Is MetLife’s (MET) New Accounting Chief a Sign of Shifting Priorities in Financial Strategy?

- MetLife recently appointed Adrienne O’Neill as Executive Vice President and Chief Accounting Officer, effective September 2, 2025, following her eighteen-year tenure in finance leadership at Manulife Financial Corporation.

- O’Neill’s background in international finance and regulatory reporting positions her to play a key part in MetLife’s efforts to enhance financial transparency and compliance as the company pursues longer-term growth initiatives.

- We’ll examine how the addition of an experienced global accounting leader could influence MetLife’s evolving investment narrative and future outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

MetLife Investment Narrative Recap

To be a MetLife shareholder, you have to believe in the company’s ability to drive steady earnings from a diversified business model while managing risk across economic cycles. The appointment of Adrienne O’Neill as Chief Accounting Officer is unlikely to be a material short-term catalyst or risk mitigator, but her deep expertise could enhance the company’s longer-term focus on financial transparency and compliance, especially as MetLife navigates currency fluctuations and interest rate uncertainty.

The upcoming Q2 2025 earnings release, scheduled for July 31, is the most relevant announcement in this context. Investors will be focused on whether MetLife maintains its growth in net income and improvement in margins amid ongoing economic and market volatility, all while transitioning to O’Neill’s leadership in finance functions.

However, investors should also be aware that foreign exchange volatility remains a key risk, especially as...

Read the full narrative on MetLife (it's free!)

MetLife's outlook projects $82.6 billion in revenue and $6.2 billion in earnings by 2028. This is based on 4.0% annual revenue growth and a $1.9 billion increase in earnings from the current $4.3 billion.

Uncover how MetLife's forecasts yield a $94.14 fair value, a 24% upside to its current price.

Exploring Other Perspectives

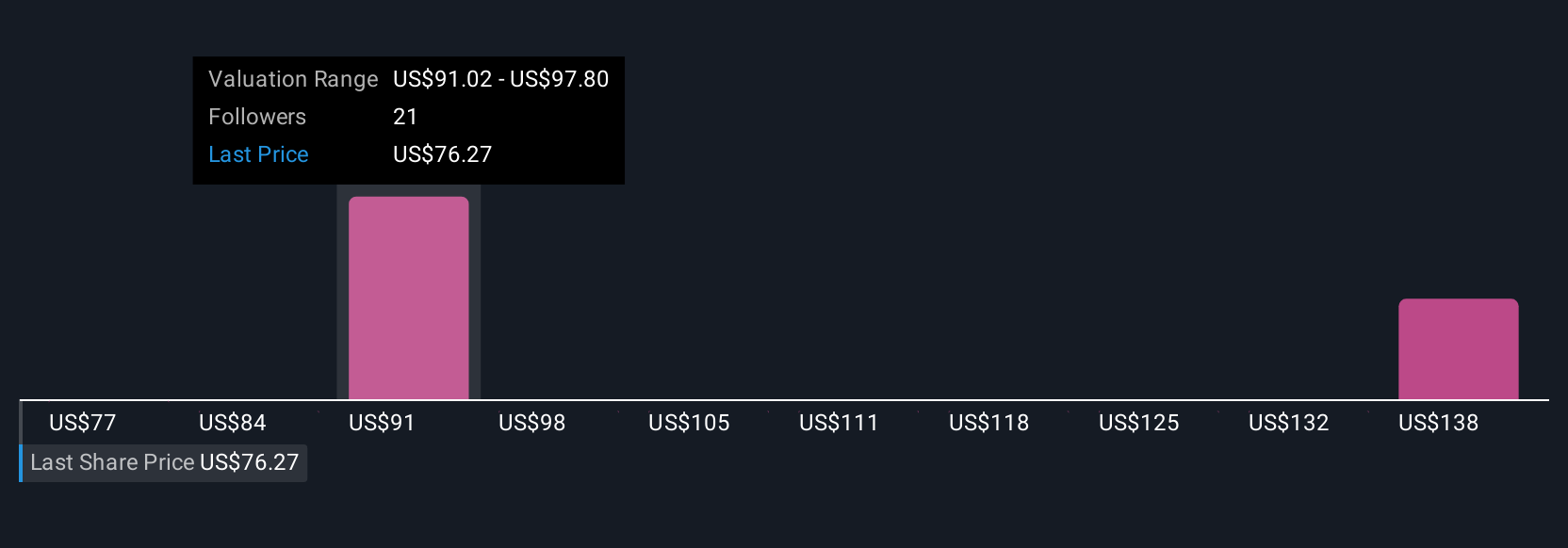

Simply Wall St Community members have shared two independent fair value estimates for MetLife, ranging from US$94.14 to US$125.29 per share. While many see catalysts like the risk transfer from reinsurance agreements, opinions vary and you can explore a range of perspectives here.

Explore 2 other fair value estimates on MetLife - why the stock might be worth just $94.14!

Build Your Own MetLife Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MetLife research is our analysis highlighting 6 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MetLife research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MetLife's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10