ASX Stocks Including Domino's Pizza Enterprises That Investors May Be Undervaluing

The Australian market has been experiencing mixed performance, with the ASX200 trading in the red as sectors like Industrials, Health Care, and Energy struggled while Real Estate and Discretionary showed resilience. In such a fluctuating environment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential growth opportunities amidst broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vysarn (ASX:VYS) | A$0.51 | A$0.99 | 48.5% |

| Superloop (ASX:SLC) | A$3.30 | A$6.54 | 49.6% |

| Reckon (ASX:RKN) | A$0.63 | A$1.19 | 46.9% |

| PointsBet Holdings (ASX:PBH) | A$1.21 | A$2.13 | 43.2% |

| Fenix Resources (ASX:FEX) | A$0.295 | A$0.51 | 42.1% |

| Collins Foods (ASX:CKF) | A$9.12 | A$15.98 | 42.9% |

| Charter Hall Group (ASX:CHC) | A$21.17 | A$36.21 | 41.5% |

| Austal (ASX:ASB) | A$7.20 | A$13.15 | 45.3% |

| Appen (ASX:APX) | A$0.90 | A$1.79 | 49.7% |

| Advanced Braking Technology (ASX:ABV) | A$0.092 | A$0.16 | 44.2% |

Click here to see the full list of 34 stocks from our Undervalued ASX Stocks Based On Cash Flows screener.

Let's review some notable picks from our screened stocks.

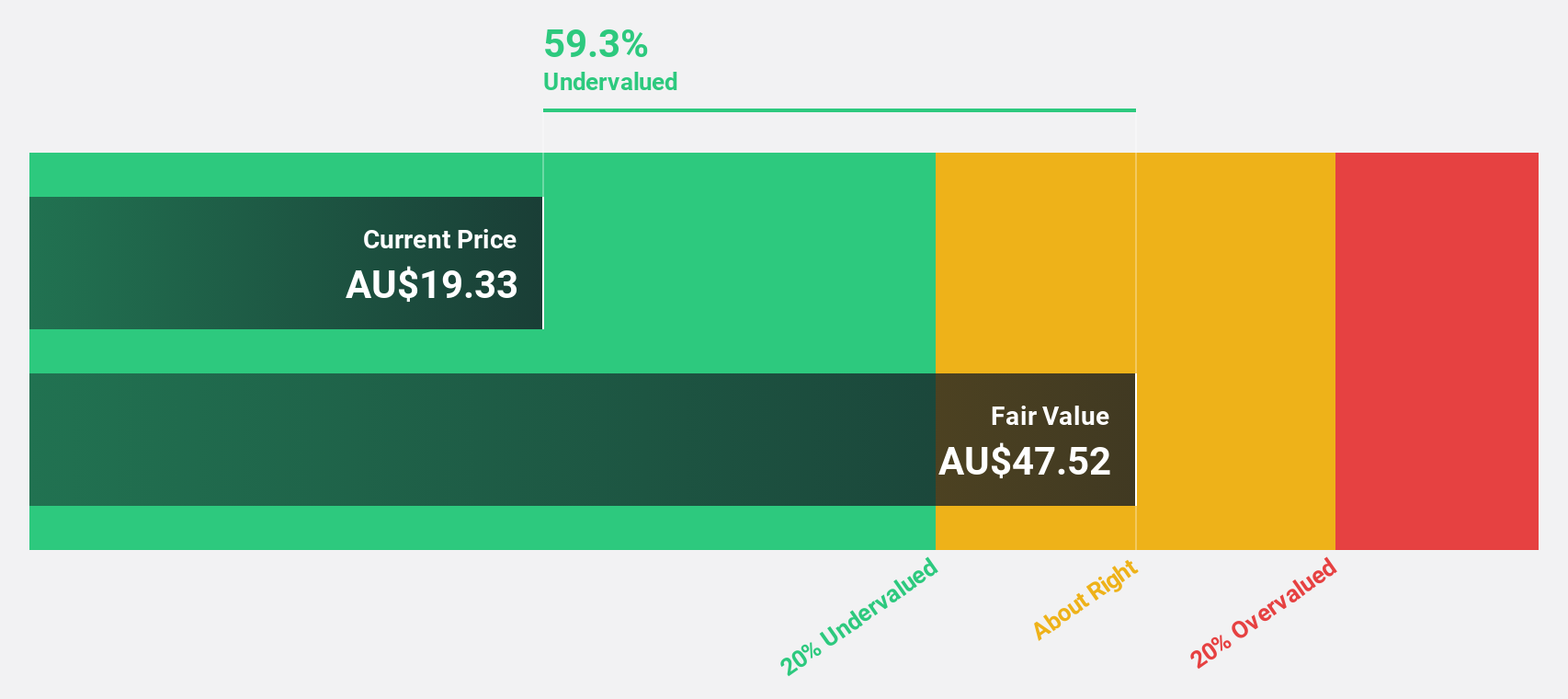

Domino's Pizza Enterprises (ASX:DMP)

Overview: Domino's Pizza Enterprises Limited operates retail food outlets and has a market capitalization of A$1.78 billion.

Operations: The company generates revenue of A$2.30 billion from its restaurant operations.

Estimated Discount To Fair Value: 38%

Domino's Pizza Enterprises is trading at A$18.82, significantly below its estimated fair value of A$30.35, suggesting it may be undervalued based on cash flows. Despite high debt levels and recent leadership changes, the company is expected to see significant annual earnings growth of 32.9%, outpacing the broader Australian market. However, profit margins have declined from last year and dividends are not well covered by earnings, indicating potential financial challenges ahead.

- The growth report we've compiled suggests that Domino's Pizza Enterprises' future prospects could be on the up.

- Click here to discover the nuances of Domino's Pizza Enterprises with our detailed financial health report.

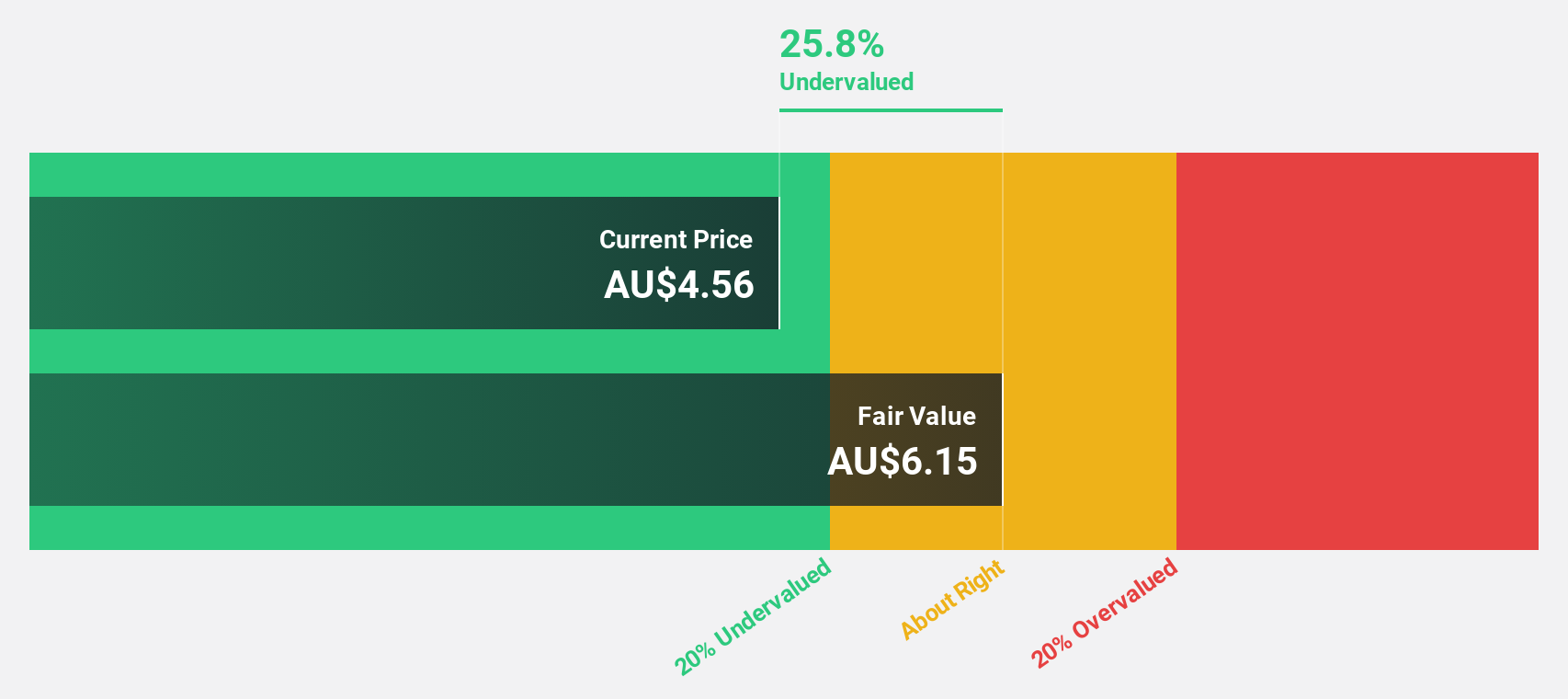

Genesis Minerals (ASX:GMD)

Overview: Genesis Minerals Limited is involved in the exploration, production, and development of gold deposits in Western Australia with a market cap of A$4.53 billion.

Operations: The company generates revenue of A$561.40 million from its mineral production, exploration, and development activities in Western Australia.

Estimated Discount To Fair Value: 27.4%

Genesis Minerals, trading at A$4.01, appears undervalued with a fair value estimate of A$5.52 and is positioned for robust growth. The company's projected annual earnings growth of 25% surpasses the Australian market average, driven by expected revenue increases of 20.9% per year. Recent leadership changes include the appointment of Jane Macey as Non-Executive Director, bringing extensive industry expertise which could enhance strategic direction amid low forecasted return on equity in three years (18.7%).

- Upon reviewing our latest growth report, Genesis Minerals' projected financial performance appears quite optimistic.

- Take a closer look at Genesis Minerals' balance sheet health here in our report.

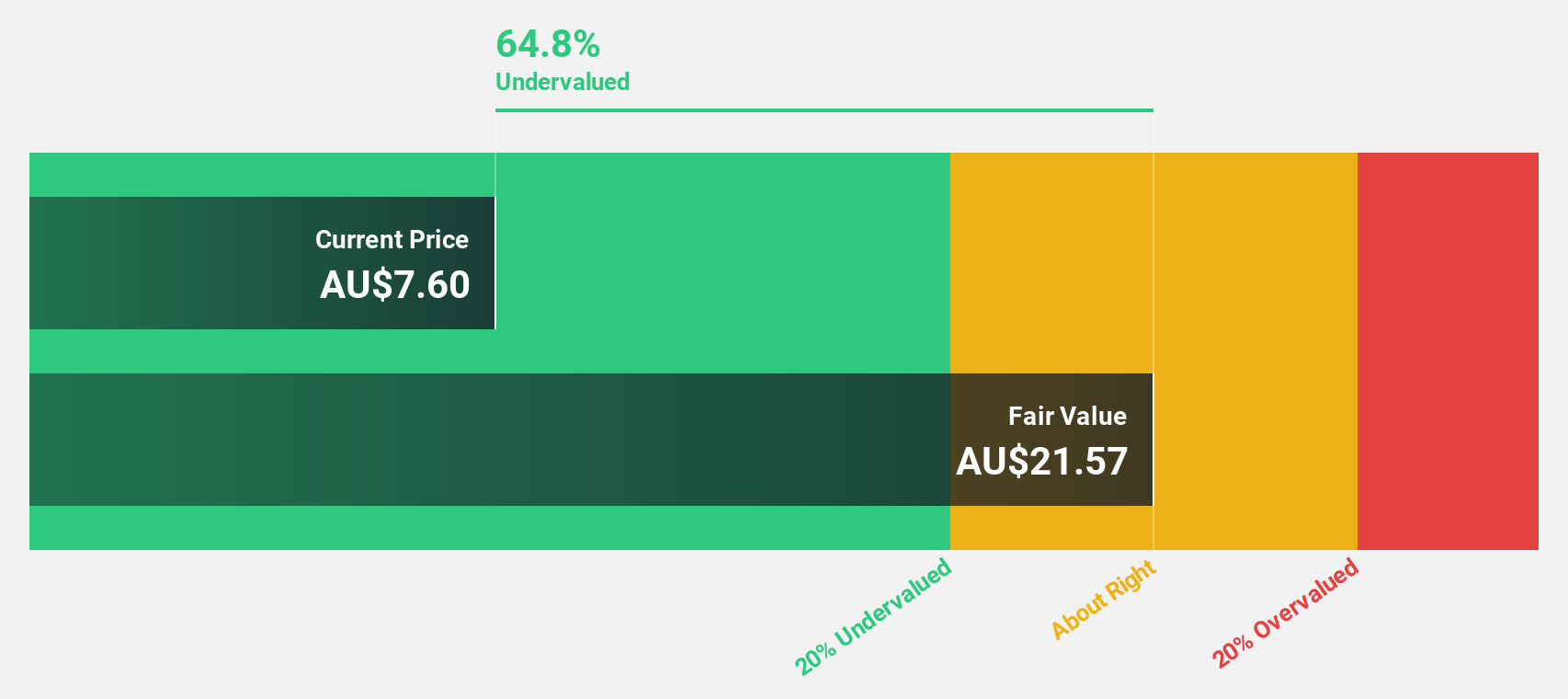

Regis Healthcare (ASX:REG)

Overview: Regis Healthcare Limited provides residential aged care services in Australia and has a market cap of A$2.65 billion.

Operations: The company's revenue is primarily derived from its residential aged care services, totaling A$1.10 billion.

Estimated Discount To Fair Value: 30.1%

Regis Healthcare, trading at A$8.8, is undervalued with a fair value estimate of A$12.59, offering potential for significant earnings growth of 24.4% annually over the next three years, outpacing the Australian market average. Despite becoming profitable this year and expected high return on equity (231.3%), challenges include negative shareholders' equity and recent insider selling activity which may warrant caution for investors assessing its cash flow valuation appeal.

- The analysis detailed in our Regis Healthcare growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Regis Healthcare stock in this financial health report.

Key Takeaways

- Navigate through the entire inventory of 34 Undervalued ASX Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10