What Highwoods Properties (HIW)'s Mixed 2025 Results Reveal About Earnings Trends and Shareholder Value

- Highwoods Properties, Inc. recently reported its second quarter and six-month earnings for 2025, showing sales of US$200.6 million and net income of US$18.86 million for the quarter, both lower than the prior year, while year-to-date net income rose to US$116.93 million from US$90.18 million a year ago.

- This contrast between weaker quarterly performance and improved year-to-date profitability provides insight into how one-off events or cost trends may outweigh seasonal revenue shifts for the company.

- With second quarter net income dropping compared to last year, we'll examine how this result could alter Highwoods Properties' investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Highwoods Properties Investment Narrative Recap

Highwoods Properties shareholders generally need confidence in the rebound of demand for quality office spaces in high-growth Sunbelt markets and the sustainability of rental revenue. The recent drop in Q2 net income, even as year-to-date profits rose, draws attention to the importance of understanding one-off gains and cost impacts, but these quarterly shifts do not appear to materially alter the key short-term catalyst for the business, which remains leasing momentum in core markets. The biggest short-term risk is that sluggish physical office demand or regional volatility could soften occupancy and rental rates, directly challenging earnings growth.

Among the latest announcements, the Board’s affirmation of a US$0.50 per share cash dividend is significant for investors seeking reliable income amid mixed quarterly earnings. This steady payout alongside the company's portfolio of high-yield properties affirms management’s commitment to income despite near-term profit swings, and keeps the dividend yield as an important consideration for those weighing the catalysts of occupancy growth and portfolio recycling.

In contrast to the stable dividend, investors should be aware of the risk that underlying office demand in the Sunbelt markets may not fully rebound, leaving...

Read the full narrative on Highwoods Properties (it's free!)

Highwoods Properties is projected to reach $903.1 million in revenue and $86.2 million in earnings by 2028. This outlook assumes annual revenue growth of 3.5%, but a decrease in earnings of $40.3 million from the current $126.5 million.

Uncover how Highwoods Properties' forecasts yield a $30.89 fair value, a 6% upside to its current price.

Exploring Other Perspectives

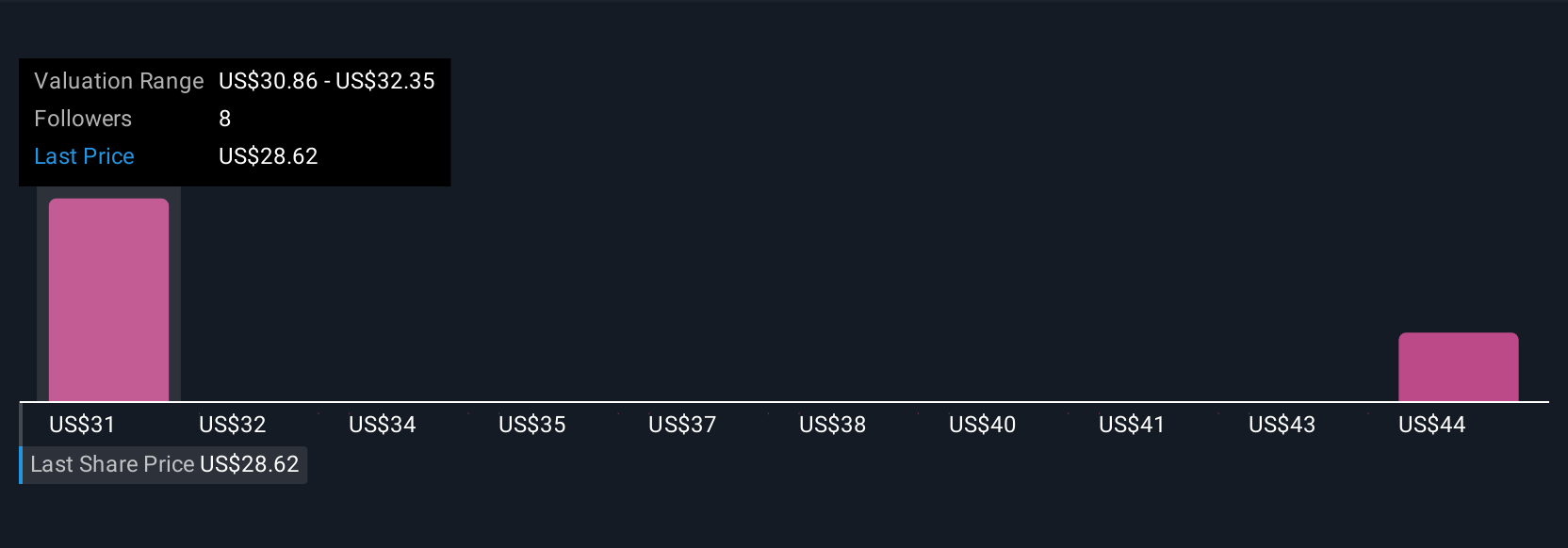

Simply Wall St Community fair value estimates for Highwoods Properties range from US$30.89 to US$41.83, with two distinct viewpoints. While some participants expect a significant margin improvement, the risk of office demand stagnation continues to shape a wide spectrum of expectations for future returns.

Explore 2 other fair value estimates on Highwoods Properties - why the stock might be worth as much as 44% more than the current price!

Build Your Own Highwoods Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Highwoods Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Highwoods Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Highwoods Properties' overall financial health at a glance.

No Opportunity In Highwoods Properties?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Highwoods Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10