Here's How Alphabet Can Become the World's Second $4 Trillion Company

-

The company generates the most profits among its big tech peers.

-

Investors are worried about the legacy search business.

-

But Alphabet has proven that it's here to stay.

Nvidia made history by becoming the world's first $4 trillion company, and no other company has achieved this feat. Currently, Microsoft and Apple are in second and third place but have a bit of work to do with their $3.8 trillion and $3.2 trillion market caps, respectively.

However, there's a dark horse that could beat those two to the $4 trillion threshold: Alphabet (GOOG -1.51%) (GOOGL -1.45%), the world's fifth-largest company by market cap with a valuation of $2.5 trillion. That's a long way away from $4 trillion and significantly behind Microsoft and Apple. But there's one factor that Alphabet has going for it that gives it a solid argument for reaching $4 trillion before any of the companies ahead of it.

Image source: Getty Images.

Alphabet's second quarter was dominant

Alphabet is likely better known by the businesses that it owns: Google, YouTube, Waymo, and the Android operating system. It has a dominant empire in various niches, but its most important is Google Search.

In the second quarter, Google Search generated $54 billion of the company's revenue of $96 billion. That's a large chunk of its total, so it needs to continue having this division perform well to succeed as a whole.

However, there are some early warning signs that have investors concerned. The most significant technologies in generative artificial intelligence (AI) have the potential to transform how people use the internet. Currently, the vast majority of people seek information using Google Search. That could change if generative AI becomes more widely adopted by the masses. The market broadly assumes that it will replace Google, but that seems far from reality.

One area where Google has bridged the gap is with AI search overviews, which give users a generative AI-powered summary of their search results. Management discussed the popularity of this feature during its second-quarter conference call and provided a couple of key insights for investors.

First, AI overviews now have over 2 billion users in 40 different languages, showcasing its widespread appeal. Another huge revelation for investors is that it sees the same monetization as regular search results, so it's not harming Google's business at all by heavily investing in this technology.

This showed up in Alphabet's results, as Google Search revenue rose 12% year over year. That's an acceleration from the 10% year-over-year growth in the first quarter. This isn't a sign of a dying business; it's a sign of one that's growing.

As a result, there's no reason for Alphabet to trade at a significant discount to its big-tech peers, since it's growing just as fast (if not faster) than most of them.

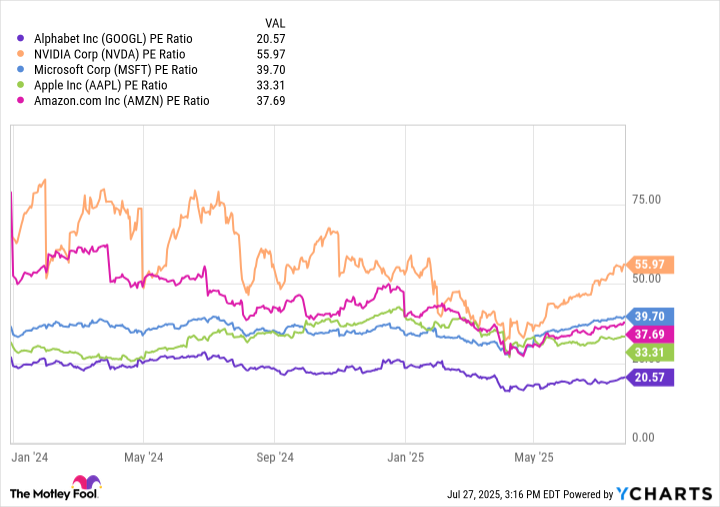

Its peers fetch a much higher premium

The four companies ahead of Alphabet in market cap are Nvidia, Microsoft, Apple, and Amazon. Compared to these four, Alphabet trades at a huge discount.

GOOGL PE Ratio data by YCharts; PE = price to earnings.

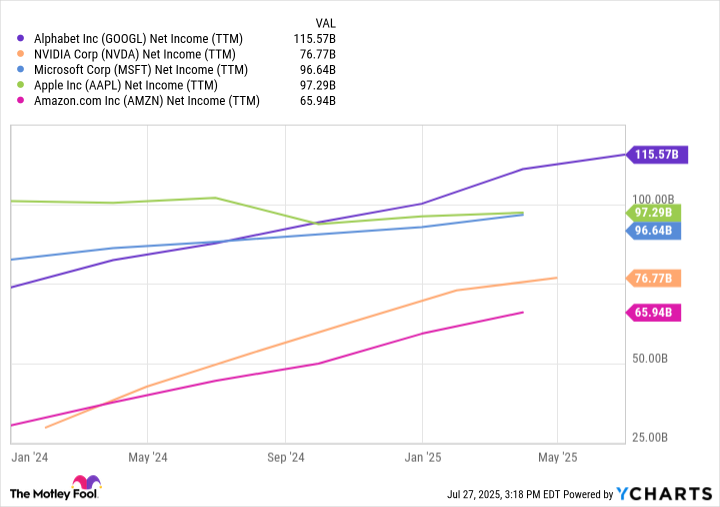

However, over the past 12 months, Alphabet has produced the most net income of any of these companies.

GOOGL Net Income (TTM) data by YCharts; TTM = trailing 12 months.

Alphabet actually produces the most profit of any company that trades on U.S. exchanges, and if it received the same multiple as its peers, it would be the largest company in the world (in some cases).

| Company | Trailing P/E | Alphabet's Valuation at That Premium |

|---|---|---|

| Nvidia | 56.0 | $6.47 Trillion |

| Microsoft | 39.7 | $4.59 Trillion |

| Apple | 33.3 | $3.85 Trillion |

| Amazon | 37.7 | $4.36 Trillion |

Data source: YCharts.

So, if the company were to receive the same respect as its peers, it would already be the world's largest company. Whether you think most of the big tech stocks are overvalued or if you think Alphabet is undervalued, it doesn't matter.

It has some of the best chances of beating the market over the next few years due to its low valuation and impressive growth, considering its size. I think it's a top stock to buy now, and it makes even more sense if you're concerned that the market in general is getting too expensive.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10