This AI Stock Just Sank 10% but Could Be Worth More Than Nvidia and Palantir Combined in 2030

-

-

Amazon's cloud computing division is doing fine and will keep growing.

-

Its margin expansion in the retail and international segments will help the stock soar to new heights by 2030.

Each quarter, another stock seems to start lagging the so-called winners in artificial intelligence (AI), namely Microsoft, Nvidia, and Palantir Technologies. This summer, it is Amazon (AMZN -0.23%) that has begun to fall behind the pack.

The cloud computing, e-commerce platform, and logistical infrastructure giant saw its stock drop 10% from highs after reporting slower growth in its cloud computing division compared to the competition. However, if you are an investor focused on the long term, you know that it is better to focus on the broad forest while Wall Street looks at the individual trees.

Here's why Amazon stock is set to soar for the rest of the decade and can become larger than Nvidia and Palantir combined in 2030.

Image source: Getty Images.

Falling behind in cloud computing?

In the second quarter, Amazon's cloud computing division -- Amazon Web Services, or AWS -- posted 17.5% revenue growth to $30.9 billion. Or, an annualized rate of $123.6 billion. However, this was much slower growth than the competition such as Microsoft Azure, which posted 34% revenue growth due to its large relationship with OpenAI, which is spending like gangbusters on cloud computing services.

Investors see this dichotomy in growth as a warning sign for AWS. Is it falling behind Microsoft? While it would be nice if Amazon won the OpenAI relationship, it is not getting left out to dry in AI.

AWS has a large relationship with Anthropic, the second-largest AI start-up, which is valued at close to $200 billion. Revenue for Anthropic is exploding, hitting $5 billion in annualized sales in July compared to $4 billion a month prior. Anthropic has committed billions of dollars to spend on AWS, which will help accelerate revenue growth for the division.

While Microsoft and others have narrowed the gap, AWS is still the leader in cloud computing today and should benefit from the rising tide of AI spending in the years to come. This will drive revenue and earnings higher for the segment. Operating income was $43 billion for AWS over the last 12 months, and could rise to close to $100 billion by 2030.

A margin expansion story

Investors may have forgotten the original heartbeat of Amazon's business: e-commerce and its Prime subscription service. North American e-commerce sales are still growing in the double digits, up 11% last quarter to $100 billion and $404 billion over the last 12 months. International -- which includes Western Europe, Japan, and India, among other regions -- has hit $150 billion in trailing-12-month sales.

Growth of 22% in advertising services is driving margin expansion for Amazon's retail divisions. Over the last 12 months, North American retail has an operating margin of 7% and international a margin of 3.4%.

This is while Amazon keeps reinvesting in moonshot projects such as Alexa and Project Kuiper, as well as reinvestments into fast delivery services into rural areas of the United States. As these investments either bear operating leverage or are phased out, Amazon's retail divisions will keep expanding profit margins. I expect North American margin to scale to at least 15% due to advertising revenue and 10% for international by 2030, although the path will likely not be linear.

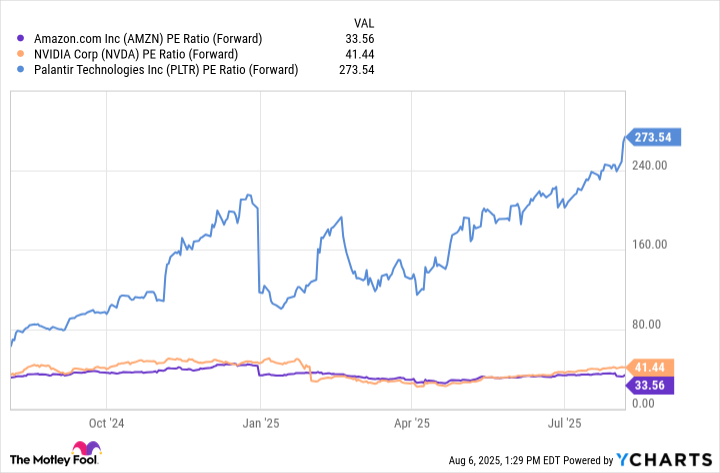

AMZN PE Ratio (Forward) data by YCharts

Why Amazon can beat Nvidia and Palantir

Which brings me back to Nvidia and Palantir, two behemoths with a combined market cap of $5 trillion. There are three reasons I think Amazon can outpace these AI winners and be the largest company in the world by 2030.

First, Amazon has two growth engines at its back: cloud computing and e-commerce/retail. This greatly expands Amazon's addressable market. Even with its overall revenue pushing past $670 billion, there is still plenty of room for the company to keep growing its sales in the years to come. Margin expansion will lead to even high profits for the company.

Second, Amazon is a customer of Nvidia. It aims to reduce its reliance on the advanced computer chip maker, with its Trainium chip taking on more capacity every quarter. This is market share being taken away from Nvidia.

Third, Amazon has a much cheaper valuation than Nvidia or Palantir. Nvidia has a forward price-to-earnings ratio (P/E) of 41 compared to 33 for Amazon. Palantir's is a sky-high 278 and will be a major drag on the stock in the coming years. Add it all up, and I think Amazon has a chance to have a much larger market cap by 2030 while Nvidia and Palantir will struggle to grow, making Amazon a better buy for investors at current prices.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10