How Freshworks’ (FRSH) Upbeat Outlook and McLaren Deal Could Shape Its Growth Trajectory

- Freshworks Inc. recently announced its second quarter 2025 earnings, reporting sales of US$204.68 million and a net loss of US$1.74 million, both showing improvements compared to the same period last year, and also raised its full-year revenue guidance to a range of US$822.9 million to US$828.9 million.

- An important highlight is the company’s new multi-year partnership with McLaren Racing, showcasing broader enterprise adoption of Freshworks’ AI-powered IT service management solutions and increasing its brand visibility on a global platform.

- We’ll review how Freshworks’ improved guidance and high-profile McLaren Racing partnership reinforce its investment narrative for growth and product adoption.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Freshworks Investment Narrative Recap

To believe in Freshworks as a shareholder, you need to have confidence in its ability to leverage AI-powered software solutions to capture a larger share of the enterprise IT market. The latest earnings report, with improved sales and reduced losses, plus raised full-year guidance, further supports the bullish catalyst of robust revenue growth; however, uncertainties in the macroeconomic environment and potential volatility remain a material risk, and the recent news does not eliminate this concern.

One of the most relevant recent announcements is the new multi-year partnership with McLaren Racing, which puts Freshworks’ AI solutions on a global stage and directly supports the company's growth catalysts by increasing both enterprise adoption and brand recognition.

Yet, despite this positive momentum, investors should also consider that if Freshworks’ AI-powered solutions don’t keep pace with competitors, it could…

Read the full narrative on Freshworks (it's free!)

Freshworks' outlook anticipates $1.1 billion in revenue and $139.8 million in earnings by 2028. This outlook assumes a 12.0% annual revenue growth rate and an increase in earnings of $213.1 million from the current level of -$73.3 million.

Uncover how Freshworks' forecasts yield a $19.86 fair value, a 48% upside to its current price.

Exploring Other Perspectives

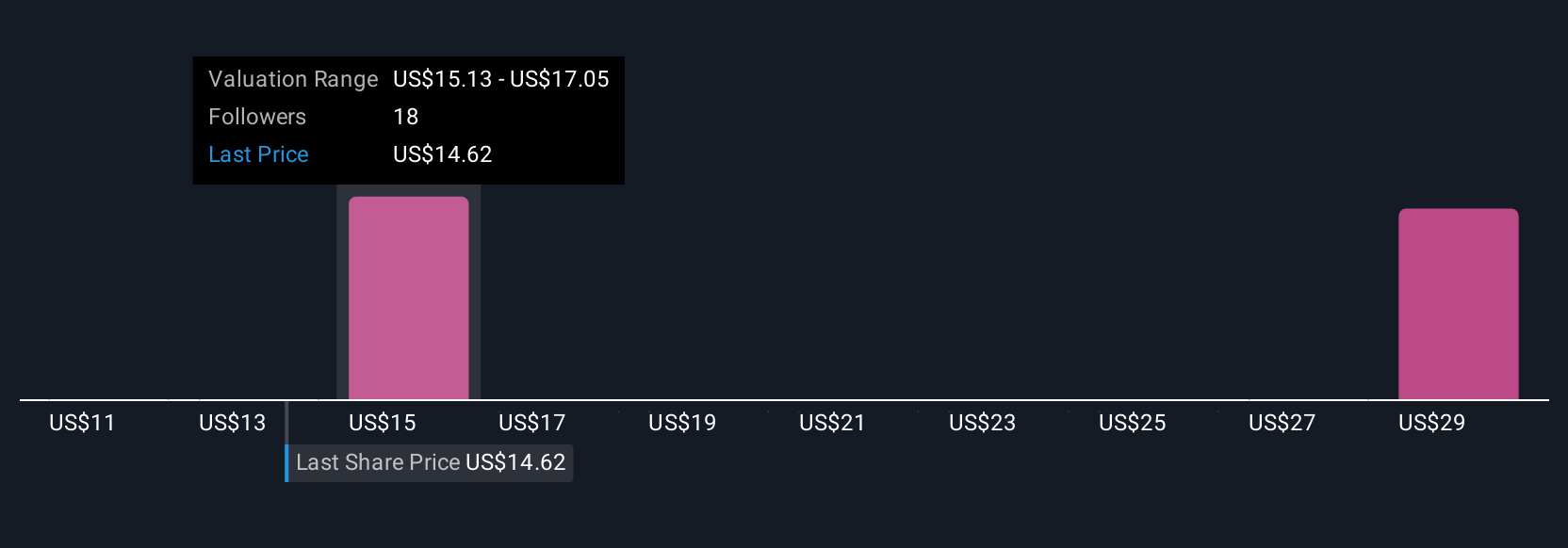

Six community members of Simply Wall St provided fair value estimates for Freshworks, ranging from US$11.30 to US$30.45 per share. While many expect rising revenue to drive future performance, differing views show how much opinions can vary; see how your expectations align with these perspectives.

Explore 6 other fair value estimates on Freshworks - why the stock might be worth 16% less than the current price!

Build Your Own Freshworks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freshworks research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Freshworks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freshworks' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10