has an accuracy rate of 61%.

- Goldman Sachs analyst Brooke Roach maintained a Sell rating and cut the price target from $90 to $87 on July 22, 2025. This analyst has an accuracy rate of 68%.

- Raymond James analyst Rick Patel maintained a Strong Buy rating and slashed the price target from $140 to $123 on July 22, 2025. This analyst has an accuracy rate of 79%.

- Wells Fargo analyst Ike Boruchow maintained an Equal-Weight rating and cut the price target from $100 to $90 on July 21, 2025. This analyst has an accuracy rate of 72%.

- UBS analyst Jay Sole maintained a Buy rating and slashed the price target from $169 to $144 on July 17, 2025. This analyst has an accuracy rate of 72%.

Considering buying DECK stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Loves ‘That Yield’ But Passes On This Stock: ‘Fundamentals Are Hurting’

Photo via Shutterstock