Think Roku Stock Is Expensive? This Chart Might Change Your Mind.

-

Roku looks expensive on forward earnings and still lacks bottom-line profits.

-

Valuing Roku on sales growth suggests the stock deserves a higher multiple.

At first glance, media-streaming technology stock Roku (ROKU 3.33%) looks incredibly expensive. Shares are changing hands at 100 times forward earnings estimates, and the company isn't even profitable on the bottom line today. You could argue that Roku hasn't earned its $12.9 billion market cap, based on its sky-high valuation ratios.

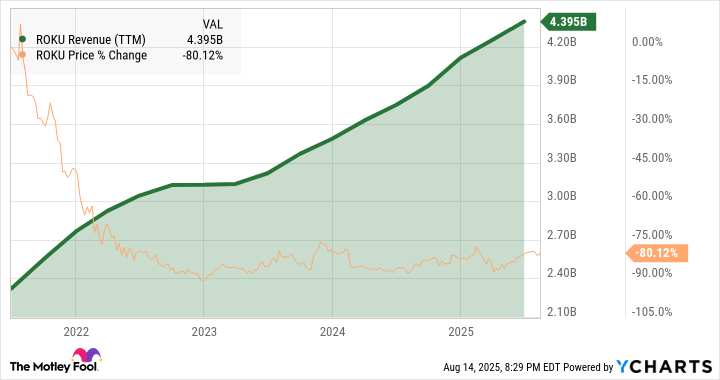

But that impression should fade away quickly when you also consider Roku's impressive business growth. This simple chart should do the trick:

ROKU Revenue (TTM) data by YCharts

Roku's price slipped, but the growth engine didn't

Roku's stock fell 81% over the last four years. At the same time, the company's top-line sales surged 89% higher. That's an average annual revenue increase of 17.3%, while the stock fell 34% per year.

I'll admit that Roku started that period at an unsustainably high plateau, riding high on the streaming-friendly effects of COVID-19 lockdowns. The stock was overdue for a correction in the summer of 2021.

Image source: Getty Images.

The price drop went too far, though. If you separate Roku from the ups and downs of the 2020 pandemic and the 2022 inflation crisis, you see a healthy company with robust growth in all the right places.

You've seen the revenue surge already. Here, Roku's growth is faster than market darlings such as Netflix (NFLX 0.70%) and Meta Platforms (META 0.38%). Yet, Netflix stock trades at 12.6 times sales, and Meta sports a price-to-sales ratio of 11. Roku is stuck with a meager 2.9 multiple in the same metric.

You should still measure Roku by its sales growth

I'm not saying that Roku should have a larger market value than Netflix or Meta. That's not the point. However, Roku's stock deserves a sales multiple in the same class, if not higher.

I have explored Roku's profit strategy and long-term market prospects in depth elsewhere, and this is not the place for another deep dive. Long story short, Roku's profit-based valuation doesn't tell the whole story. The stock looks deeply undervalued when you include its fundamental business growth in your analysis.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10