Alight (NYSE:ALIT) Posts Better-Than-Expected Sales In Q2 But Full-Year Sales Guidance Misses Expectations

Human capital management provider Alight $(ALIT)$ reported Q2 CY2025 results topping the market’s revenue expectations, but sales fell by 1.9% year on year to $528 million. On the other hand, the company’s full-year revenue guidance of $2.31 billion at the midpoint came in 1.7% below analysts’ estimates. Its non-GAAP profit of $0.10 per share was in line with analysts’ consensus estimates.

Is now the time to buy Alight? Find out by accessing our full research report, it’s free.

Alight (ALIT) Q2 CY2025 Highlights:

- Revenue: $528 million vs analyst estimates of $525 million (1.9% year-on-year decline, 0.6% beat)

- Adjusted EPS: $0.10 vs analyst estimates of $0.10 (in line)

- Adjusted EBITDA: $127 million vs analyst estimates of $126.4 million (24.1% margin, in line)

- The company dropped its revenue guidance for the full year to $2.31 billion at the midpoint from $2.35 billion, a 2% decrease

- Management reiterated its full-year Adjusted EPS guidance of $0.61 at the midpoint

- EBITDA guidance for the full year is $632.5 million at the midpoint, above analyst estimates of $625.7 million

- Operating Margin: -191%, down from -9.7% in the same quarter last year largely due to a $983 million non-cash goodwill impairment charge related to our Health Solutions reporting unit

- Free Cash Flow Margin: 21.8%, up from 2% in the same quarter last year

- Market Capitalization: $2.71 billion

“Our underlying business operations continued to strengthen during the second quarter,” said CEO Dave Guilmette.

Company Overview

Born from a corporate spinoff in 2017 to focus on employee experience technology, Alight (NYSE:ALIT) provides human capital management solutions that help companies administer employee benefits, payroll, and workforce management systems.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $2.31 billion in revenue over the past 12 months, Alight is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

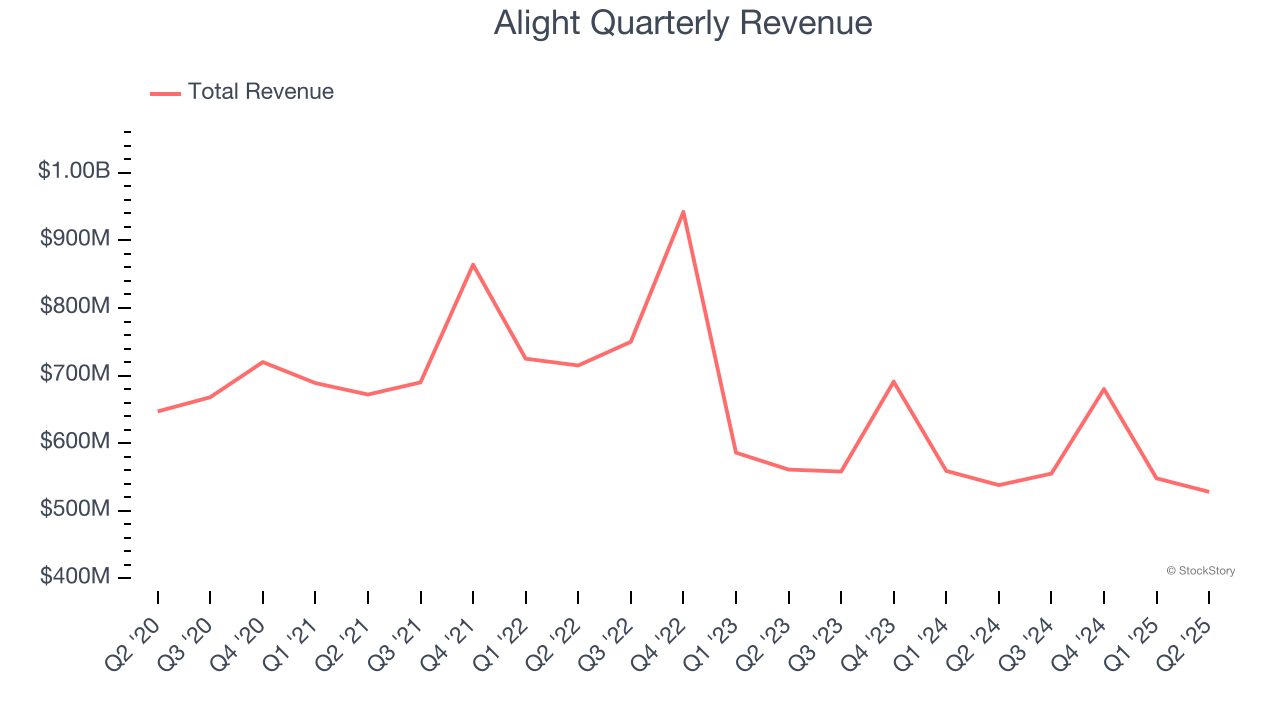

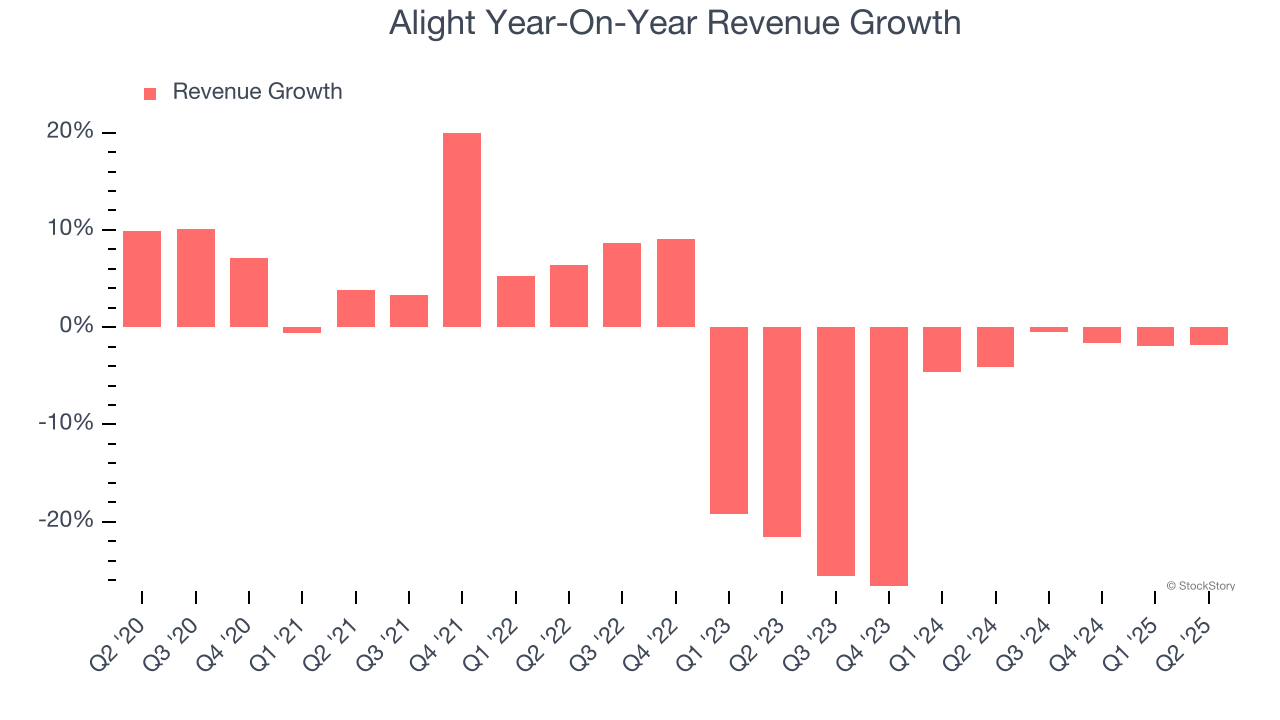

As you can see below, Alight’s revenue declined by 2.5% per year over the last five years, a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Alight’s recent performance shows its demand remained suppressed as its revenue has declined by 9.8% annually over the last two years.

This quarter, Alight’s revenue fell by 1.9% year on year to $528 million but beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

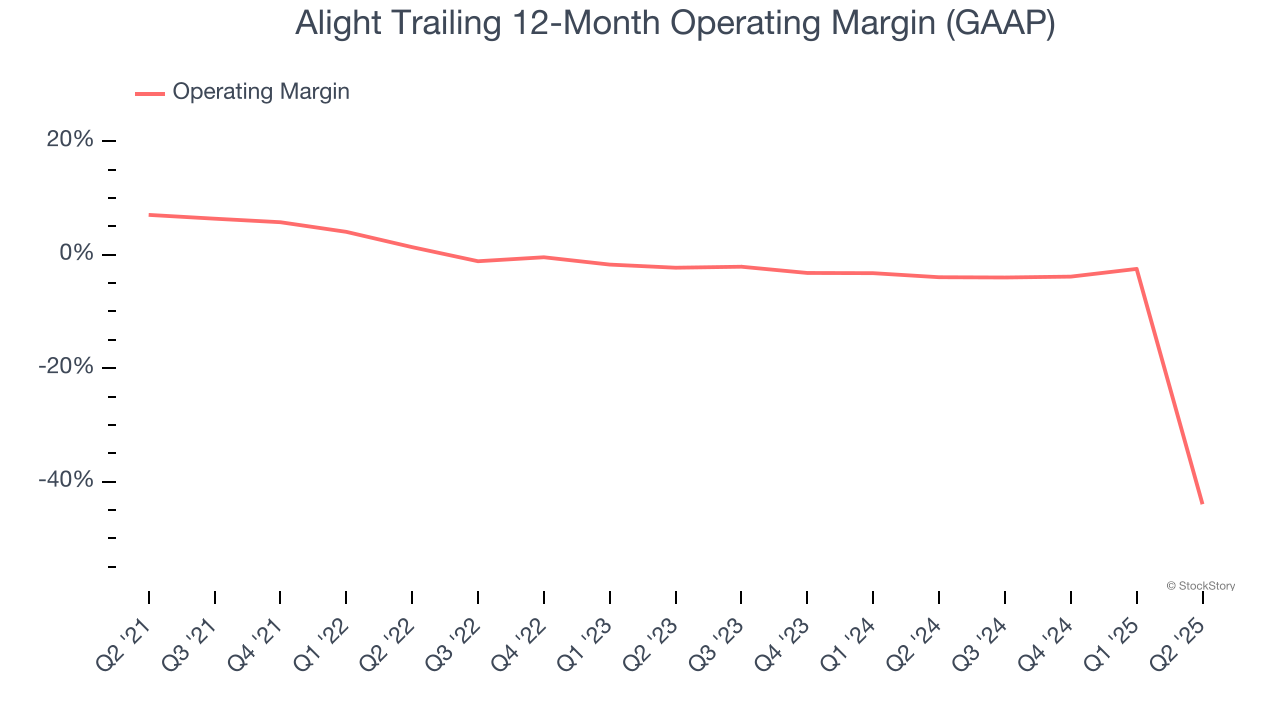

Alight’s high expenses have contributed to an average operating margin of negative 7.1% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Alight’s operating margin decreased by 51 percentage points over the last five years. Alight’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Alight generated a negative 191% operating margin largely due to a $983 million non-cash goodwill impairment charge related to our Health Solutions reporting unit.

Earnings Per Share

We track the change in earnings per share $(EPS)$ for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

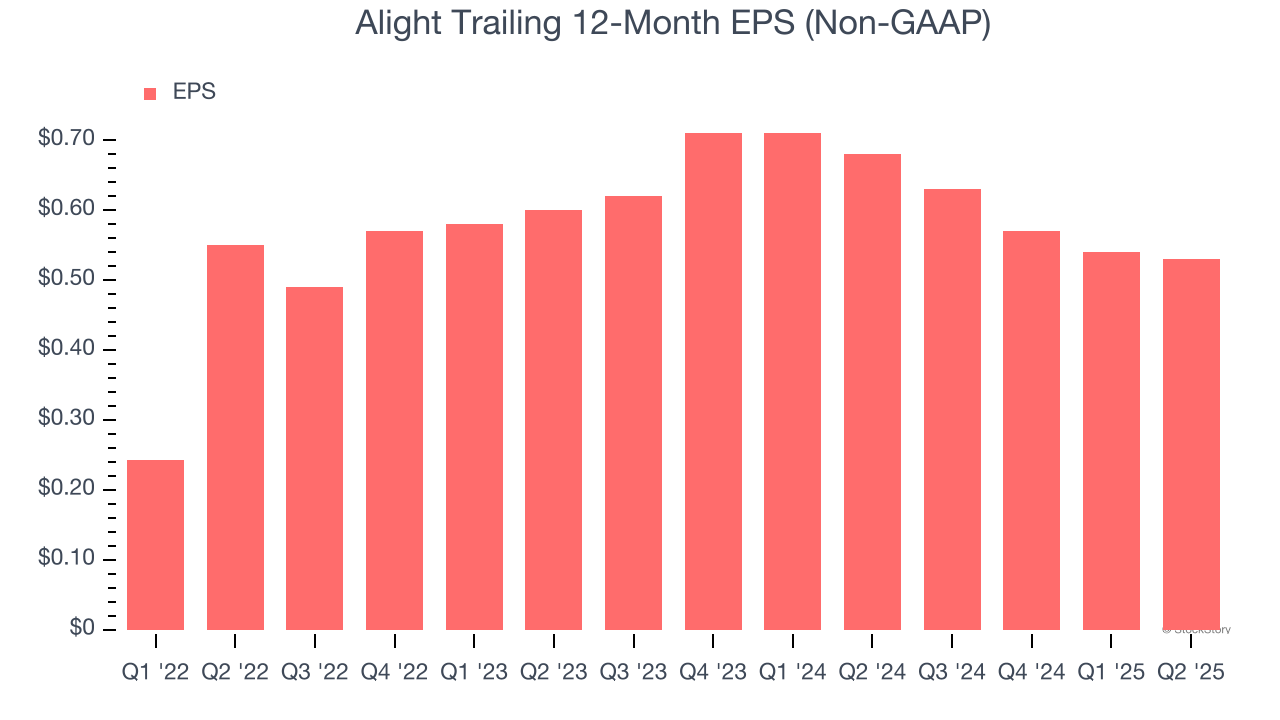

Sadly for Alight, its EPS and revenue declined by 6% and 9.8% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Alight’s low margin of safety could leave its stock price susceptible to large downswings.

In Q2, Alight reported adjusted EPS at $0.10, down from $0.11 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Alight’s full-year EPS of $0.53 to grow 18.3%.

Key Takeaways from Alight’s Q2 Results

We enjoyed seeing Alight beat analysts’ full-year EPS guidance expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EPS missed and its full-year revenue guidance fell short of Wall Street’s estimates. Overall, this quarter was mixed but good enough for investors. The stock traded up 4.8% to $5.39 immediately after reporting.

Is Alight an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10