- Mastercard reported strong second-quarter results, with sales reaching US$8.13 billion and net income rising to US$3.70 billion for the period ended June 30, 2025.

- These results highlighted the company's ability to drive both top- and bottom-line growth through recent product launches and global partnership expansions.

- We will explore how Mastercard’s accelerating earnings growth, powered by digital payment innovation, influences its overall investment narrative and future prospects.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Mastercard Investment Narrative Recap

To be a Mastercard shareholder, you need to believe in the company's ongoing ability to grow payments volumes by leading digital innovation and expanding its global partnerships. While the recent earnings release showed healthy top- and bottom-line growth and reaffirmed Mastercard’s strengths, the reported discussions around a possible shift of the Apple Card’s payment processing to Visa do not materially change the most important near-term catalyst, which is continued growth in digital and cross-border payments. However, competitive shifts in key card portfolios remain a risk to monitor.

Among Mastercard's recent announcements, the expansion of its partnership with BMO to enhance international money transfer stands out. This move strengthens Mastercard's cross-border capabilities, directly supporting one of its key growth drivers while offering diversified revenue streams outside traditional cards, which is particularly relevant as the card network space faces increased competition for high-profile portfolios like Apple Card.

On the flip side, investors should be aware that if further high-profile card programs migrate to rival networks, it could...

Read the full narrative on Mastercard (it's free!)

Mastercard's outlook suggests revenues of $41.2 billion and earnings of $19.3 billion by 2028. This is based on an expected annual revenue growth rate of 12.3% and an increase in earnings of $6.2 billion from the current $13.1 billion.

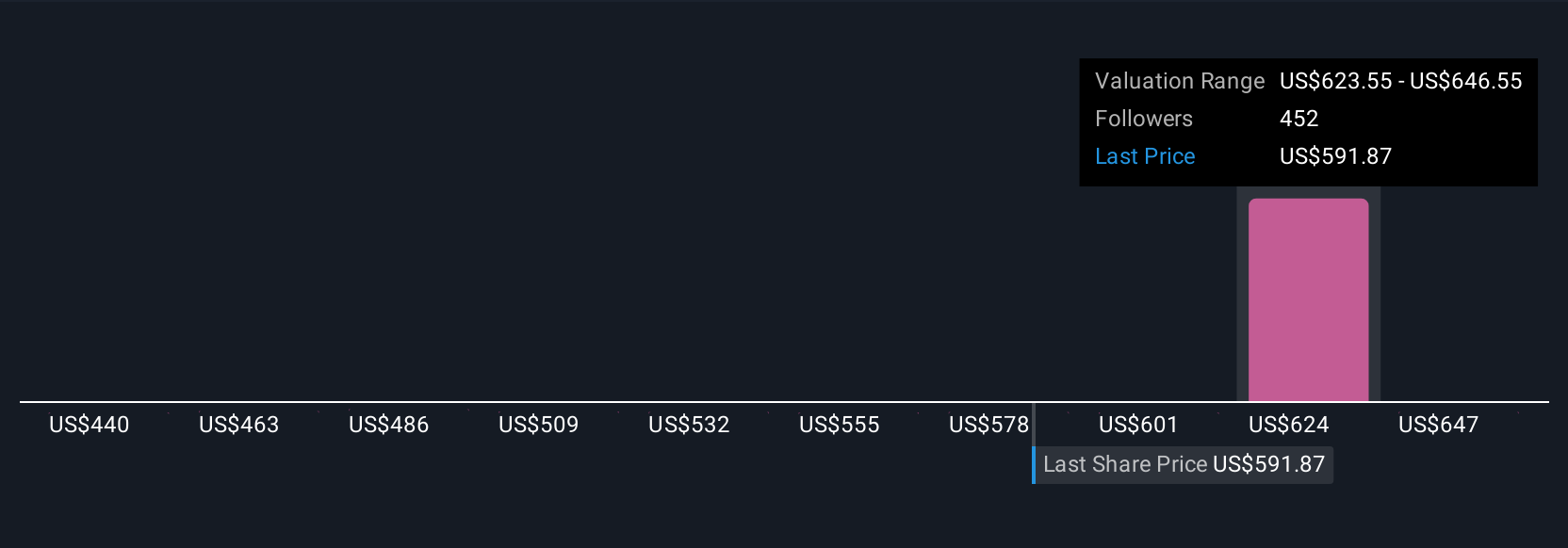

Uncover how Mastercard's forecasts yield a $629.63 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Twenty members of the Simply Wall St Community estimated Mastercard's fair value, ranging widely from US$425 to US$669.54 per share. As market participants offer their own analyses, competition for major payment portfolios underscores the need to keep up with evolving opportunities and risks.

Explore 20 other fair value estimates on Mastercard - why the stock might be worth 25% less than the current price!

Build Your Own Mastercard Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mastercard research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mastercard research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mastercard's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com