3 ASX Stocks Estimated To Be 25.8% To 50% Below Their Intrinsic Value

As the Australian market faces a challenging period with futures indicating a dip and global trade tensions intensifying, investors are keenly observing how these factors might affect stock valuations. In such an environment, identifying stocks that are trading below their intrinsic value can present opportunities for those looking to invest in fundamentally strong companies at potentially attractive prices.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Superloop (ASX:SLC) | A$3.35 | A$6.38 | 47.5% |

| Ridley (ASX:RIC) | A$2.89 | A$5.78 | 50% |

| PointsBet Holdings (ASX:PBH) | A$1.215 | A$2.10 | 42% |

| Medical Developments International (ASX:MVP) | A$0.555 | A$1.07 | 48.1% |

| Infomedia (ASX:IFM) | A$1.295 | A$2.07 | 37.3% |

| Fenix Resources (ASX:FEX) | A$0.295 | A$0.49 | 40.1% |

| Domino's Pizza Enterprises (ASX:DMP) | A$18.24 | A$29.70 | 38.6% |

| Collins Foods (ASX:CKF) | A$9.29 | A$15.89 | 41.5% |

| Charter Hall Group (ASX:CHC) | A$19.92 | A$35.43 | 43.8% |

| Advanced Braking Technology (ASX:ABV) | A$0.093 | A$0.16 | 42.7% |

Click here to see the full list of 29 stocks from our Undervalued ASX Stocks Based On Cash Flows screener.

Let's uncover some gems from our specialized screener.

ALS (ASX:ALQ)

Overview: ALS Limited provides professional technical services focused on testing, measurement, and inspection across regions including Africa, Asia Pacific, Europe, the Middle East, North Africa, and the United States with a market capitalization of A$9.16 billion.

Operations: The company's revenue is derived from two main segments: Commodities, contributing A$1.09 billion, and Life Sciences, accounting for A$1.91 billion.

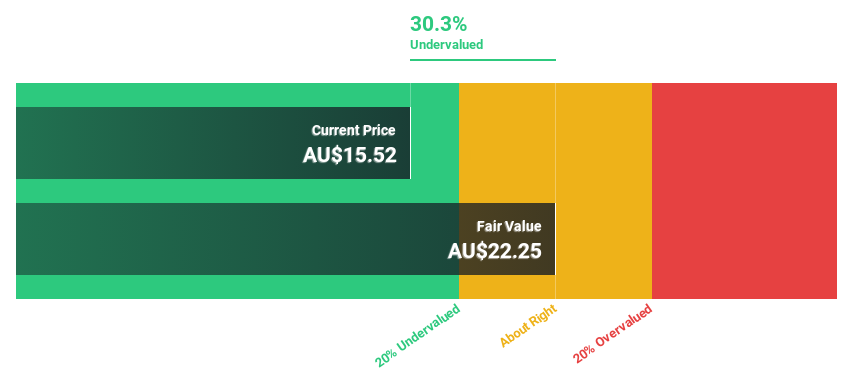

Estimated Discount To Fair Value: 34.2%

ALS Limited is trading at A$18.06, significantly below its estimated fair value of A$27.44, highlighting its undervaluation based on discounted cash flow analysis. Despite a high level of debt, ALS's earnings are projected to grow 13.07% annually, surpassing the Australian market average. Recent capital raising efforts totaling A$390 million aim to support laboratory expansion and M&A activities while maintaining a focus on deleveraging and organic growth opportunities in the testing services sector.

- Our growth report here indicates ALS may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in ALS' balance sheet health report.

Judo Capital Holdings (ASX:JDO)

Overview: Judo Capital Holdings Limited, with a market cap of A$1.74 billion, operates through its subsidiaries to provide a range of banking products and services tailored for small and medium businesses in Australia.

Operations: Judo Capital Holdings Limited generates revenue of A$325.50 million from its banking segment, focusing on services for small and medium enterprises in Australia.

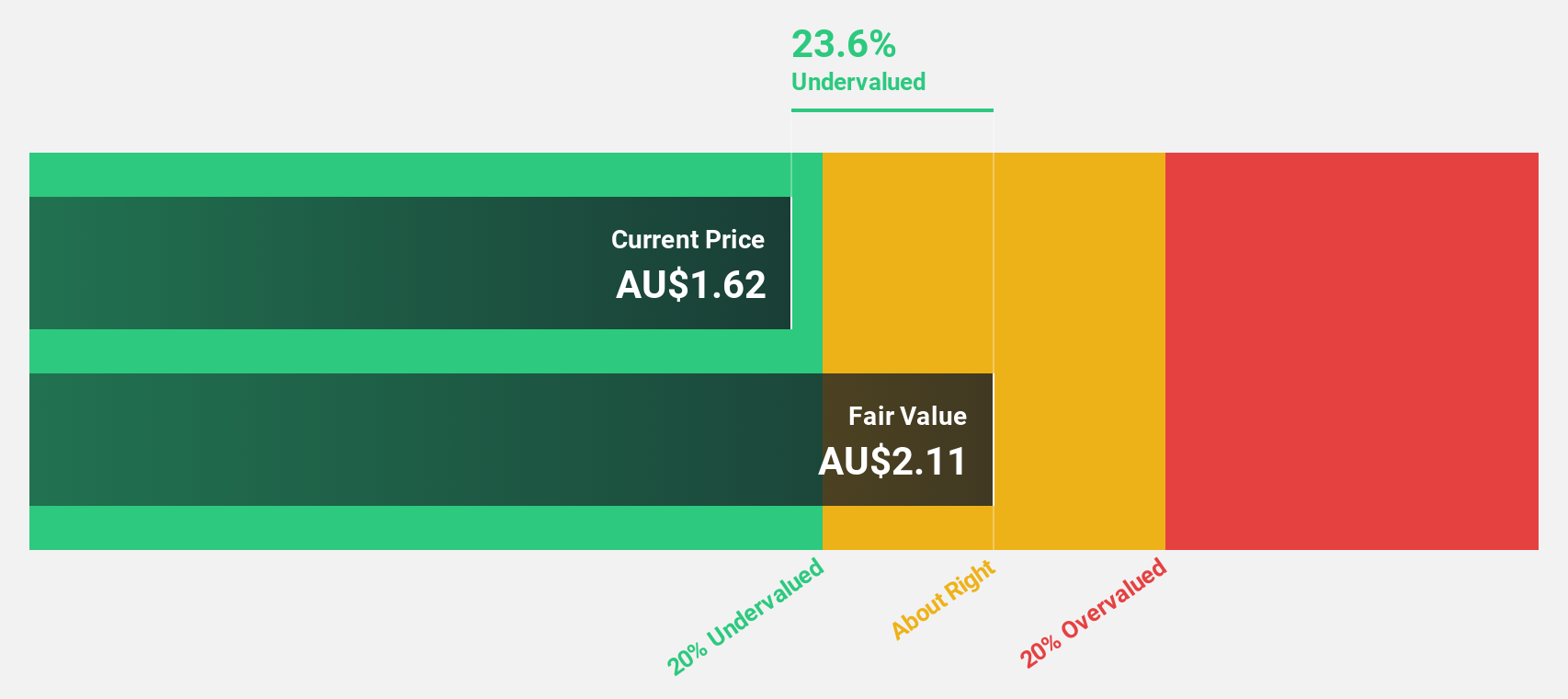

Estimated Discount To Fair Value: 25.8%

Judo Capital Holdings is trading at A$1.56, below its estimated fair value of A$2.1, indicating undervaluation based on discounted cash flow analysis. Earnings are expected to grow significantly at 24.8% annually, outpacing the Australian market average of 10.7%. However, the forecasted Return on Equity remains low at 9.5%. Revenue growth is projected at 17.5% per year, faster than the market's 5.5%, but below a high-growth threshold of 20%.

- Our earnings growth report unveils the potential for significant increases in Judo Capital Holdings' future results.

- Dive into the specifics of Judo Capital Holdings here with our thorough financial health report.

Ridley (ASX:RIC)

Overview: Ridley Corporation Limited, with a market cap of A$1.08 billion, operates in Australia providing animal nutrition solutions through its subsidiaries.

Operations: The company's revenue is primarily derived from Bulk Stockfeeds at A$894.26 million and Packaged/Ingredients at A$389.70 million.

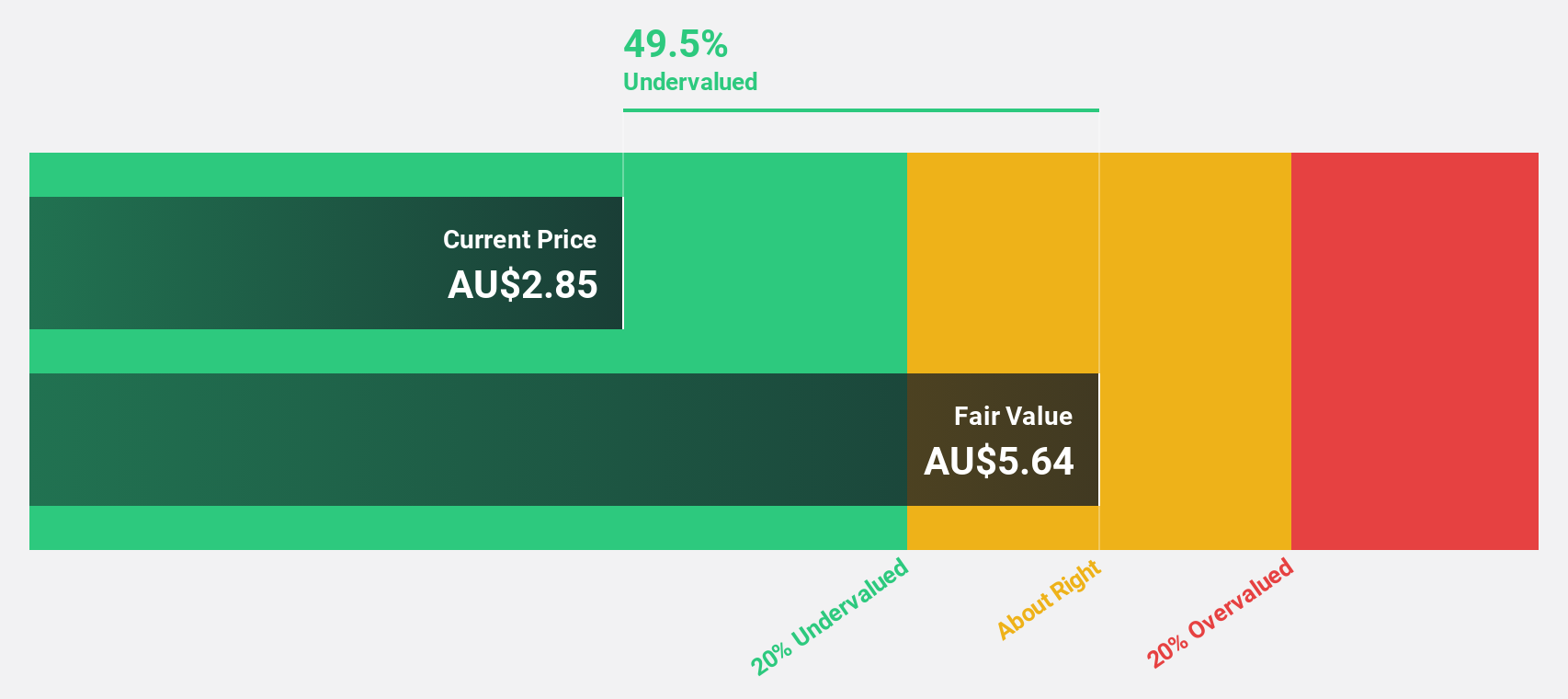

Estimated Discount To Fair Value: 50%

Ridley Corporation, trading at A$2.89, is significantly undervalued with a fair value estimate of A$5.78 based on discounted cash flow analysis. Revenue is projected to grow at 20.7% annually, surpassing the Australian market's average growth rate of 5.5%. Earnings are expected to increase by 16.6% per year, exceeding the market's 10.7%. However, its Return on Equity forecast is modest at 14.4%, and dividend stability remains uncertain amid recent equity and fixed-income offerings totaling A$175 million.

- The growth report we've compiled suggests that Ridley's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Ridley.

Turning Ideas Into Actions

- Click this link to deep-dive into the 29 companies within our Undervalued ASX Stocks Based On Cash Flows screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10