Fidelity D & D Bancorp And 2 Other Solid Dividend Stocks For Your Portfolio

As major U.S. indices like the S&P 500 and Nasdaq Composite edge towards new record highs, investors are closely monitoring upcoming economic data to gauge inflation trends and potential Federal Reserve actions. In such a dynamic market environment, dividend stocks can offer stability and income, making them an attractive option for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.76% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.85% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.43% | ★★★★★★ |

| Ennis (EBF) | 5.51% | ★★★★★★ |

| Employers Holdings (EIG) | 3.11% | ★★★★★☆ |

| Dillard's (DDS) | 5.52% | ★★★★★★ |

| DHT Holdings (DHT) | 8.31% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.98% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.99% | ★★★★★☆ |

| Archer-Daniels-Midland (ADM) | 3.53% | ★★★★★☆ |

Click here to see the full list of 142 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

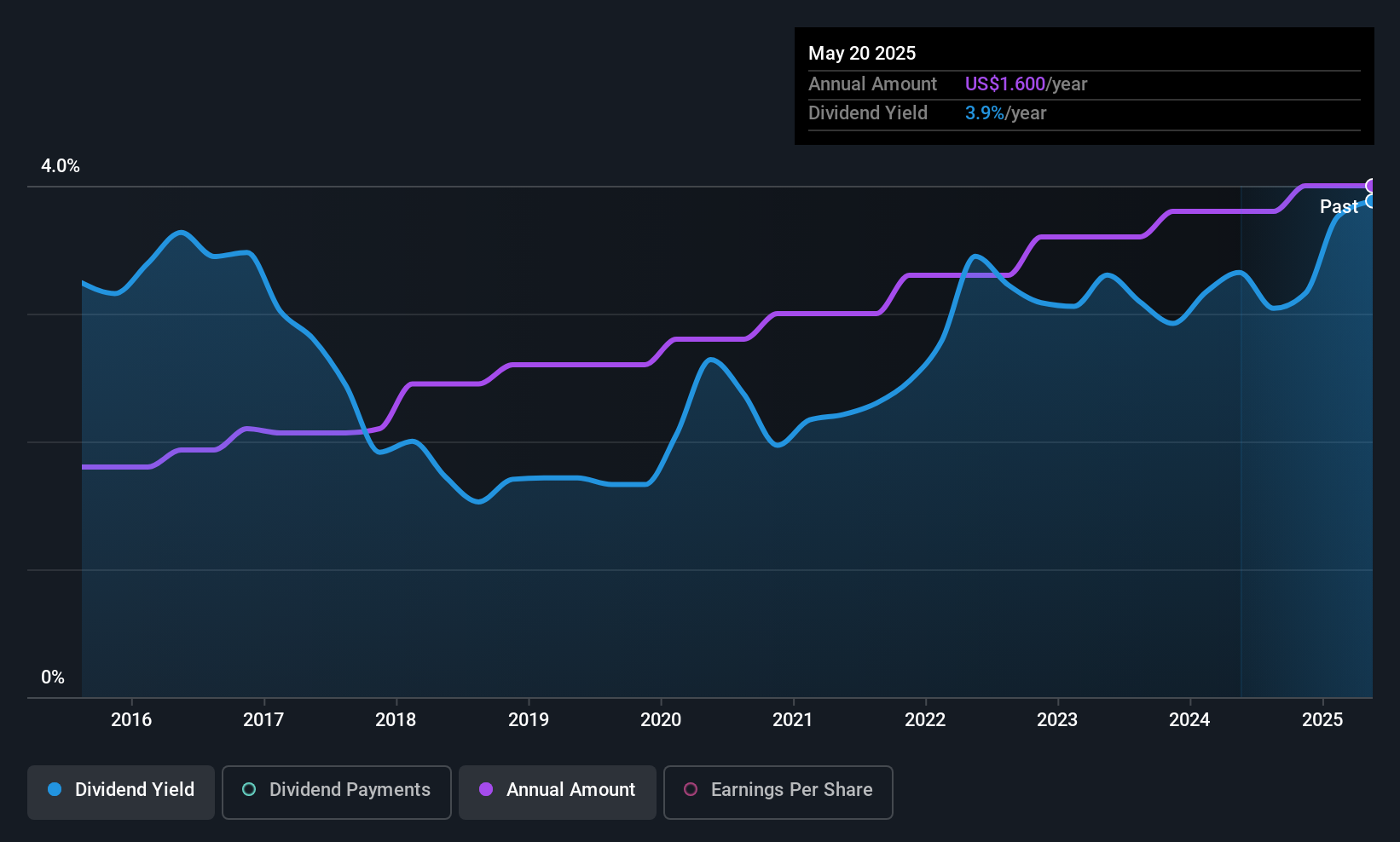

Fidelity D & D Bancorp (FDBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fidelity D & D Bancorp, Inc. is the bank holding company for The Fidelity Deposit and Discount Bank, offering banking, trust, and financial services to individuals, small businesses, and corporate customers with a market cap of $233.47 million.

Operations: Fidelity D & D Bancorp, Inc. generates revenue through its provision of diverse financial services, including banking and trust solutions, to individual clients, small enterprises, and corporate entities.

Dividend Yield: 4%

Fidelity D & D Bancorp offers a stable dividend profile with consistent payments over the past decade, currently yielding 3.95%. The recent earnings report showed significant growth, with net income rising to US$6.92 million in Q2 2025 from US$4.94 million a year ago, supporting its reliable dividends. Despite trading below estimated fair value by 52.3%, the dividend yield is lower than the top quartile of U.S. dividend payers at 4.63%.

- Unlock comprehensive insights into our analysis of Fidelity D & D Bancorp stock in this dividend report.

- Upon reviewing our latest valuation report, Fidelity D & D Bancorp's share price might be too pessimistic.

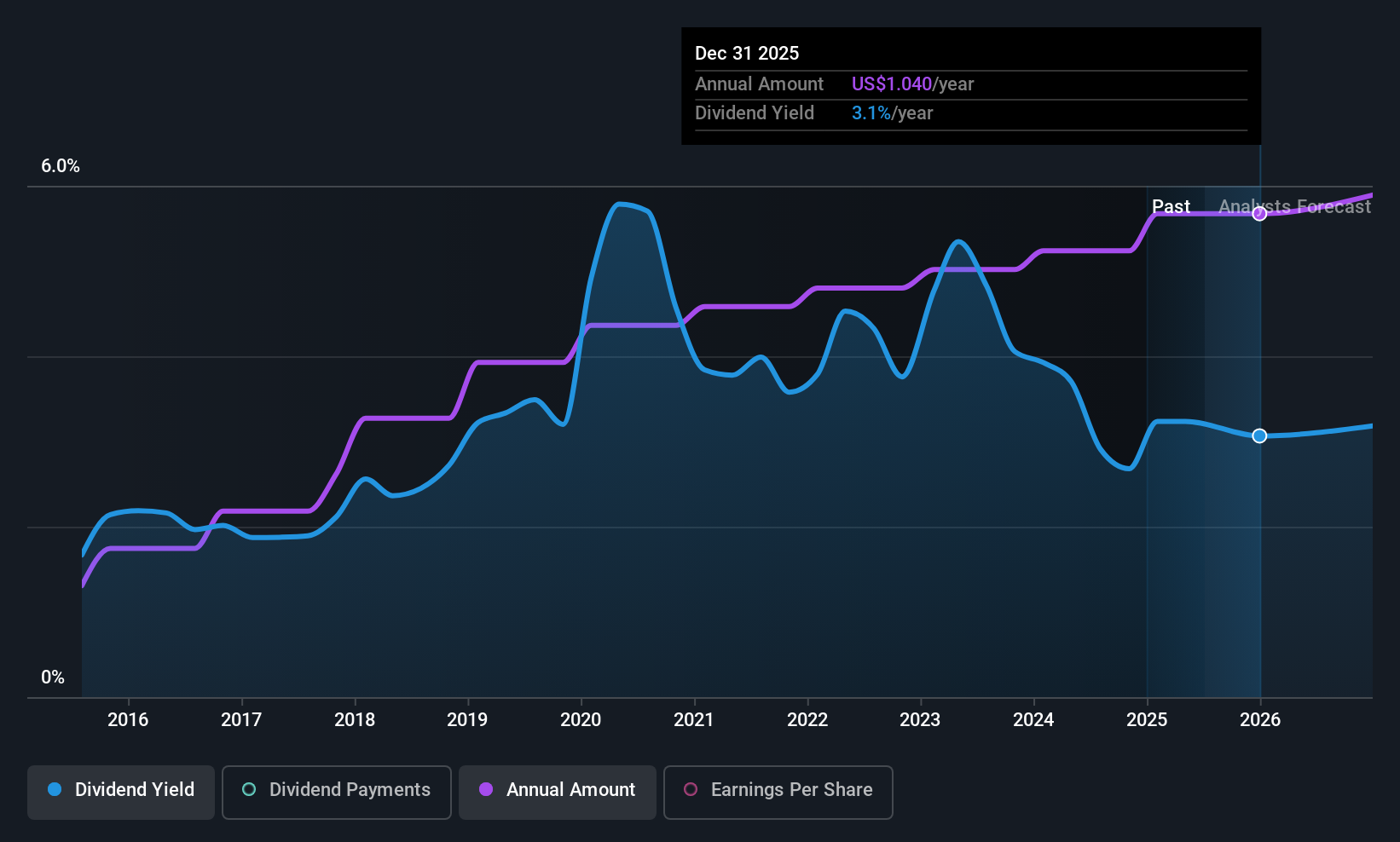

Independent Bank (IBCP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Independent Bank Corporation, with a market cap of $630.60 million, operates as the bank holding company for Independent Bank, offering various banking services across the United States.

Operations: Independent Bank Corporation generates revenue of $220.58 million from its banking services in the United States through its subsidiary, Independent Bank.

Dividend Yield: 3.4%

Independent Bank Corporation maintains a stable dividend history with consistent growth over the past decade, currently yielding 3.42%. The dividend is well covered by earnings, evidenced by a low payout ratio of 32.2%. Recent financials show net interest income at US$44.62 million for Q2 2025, though net income decreased to US$16.88 million from the previous year. The company completed share buybacks worth US$7.33 million, reinforcing shareholder value initiatives.

- Take a closer look at Independent Bank's potential here in our dividend report.

- The valuation report we've compiled suggests that Independent Bank's current price could be quite moderate.

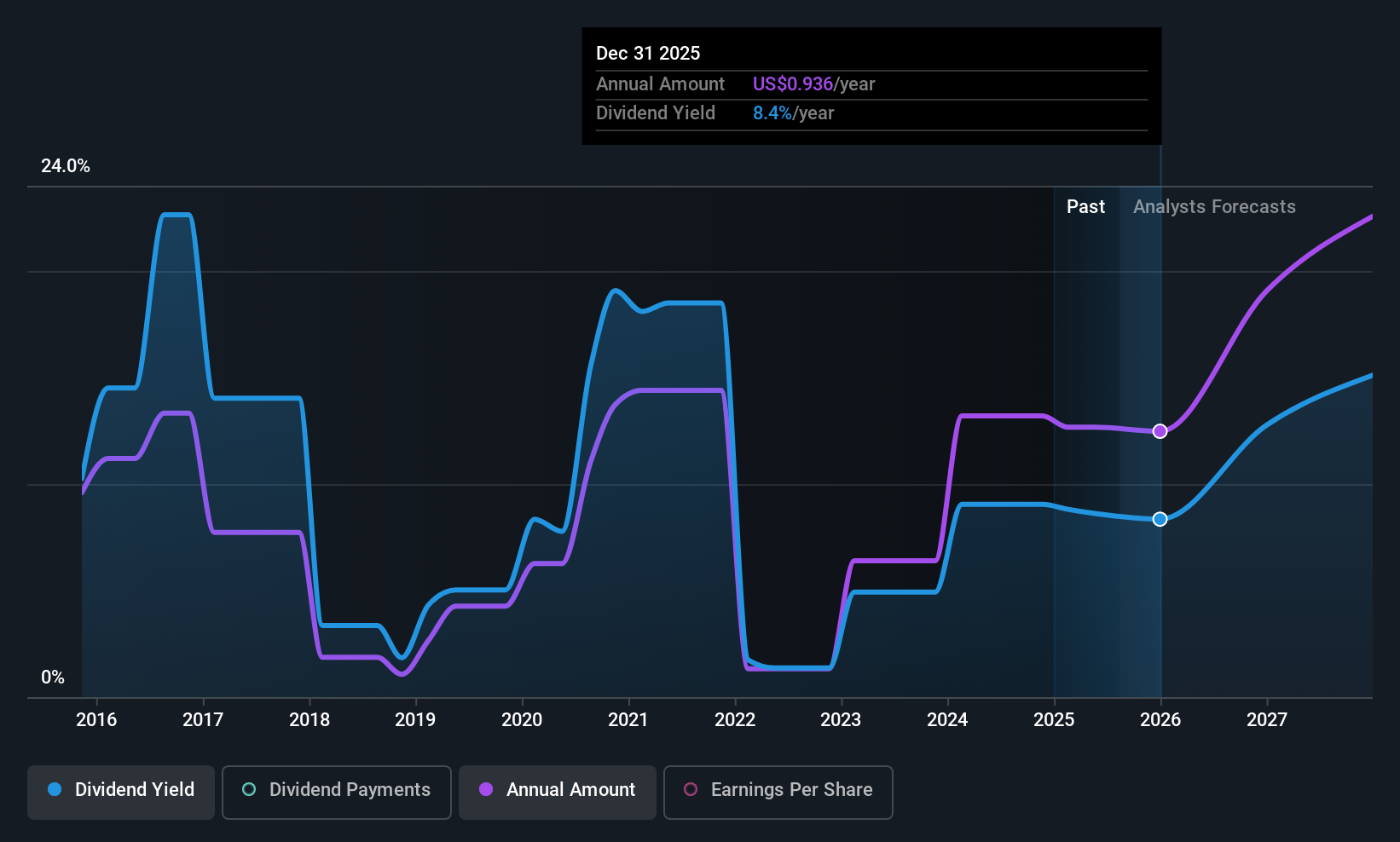

DHT Holdings (DHT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DHT Holdings, Inc. owns and operates crude oil tankers across Monaco, Singapore, Norway, and India with a market cap of $1.84 billion.

Operations: DHT Holdings, Inc. generates its revenue primarily from its fleet of crude oil tankers, amounting to $557.64 million.

Dividend Yield: 8.3%

DHT Holdings offers a high dividend yield, ranking in the top 25% of U.S. payers, though its dividend history is volatile and unreliable. Recent earnings growth of 21% supports dividend sustainability, with payout ratios indicating coverage by both earnings and cash flows. The company reported Q2 2025 net income of US$56.1 million despite a revenue decline to US$128.32 million, while securing a $308.4 million credit facility for newbuildings delivery in 2026.

- Click to explore a detailed breakdown of our findings in DHT Holdings' dividend report.

- According our valuation report, there's an indication that DHT Holdings' share price might be on the cheaper side.

Key Takeaways

- Explore the 142 names from our Top US Dividend Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10