Lincoln Electric Holdings, Inc. Beat Analyst Estimates: See What The Consensus Is Forecasting For This Year

Lincoln Electric Holdings, Inc. (NASDAQ:LECO) defied analyst predictions to release its quarterly results, which were ahead of market expectations. It was overall a positive result, with revenues beating expectations by 4.5% to hit US$1.1b. Lincoln Electric Holdings reported statutory earnings per share (EPS) US$2.56, which was a notable 11% above what the analysts had forecast. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

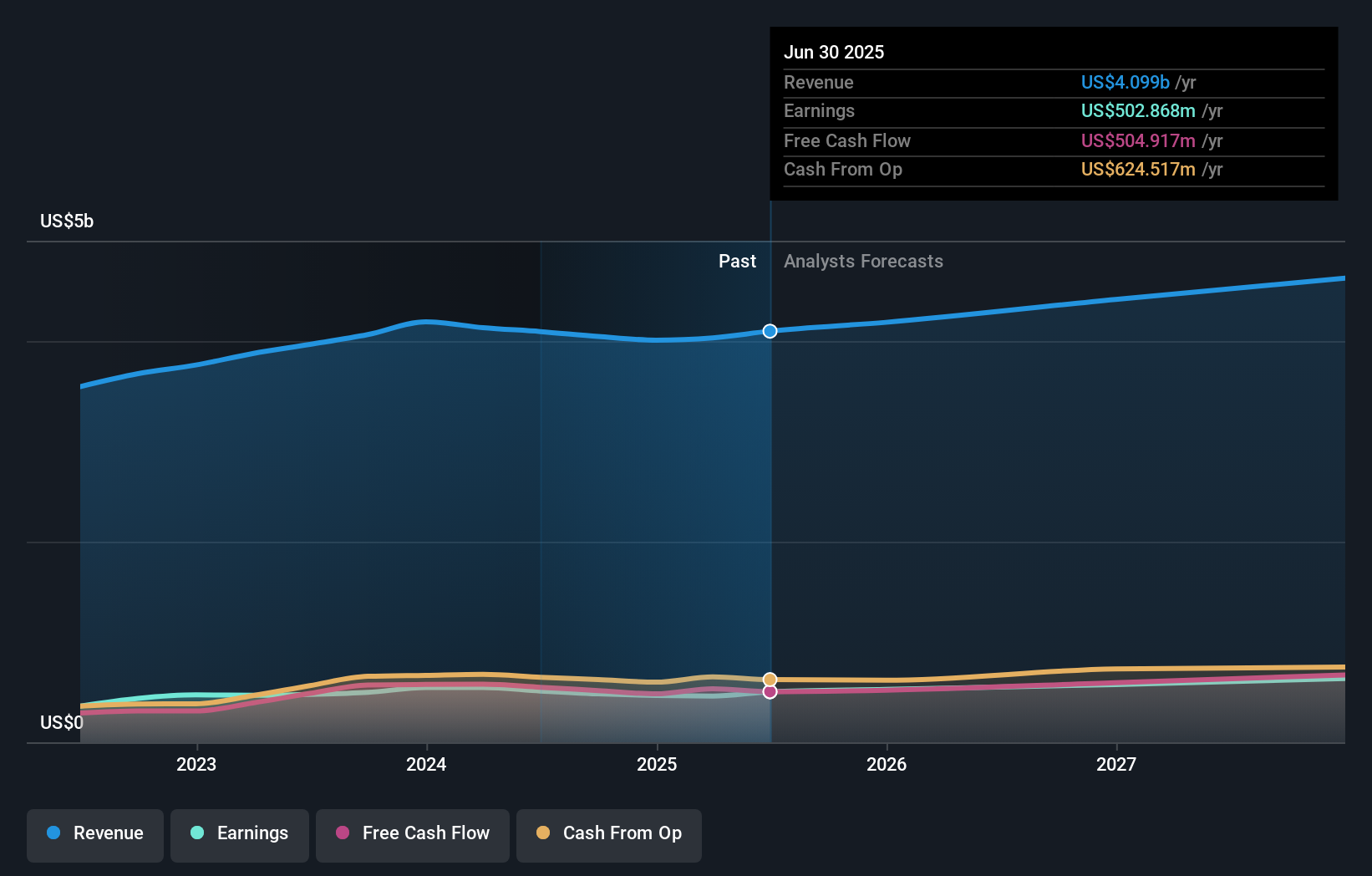

Taking into account the latest results, the current consensus from Lincoln Electric Holdings' nine analysts is for revenues of US$4.19b in 2025. This would reflect a satisfactory 2.1% increase on its revenue over the past 12 months. Statutory earnings per share are predicted to rise 4.1% to US$9.48. Yet prior to the latest earnings, the analysts had been anticipated revenues of US$4.10b and earnings per share (EPS) of US$9.01 in 2025. It looks like there's been a modest increase in sentiment following the latest results, withthe analysts becoming a bit more optimistic in their predictions for both revenues and earnings.

Check out our latest analysis for Lincoln Electric Holdings

It will come as no surprise to learn that the analysts have increased their price target for Lincoln Electric Holdings 11% to US$244on the back of these upgrades. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on Lincoln Electric Holdings, with the most bullish analyst valuing it at US$290 and the most bearish at US$180 per share. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's pretty clear that there is an expectation that Lincoln Electric Holdings' revenue growth will slow down substantially, with revenues to the end of 2025 expected to display 4.3% growth on an annualised basis. This is compared to a historical growth rate of 9.4% over the past five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 4.3% annually. So it's pretty clear that, while Lincoln Electric Holdings' revenue growth is expected to slow, it's expected to grow roughly in line with the industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Lincoln Electric Holdings following these results. There was also an upgrade to revenue estimates, although as we saw earlier, forecast growth is only expected to be about the same as the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Lincoln Electric Holdings going out to 2027, and you can see them free on our platform here..

Before you take the next step you should know about the 1 warning sign for Lincoln Electric Holdings that we have uncovered.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10