Lucid Group (LCID) Unveils New Concept at Monterey Car Week 2025

Lucid Group (LCID) is poised to make a mark at Monterey Car Week 2025 with a new concept vehicle. However, despite showcasing innovation at this high-profile event, the company's shares experienced a 4% decline over the past month. This price movement contrasts sharply with broader market trends, as major indexes reached all-time highs boosted by optimistic economic indicators. Lucid's participation in significant strategic events and updates, such as its alliance to bolster domestic mineral supply chains and its advancements in autonomous driving and accessibility to Tesla's Supercharger network, suggests a counterweight to market enthusiasm rather than alignment with it.

Every company has risks, and we've spotted 3 possible red flags for Lucid Group (of which 1 is concerning!) you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Lucid Group's involvement in Monterey Car Week 2025, featuring a new concept vehicle, aligns with the company's emphasis on innovation and technological leadership. However, this buzz has not translated into positive short-term share performance, indicated by the 4% decline in share price over the past month. Over a longer period, specifically the last year, Lucid's total shareholder return was 24.48% negative, underscoring ongoing challenges despite broad market gains. Over the same year, Lucid underperformed both the US market, which returned 19.4%, and the US Auto industry, which saw a 59% return. This clearly illustrates difficulties within the company's operational and competitive landscape.

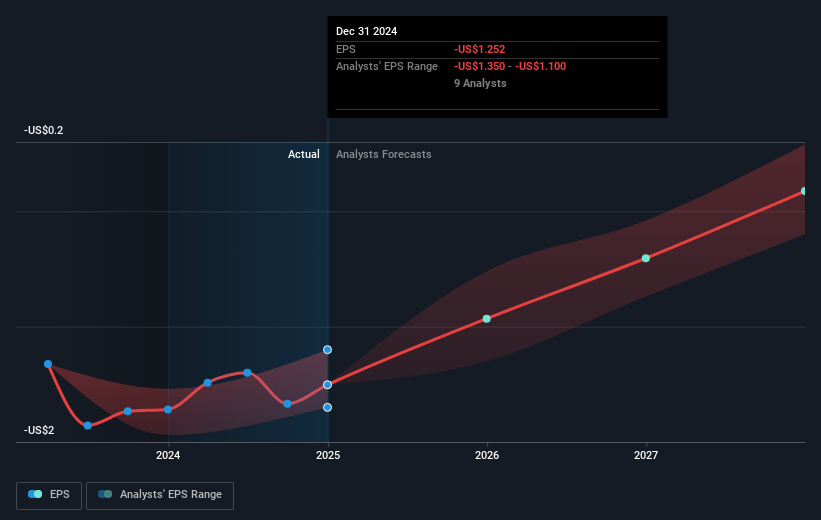

The unveiling at Monterey Car Week, alongside its various partnerships and technological advances, is expected to bolster revenue potential through increased demand and expansions into the autonomous vehicle segment. The recently announced Uber partnership is particularly noteworthy for the potential revenue boost via licencing and fleet sales. Nonetheless, ongoing losses evidenced by negative earnings of US$3.06 billion and reliance on external funding emphasize significant hurdles in achieving profitability. Analysts forecast a revenue growth rate of 41.4% per year, despite persistent unprofitability within the next three years.

The current share price of US$2.19 reflects a cautionary stance relative to the consensus analyst price target of US$2.50, indicating potential upside of 13.31%. However, reaching this target would require substantial improvement in profitability and operational efficiency, as well as favorable market conditions. Investors should weigh Lucid's innovative strides against its financial risk profile and market expectations.

Gain insights into Lucid Group's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10