Discovering Australia's Hidden Investment Gems August 2025

As the Australian market navigates a landscape marked by fluctuating sector performances and global economic uncertainties, small-cap stocks continue to capture attention with their potential for growth amid broader market volatility. In this dynamic environment, identifying hidden gems requires a keen eye for companies that demonstrate resilience and innovation in sectors poised for long-term demand.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Click here to see the full list of 49 stocks from our ASX Undiscovered Gems With Strong Fundamentals screener.

Underneath we present a selection of stocks filtered out by our screen.

Alkane Resources (ASX:ALK)

Simply Wall St Value Rating: ★★★★★☆

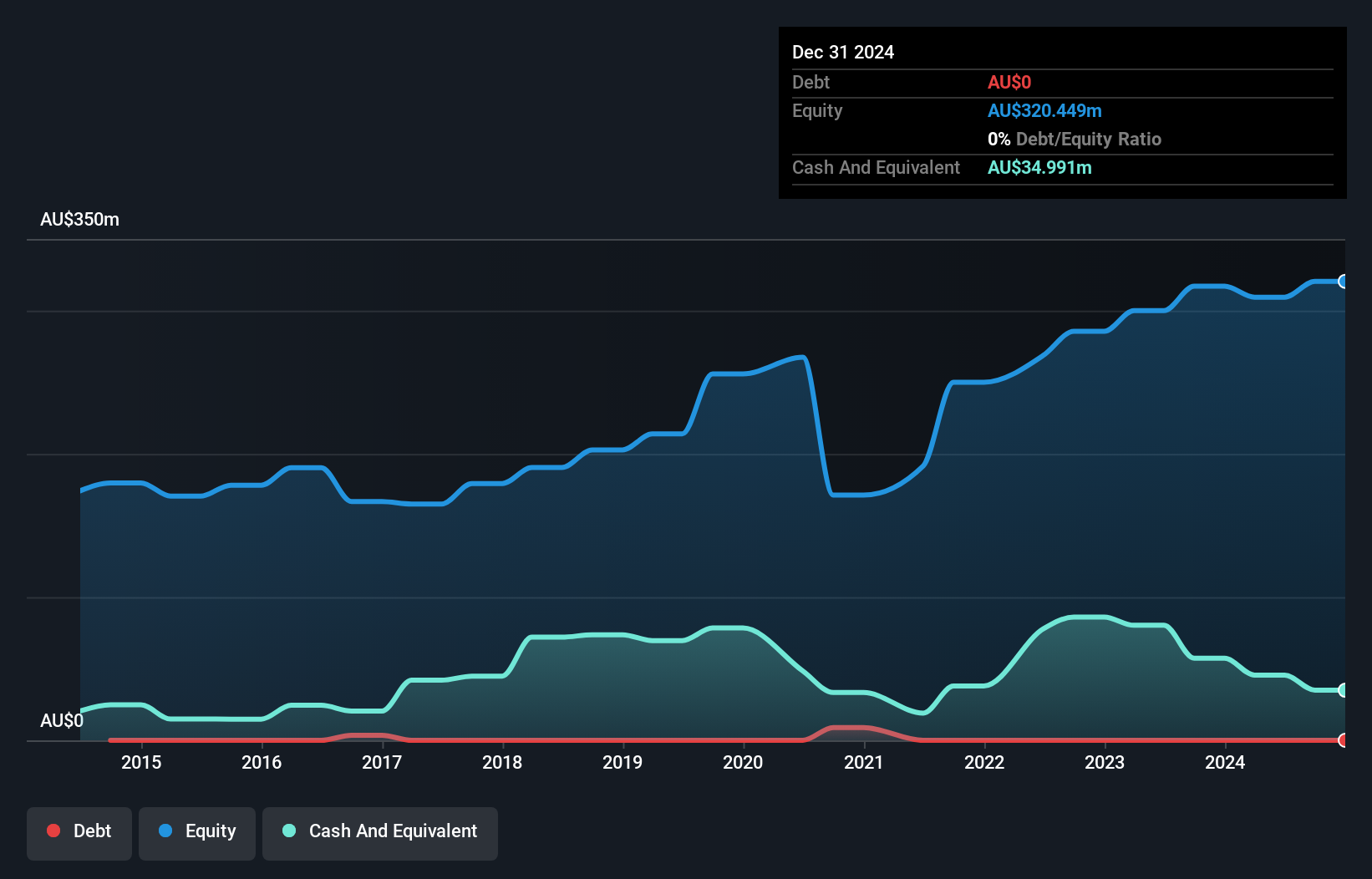

Overview: Alkane Resources Ltd is an Australian company focused on gold exploration and production, with a market capitalization of A$426.91 million.

Operations: Alkane Resources generates revenue primarily from its gold operations, amounting to A$239.14 million.

Alkane Resources, a notable player in the mining sector, has been making waves with its impressive earnings growth of 47.3% over the past year, outpacing the industry average of 14.3%. The company reported third-quarter sales of A$63.2 million, doubling from A$30.46 million a year ago, and net income reached A$8.1 million compared to a previous loss of A$2 million. Trading at 86.5% below its estimated fair value suggests potential undervaluation in the market's eyes. Despite not being free cash flow positive recently, Alkane remains debt-free and profitable with promising forecasts for future earnings growth at an annual rate of 63.66%.

- Click to explore a detailed breakdown of our findings in Alkane Resources' health report.

Learn about Alkane Resources' historical performance.

IVE Group (ASX:IGL)

Simply Wall St Value Rating: ★★★★★☆

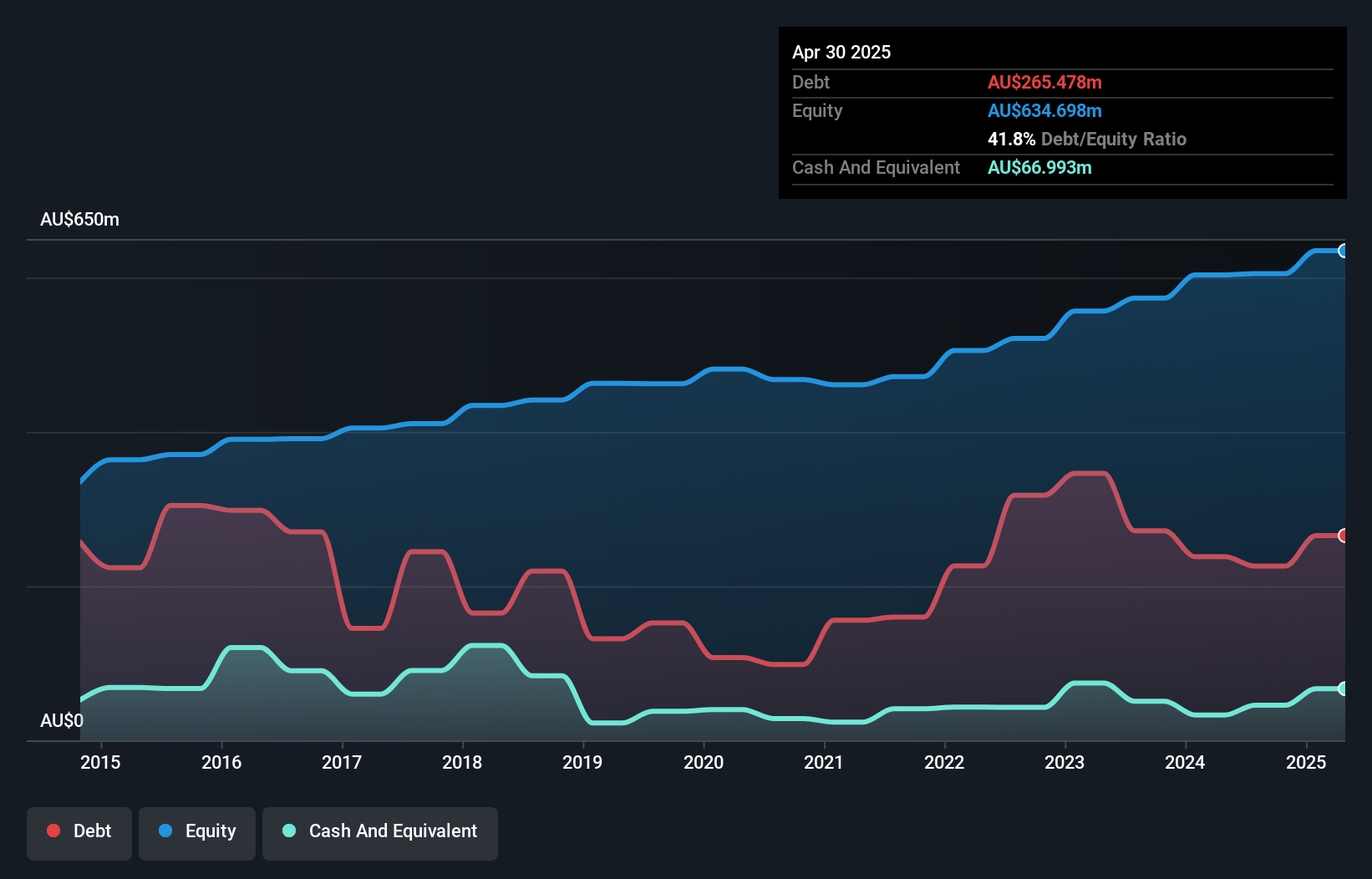

Overview: IVE Group Limited operates within the marketing sector in Australia, with a market capitalization of A$453.29 million.

Operations: IVE Group generates revenue primarily from its advertising segment, amounting to A$975.43 million. The company's financial performance is highlighted by a focus on this significant revenue stream in the marketing sector.

IVE Group is carving a niche in the packaging and 3PL sectors, with its strategic expansion efforts including a new facility in New South Wales and consolidation at Kemps Creek. These moves are likely to bolster operational efficiency and trim costs. Analysts foresee revenue growth at 1.5% annually over the next three years, with profit margins improving from 4.3% to 5.5%. Earnings are projected to hit A$55.9 million by July 2028, though market challenges and reliance on projects like Lasoo could pose risks. The consensus price target stands at A$3.275, reflecting cautious optimism amidst potential volatility.

- IVE Group's expansion in packaging and 3PL is driving significant revenue growth; click here to explore the full narrative on their strategic initiatives.

Ricegrowers (ASX:SGLLV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ricegrowers Limited is a rice food company with operations spanning Australia, New Zealand, the Pacific Islands, Europe, the Middle East, Africa, Asia, and North America, and it has a market capitalization of approximately A$834.13 million.

Operations: Ricegrowers generates revenue primarily from its International Rice segment at A$860.96 million and the Rice Pool segment at A$481.87 million, with additional contributions from Cop Rice and Riviana segments. The company's net profit margin is a key financial metric to consider when evaluating its profitability trends over time.

Ricegrowers is making strategic moves into the Middle East and U.S. markets, aiming to tap into growing demand for rice. With over 40 new product launches, the company is focusing on premium offerings to boost margins. Investments in agritech and sustainability are likely to enhance cost efficiency, aligning with global food security goals. Despite these positives, challenges such as competition and currency volatility persist. Recent earnings show a net income of A$68 million, up from A$63 million last year, with basic EPS at A$1.03 versus A$0.98 previously. The stock trades at A$11.76 against a target of A$14.

- Ricegrowers is strategically expanding into high-growth markets to leverage rising rice demand. Click here to explore the full narrative on Ricegrowers' strategic expansion and innovation efforts.

Where To Now?

- Discover the full array of 49 ASX Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10