Does LexinFintech Holdings' (LX) $50 Million Buyback Reveal Shifting Priorities in Capital Allocation?

- On July 21, 2025, LexinFintech Holdings announced that its Board of Directors had authorized a share repurchase program of up to US$50 million, valid over the next 12 months.

- This move is often interpreted by the market as a sign that management sees value in the company's shares and is committed to returning capital to shareholders.

- We will explore how the new buyback program could influence LexinFintech's investment case and shareholder value priorities.

Find companies with promising cash flow potential yet trading below their fair value.

LexinFintech Holdings Investment Narrative Recap

To be a shareholder in LexinFintech Holdings, you need confidence in its ability to grow earnings through technological investment and capital-light models, while managing operational and credit risks. The newly announced US$50 million share repurchase program may support short-term sentiment and signal management’s faith in the company’s valuation, but by itself, it does not materially shift the most immediate catalyst, improved profitability from AI-driven risk management, or the persistent risk of funding cost fluctuations.

Among recent announcements, the cash dividend payout ratio increase, effective H2 2025, stands out for its impact on capital allocation. While dividends and buybacks both reward shareholders, the raised payout could affect free cash flow and intersects with the ongoing need for operational investment, highlighting management's balancing act between distributing profits and funding future growth.

On the other hand, investor awareness is critical as shifts in funding costs could …

Read the full narrative on LexinFintech Holdings (it's free!)

LexinFintech Holdings' outlook anticipates CN¥16.8 billion in revenue and CN¥4.4 billion in earnings by 2028. This requires 6.2% annual revenue growth and a CN¥3.1 billion increase in earnings from the current CN¥1.3 billion.

Uncover how LexinFintech Holdings' forecasts yield a $11.52 fair value, a 80% upside to its current price.

Exploring Other Perspectives

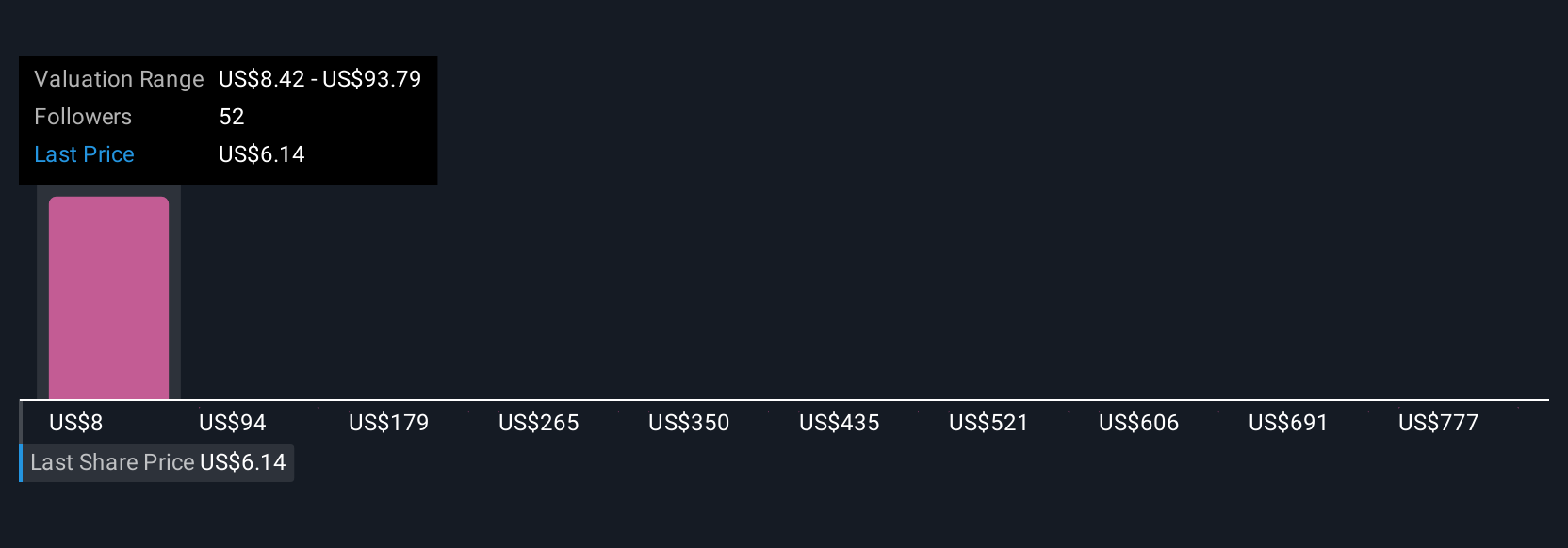

Seven members of the Simply Wall St Community estimated LexinFintech’s fair value from US$8.42 to over US$862.11 per share. As capital-light expansion and AI investments shape future margins, consider how varied viewpoints can influence your understanding of the company’s potential and risks.

Explore 7 other fair value estimates on LexinFintech Holdings - why the stock might be a potential multi-bagger!

Build Your Own LexinFintech Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LexinFintech Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LexinFintech Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LexinFintech Holdings' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10