If You'd Invested $1,000 in Palantir Stock 3 Years Ago, Here's How Much You'd Have Today

-

Palantir's AIP contributed to accelerated revenue growth.

-

Its growth has led to a pricey valuation, making its near-term direction less certain.

Palantir Technologies (PLTR 2.53%) stock has been on a tear since last year's U.S. presidential election. Since the election on Nov. 5, the stock is up by about 250%.

While that is a considerable return, it is relatively modest compared to how the stock has performed over the last three years, when the market and Palantir were in the middle of a bear market. Amid the rising popularity of AI and its productivity solution, Palantir's returns since that time are nothing short of eye-popping.

Image source: Getty Images.

Palantir over the last three years

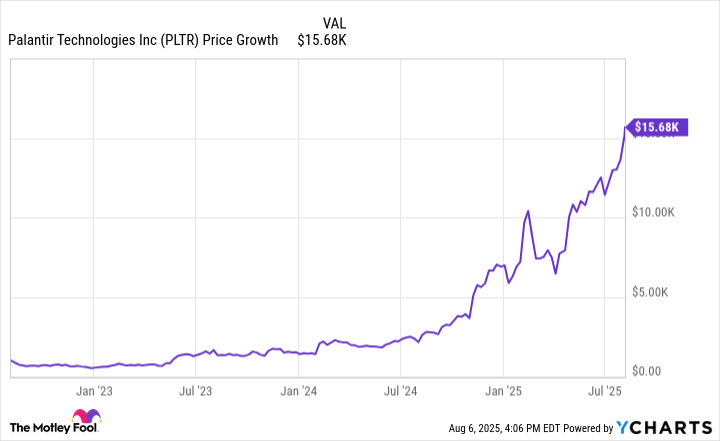

If one had bought Palantir on Aug. 8, 2022, a $1,000 investment would be worth about $15,700 today.

PLTR data by YCharts

Three years ago, a dramatic pullback from the highs of the 2021 bull market left Palantir trading below $10 per share, the approximate level where it sold on its first day of trading on Sept. 30, 2020.

Additionally, it got off to a slow start as it briefly fell below $6 per share in December 2022. Nonetheless, Palantir began moving higher in 2023, particularly after Open AI's release of an upgraded version of ChatGPT put the spotlight on generative AI.

Palantir responded with its own generative AI solution, the artificial intelligence platform (AIP), in April 2023. Customers began reporting massive productivity gains. Over time, the stock's growth accelerated as revenue growth began to rise at a significantly faster rate.

Consequently, the stock reached stratospheric highs, with a P/E ratio approaching 600. Although such earnings multiples can be common with growth stocks, its price-to-sales (P/S) ratio of 130 all but verifies that the market has priced the stock for perfection. That increases the odds of a dramatic fall at the slightest hint of bad news.

However, few can deny the success of Palantir's investors over the last three years. Even if its near-term prospects are less clear, Palantir should succeed long term, since its tools have delivered massive productivity gains for its customers.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10