Trading Near Its 52-Week High, Is Altria Stock a Good Buy Right Now?

-

Altria beat expectations last quarter, on both the top and bottom lines.

-

However, it continues to struggle to grow its top line.

-

The stock is trading at just 12 times its trailing earnings.

Tobacco giant Altria (MO 0.98%) has rallied 18% this year and it has recently posted a new 52-week high. Between a high dividend, a recent earnings beat, and a low valuation, you might be compelled to take a chance on the company.

But Altria isn't without its risks. Its core business is struggling and its future growth prospects are questionable. The company is facing significant challenges ahead; it's important to look beyond just chart movements when deciding whether to add a stock to your portfolio.

Could Altria be a good value buy right now, or are you better off avoiding it? Let's take a close look at its recent financials and overall fundamentals to find out.

Image source: Getty Images.

Altria beats expectations, but continues to struggle with revenue growth

Altria reported its second-quarter earnings last month (which covered the period ended June 30), and it beat expectations on both the top and bottom lines. Adjusted earnings per share of $1.44 was better than analyst projections of $1.39. And revenue (net of excise taxes) came in at $5.29 billion, which was higher than the $5.19 billion that Wall Street was expecting.

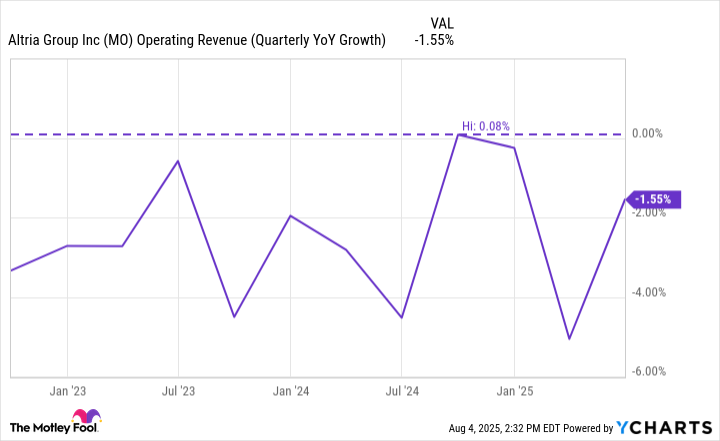

But while that may seem impressive, the company's top line still fell by 2% when compared to the same period last year. And the overall trend has been a troubling one for Altria, with the company struggling to generate any kind of positive growth in recent years.

MO Operating Revenue (Quarterly YoY Growth) data by YCharts

The stock may appear cheap, but it comes with significant risks

Altria's stock only trades at 12 times its trailing earnings, which may seem like a bargain given that investors are paying 25 times earnings for the average S&P 500 stock.

But given the question marks around its future growth, a discount is more than justifiable for Altria. Consumers are, after all, moving away from tobacco as they look to get healthier. And while the company is looking to focus more on smoke-free products, its smokeable segment still generates the lion's share of its revenue -- 88%.

Even for dividend investors who may be tempted to simply hang on and collect the company's recurring payout (which currently yields 6.6%), that's not entirely safe either. In the past six months, the company's operating cash flow totaled $2.9 billion -- short of the $3.5 billion that Altria paid out in dividends over that same time frame.

While cash flow can and will fluctuate and the dividend remains intact right now, the danger for investors is that a cut could still happen in the future, and warning signs are already appearing, including a declining top line and lackluster growth prospects.

Despite its gains, Altria is a stock you're probably better off avoiding

Altria's stock may seem like a hot buy right now given how well it's doing, but you should always consider a company's fundamentals and its underlying growth potential before making any investment decisions. Otherwise, you're making a speculative move based primarily on chart movements or a high dividend, which can set you up for losses down the road.

While it's definitely cheap, Altria looks to be a classic a value trap. And although its dividend may be tempting, it may not prove to be safe and dependable in the long run, despite Altria being a Dividend King.

If you're looking for good investment with recurring revenue that you can rely on, there are far safer and better high-yielding dividend stocks to consider than Altria. The stock simply isn't worth the risk.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10