Astrana Health And 2 Insider Favorites For High Growth

As the Nasdaq reaches record highs, buoyed by a robust tech stock rally and easing concerns over tariffs, investors are increasingly focusing on growth companies with significant insider ownership. In such a thriving market environment, stocks like Astrana Health stand out for their potential high-growth prospects, supported by strong insider confidence.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.5% | 93.1% |

| Niu Technologies (NIU) | 37.2% | 88.1% |

| Hippo Holdings (HIPO) | 12.8% | 52.5% |

| FTC Solar (FTCI) | 23.2% | 63.1% |

| Duolingo (DUOL) | 14.1% | 36.8% |

| Credo Technology Group Holding (CRDO) | 11.5% | 36.4% |

| Cloudflare (NET) | 10.6% | 45.8% |

| Celsius Holdings (CELH) | 10.8% | 39.6% |

| Atour Lifestyle Holdings (ATAT) | 22% | 23.5% |

| Astera Labs (ALAB) | 12.5% | 37% |

Click here to see the full list of 187 stocks from our Fast Growing US Companies With High Insider Ownership screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Astrana Health (ASTH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Astrana Health, Inc. is a healthcare management company offering medical care services in the United States with a market cap of approximately $1.40 billion.

Operations: Astrana Health generates revenue through three primary segments: Care Delivery ($142.87 million), Care Partners ($2.34 billion), and Care Enablement ($166.46 million).

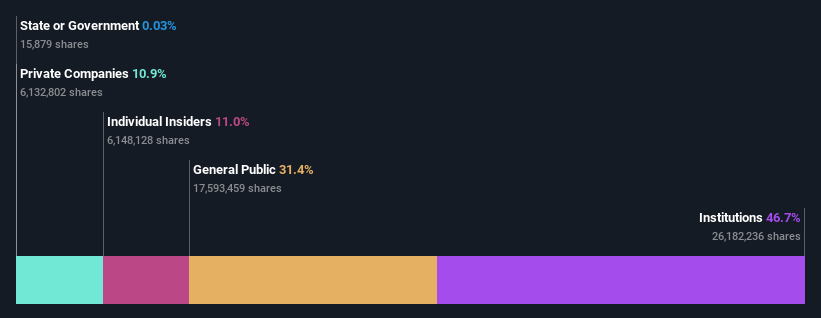

Insider Ownership: 12.5%

Earnings Growth Forecast: 35% p.a.

Astrana Health is experiencing significant earnings growth, forecasted at 35% annually, outpacing the US market. Despite recent volatility and lower net profit margins compared to last year, the company is trading well below its estimated fair value. Recent leadership enhancements aim to scale their AI-enabled care platform. Revenue for Q2 was US$654.81 million but net income declined year-over-year. Guidance suggests annual revenue could reach up to US$3.3 billion by year's end.

- Take a closer look at Astrana Health's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Astrana Health shares in the market.

USA Rare Earth (USAR)

Simply Wall St Growth Rating: ★★★★★☆

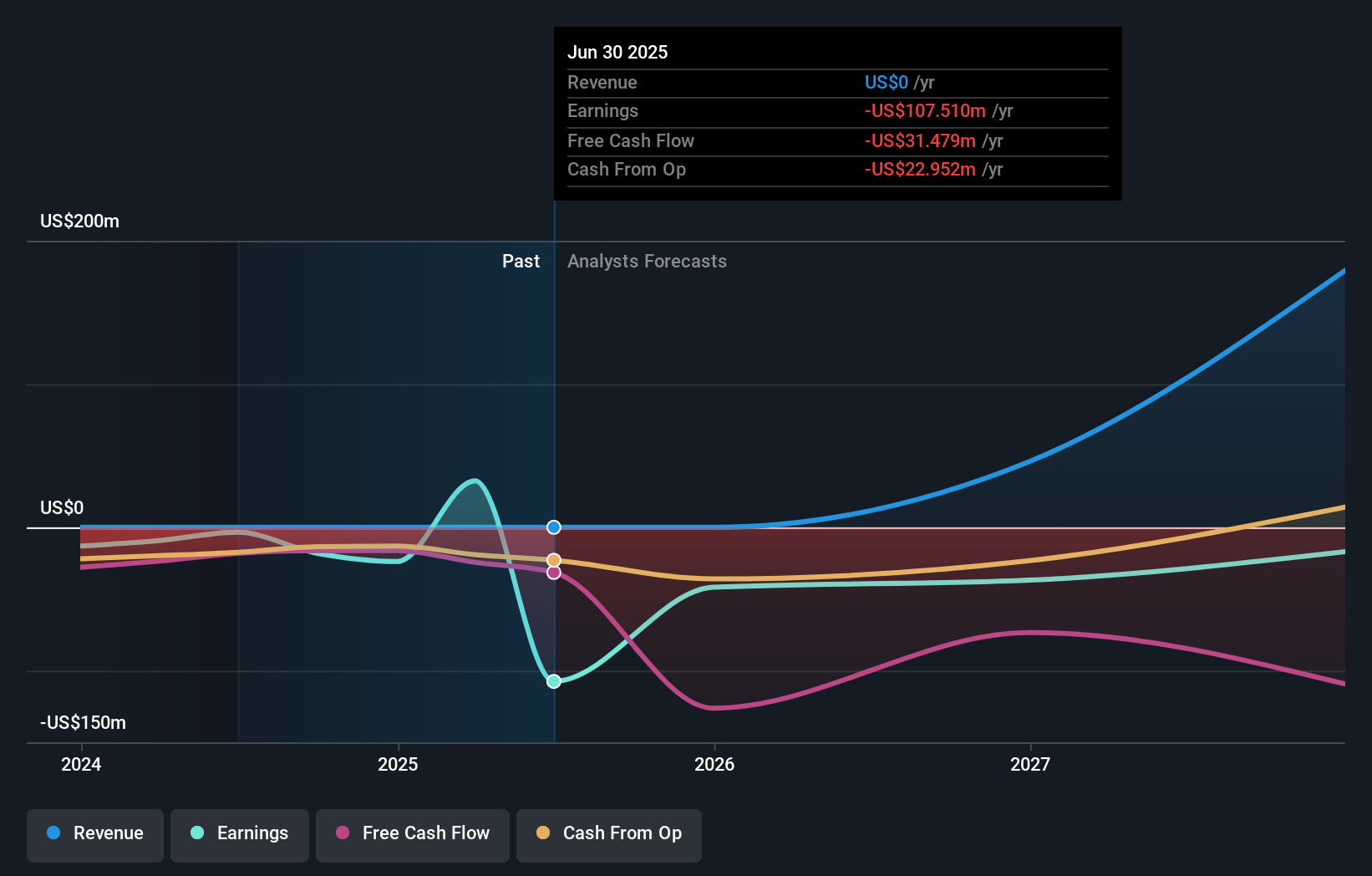

Overview: USA Rare Earth, Inc. is involved in the mining, processing, and supply of rare earths and critical minerals in the United States with a market cap of $1.54 billion.

Operations: Revenue segments for USA Rare Earth, Inc. are not specified in the provided text.

Insider Ownership: 18.6%

Earnings Growth Forecast: 21.3% p.a.

USA Rare Earth is experiencing significant growth, with earnings projected to rise 21.3% annually, surpassing the US market average. Despite recent shareholder dilution and highly volatile share prices, the company trades at a substantial discount to its estimated fair value. Recent strategic alliances, like the joint development agreement with ePropelled for neo magnets in UAVs and other vehicles, highlight its expansion efforts. However, revenue remains minimal as production scales up for future demand fulfillment.

- Get an in-depth perspective on USA Rare Earth's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that USA Rare Earth is priced lower than what may be justified by its financials.

Krystal Biotech (KRYS)

Simply Wall St Growth Rating: ★★★★★☆

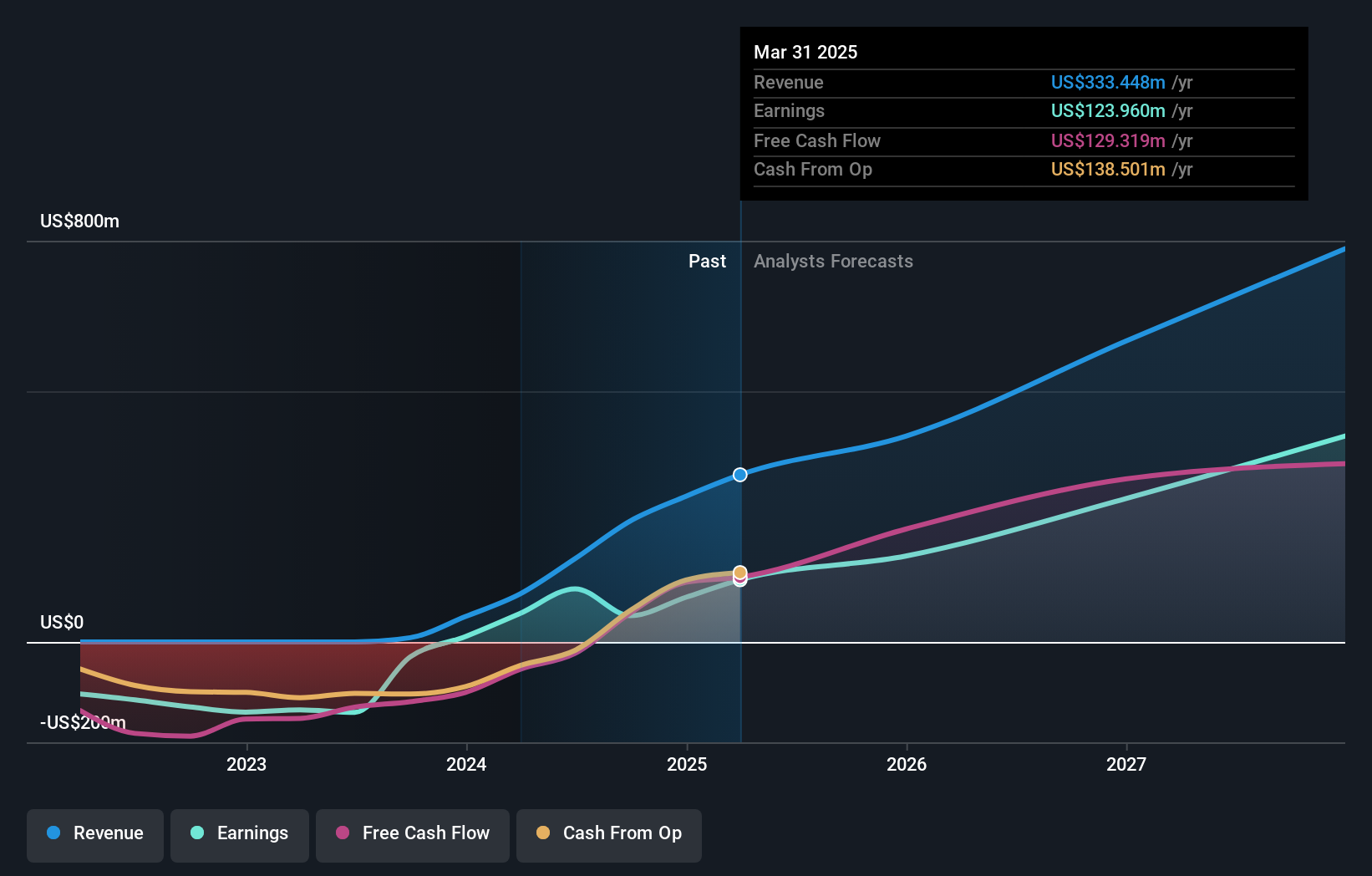

Overview: Krystal Biotech, Inc. is a commercial-stage biotechnology company focused on discovering, developing, manufacturing, and commercializing genetic medicines for diseases with high unmet medical needs in the United States, with a market cap of $4.01 billion.

Operations: The company's revenue segment is primarily derived from its genetic medicines aimed at addressing diseases with high unmet medical needs, totaling $359.21 million.

Insider Ownership: 10.3%

Earnings Growth Forecast: 33.8% p.a.

Krystal Biotech is poised for substantial growth, with earnings projected to increase 33.8% annually, outpacing the US market. Recent Q2 earnings showed a significant rise in net income to US$38.33 million from last year's US$15.57 million, driven by strategic product developments like VYJUVEK's approval in Japan for DEB treatment. Despite lower profit margins compared to last year and low forecasted return on equity, its revenue growth remains robust at 26.5% per year, trading significantly below estimated fair value.

- Dive into the specifics of Krystal Biotech here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Krystal Biotech is trading behind its estimated value.

Next Steps

- Click this link to deep-dive into the 187 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Curious About Other Options? We've found 21 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10