Exploring Undervalued Small Caps With Insider Buying In August 2025

As the U.S. stock market rebounds from a recent sell-off, with major indices like the S&P 500 and Nasdaq Composite posting significant gains, investor attention is increasingly turning toward small-cap stocks. In this dynamic environment, characterized by fluctuating economic indicators and evolving monetary policies, identifying undervalued small-cap companies with insider buying can be a strategic approach to uncovering potential opportunities amidst broader market volatility.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 1.0x | 22.10% | ★★★★★★ |

| Southside Bancshares | 10.2x | 3.4x | 44.14% | ★★★★★☆ |

| Tilray Brands | NA | 0.8x | 48.17% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.9x | 20.63% | ★★★★★☆ |

| Citizens & Northern | 10.7x | 2.7x | 49.85% | ★★★★☆☆ |

| Gentherm | 31.2x | 0.7x | 35.12% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 30.38% | ★★★★☆☆ |

| Montrose Environmental Group | NA | 1.0x | 37.79% | ★★★★☆☆ |

| Shore Bancshares | 9.6x | 2.5x | -9.82% | ★★★☆☆☆ |

| Farmland Partners | 7.1x | 8.6x | -33.19% | ★★★☆☆☆ |

Click here to see the full list of 68 stocks from our Undervalued US Small Caps With Insider Buying screener.

We're going to check out a few of the best picks from our screener tool.

Greene County Bancorp (GCBC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Greene County Bancorp operates as a thrift and savings and loan institution with a market capitalization of approximately $0.50 billion.

Operations: The primary revenue stream for the company is derived from its operations in thrift and savings institutions, with recent revenue reported at $74.04 million. Operating expenses are a significant component of costs, reaching $39.37 million in the latest period. Notably, the net income margin has shown variability, recently recorded at 42.06%.

PE: 12.8x

Greene County Bancorp, a smaller financial institution, shows potential with its recent earnings report. For the year ending June 30, 2025, net income rose to US$31.14 million from US$24.77 million last year. Insider confidence is evident as an insider acquired 7,000 shares for US$163,760 in July 2025. The company also increased its annual dividend by 11% and joined several Russell indices in June 2025, highlighting its market presence and growth prospects within the sector.

- Get an in-depth perspective on Greene County Bancorp's performance by reading our valuation report here.

Gain insights into Greene County Bancorp's past trends and performance with our Past report.

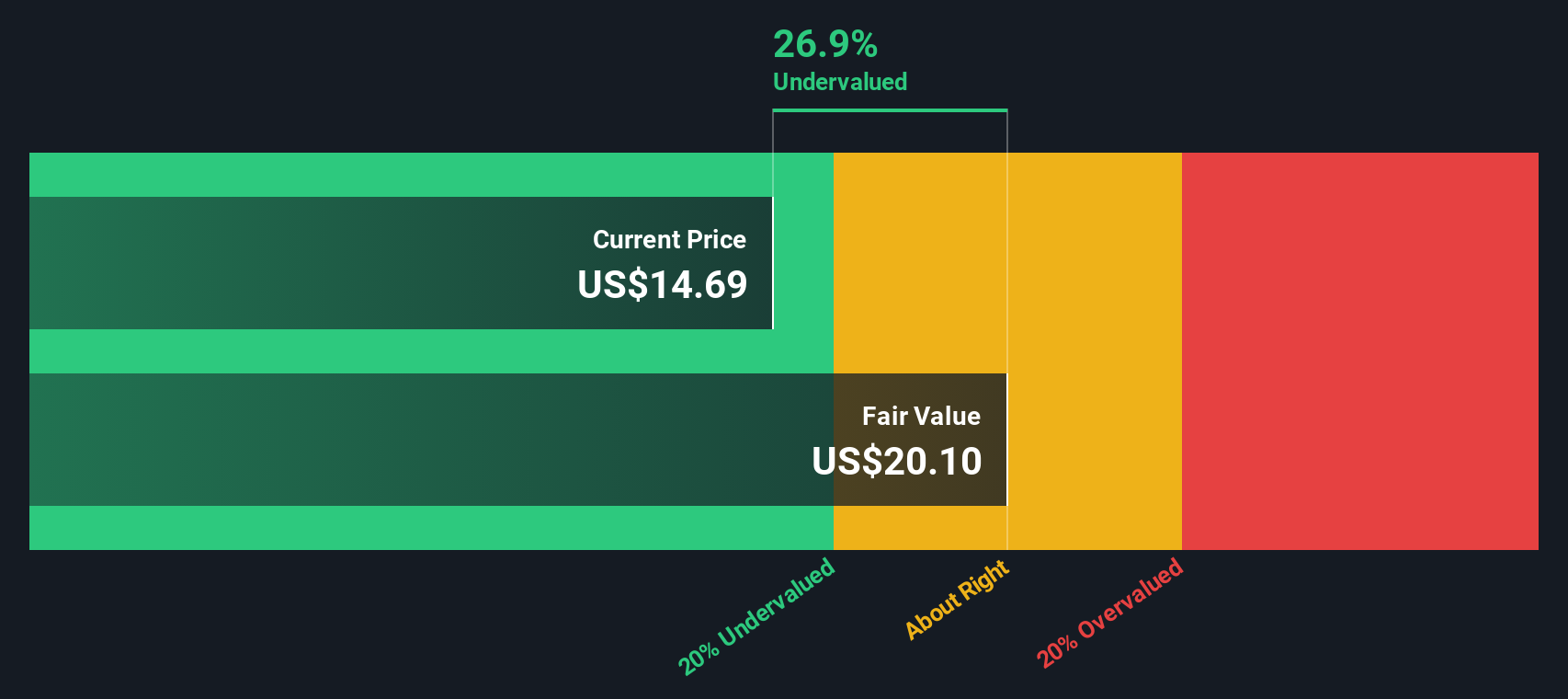

National Research (NRC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: National Research provides business services focused on healthcare analytics and insights, with a market cap of $1.48 billion.

Operations: NRC generates its revenue primarily from Business Services, with a recent quarterly revenue of $140.31 million. The company's gross profit margin has shown variability, reaching 64.69% in June 2021 before declining to 60.31% by June 2025. Operating expenses have been rising, notably general and administrative expenses which hit $50.47 million in the latest quarter, impacting net income margins that fell to 12.78%.

PE: 17.6x

National Research, a small company recently added to several Russell indices, has faced challenges with declining earnings and profit margins. Their recent Q2 2025 report showed a net loss of US$0.106 million compared to last year's US$6.18 million profit. However, insider confidence is evident as they repurchased 381,736 shares for US$5.71 million between April and June 2025. Despite high debt levels and reliance on external borrowing, their dividend policy remains consistent with a declared quarterly payout of $0.12 per share for October 2025.

- Click here to discover the nuances of National Research with our detailed analytical valuation report.

Learn about National Research's historical performance.

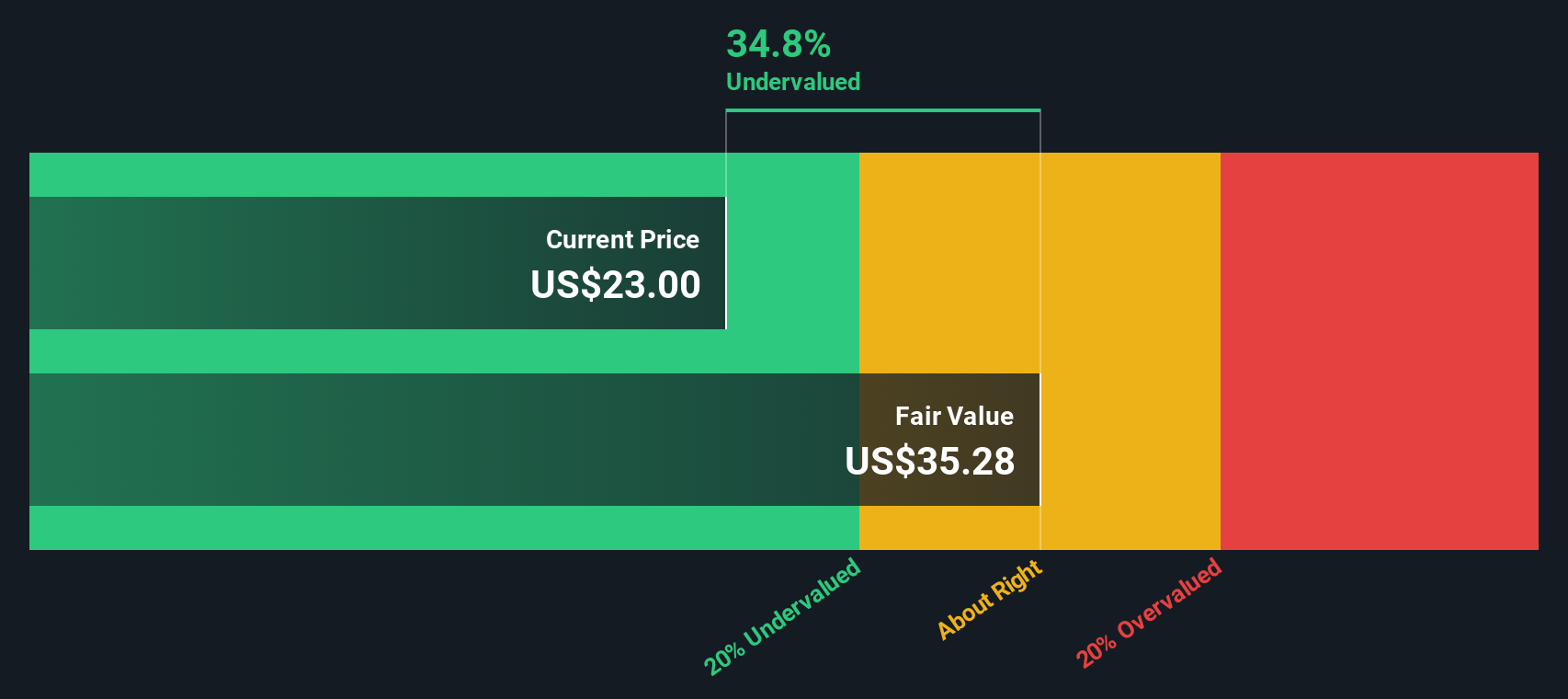

Century Communities (CCS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Century Communities is a homebuilder that operates across various regions in the United States, including the West, Texas, Mountain, and Southeast areas, with a market cap of approximately $2.25 billion.

Operations: The company generates revenue primarily from its regional operations, with the Mountain and Century Complete segments contributing significantly to its income. Its gross profit margin has shown variability, reaching a high of 27.42% in June 2022 before declining to 20.31% by mid-2025. Operating expenses have consistently impacted profitability, with general and administrative expenses being a substantial component of these costs.

PE: 6.8x

Century Communities, a player in the U.S. homebuilding sector, has been expanding its footprint with new communities across various states. Recent announcements highlight developments in Georgia, Arizona, and Kentucky offering affordable homes with modern amenities like quartz countertops and stainless-steel appliances. Despite being dropped from several growth indices by June 2025, insider confidence is evident as insiders have increased their stake over recent months. The company repurchased shares worth US$48 million in Q2 2025, indicating strategic financial maneuvers amidst challenging market conditions and declining earnings forecasts.

- Take a closer look at Century Communities' potential here in our valuation report.

Evaluate Century Communities' historical performance by accessing our past performance report.

Make It Happen

- Investigate our full lineup of 68 Undervalued US Small Caps With Insider Buying right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10