GigaCloud Technology (GCT) Surges 59% In Last Quarter

GigaCloud Technology (GCT) recently announced the leasing of a new fulfillment center in Germany and the approval of a class action settlement, which adds to its operational and legal framework enhancements. These developments might have added weight to the company’s share price increase of 59% over the last quarter, even as the broader market experienced turbulence, tumbling by 18% recently amid trade uncertainties and weaker job data. Participation in key events like the Las Vegas Market and being added to multiple indices could have further supported the GigaCloud's value, aligning the company slightly counter to the recent market downturn.

We've discovered 1 possible red flag for GigaCloud Technology that you should be aware of before investing here.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

The recent developments at GigaCloud Technology, including the leasing of a new fulfillment center in Germany and the class action settlement approval, could bolster their European market share and operational stability. These enhancements have the potential to improve both revenue and earnings forecasts, aligning with their rebranding efforts and integration strategies. With analysts projecting a revenue increase to US$1.3 billion by 2028, the new center may significantly contribute to this growth path.

Over the last year, GigaCloud's total shareholder return, including share price and dividends, decreased by 17.96%. Despite this decline, the company's shares have increased by 59% over the most recent quarter, a stark contrast to the broader market's 18% decline amid economic uncertainties. This performance indicates a potential reversal of sentiment, although it lags compared to the 17.5% return of the overall U.S. market and the US Retail Distributors industry's 14.9% drop within the same timeframe.

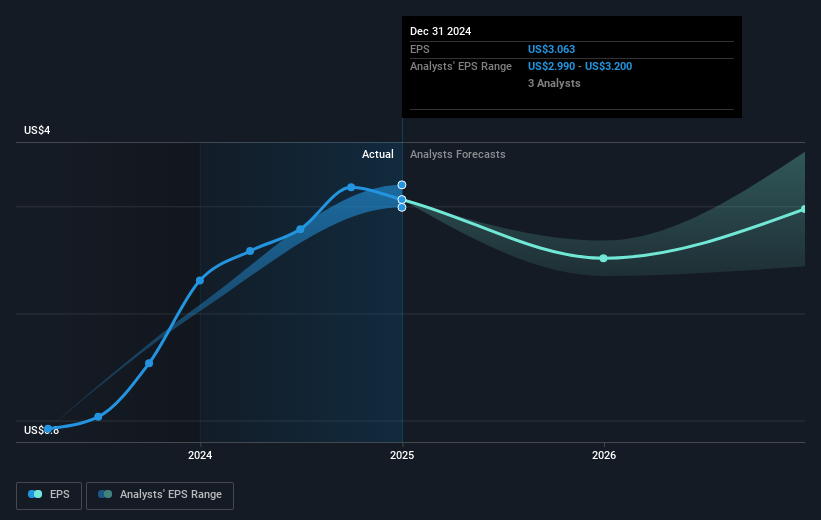

The current share price of US$20.97 shows a significant discount to the consensus price target of US$29.5, indicating analysts' expectations of higher future value. The recent strategic moves highlight potential for growth in earnings and market positioning, aiding in closing this valuation gap. As the company navigates macroeconomic challenges and competitive pressures, the fulfillment center might be a pivotal factor in achieving the forecasted outcomes, although reaching earnings of US$82.1 million by 2028 with a PE ratio of 13.4x remains a challenge that reflects analysts' mixed opinions on GigaCloud's future trajectory.

Upon reviewing our latest valuation report, GigaCloud Technology's share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10