Top Growth Companies With High Insider Ownership In August 2025

As of August 2025, the U.S. stock market is experiencing a period of relative stability with major indexes hovering near record highs, despite fluctuating investor expectations around interest rate cuts and upcoming retail sector earnings. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong internal confidence in the company's potential for long-term success.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.5% | 93.2% |

| Prairie Operating (PROP) | 30.4% | 86.3% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| Hippo Holdings (HIPO) | 12.7% | 41.2% |

| Hesai Group (HSAI) | 21.3% | 42.3% |

| FTC Solar (FTCI) | 23.2% | 63.1% |

| Credo Technology Group Holding (CRDO) | 11.5% | 36.4% |

| Cloudflare (NET) | 10.6% | 45.8% |

| Atour Lifestyle Holdings (ATAT) | 21.9% | 23.5% |

| Astera Labs (ALAB) | 12.3% | 37.2% |

Click here to see the full list of 194 stocks from our Fast Growing US Companies With High Insider Ownership screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Dave (DAVE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dave Inc. operates a financial services platform offering various financial products and services in the United States, with a market cap of approximately $2.72 billion.

Operations: The company's revenue primarily comes from its service-based and transaction-based operations, totaling $433.07 million.

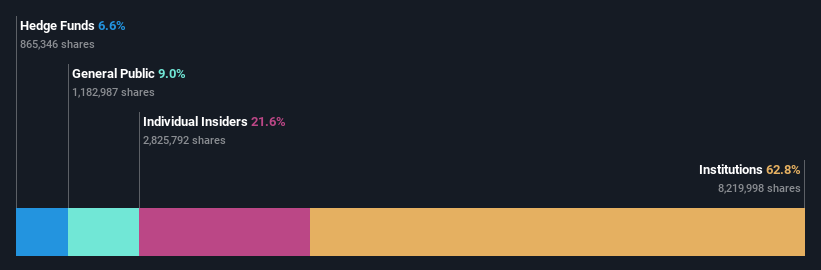

Insider Ownership: 20.1%

Revenue Growth Forecast: 16% p.a.

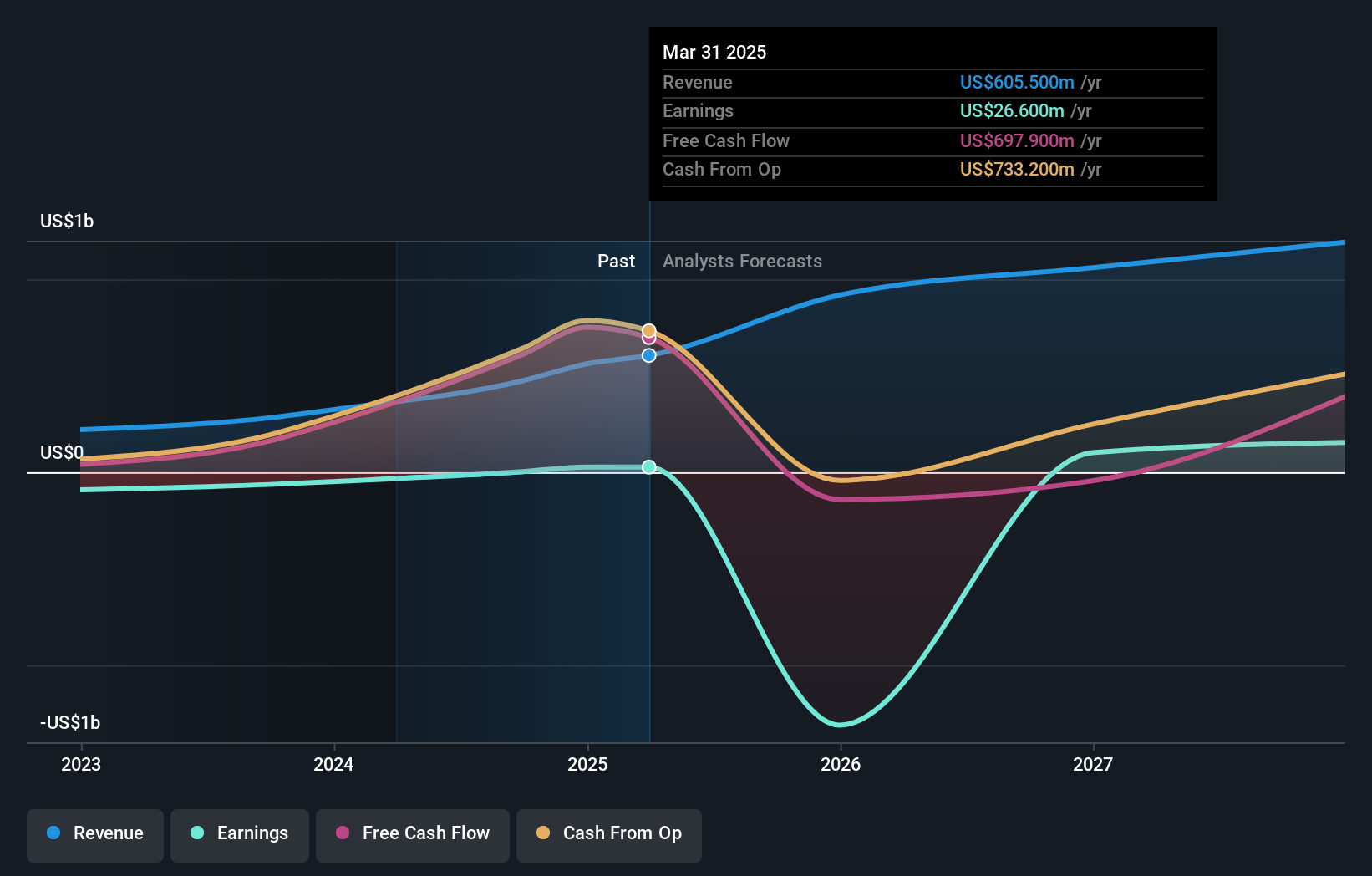

Dave Inc. showcases significant earnings growth, projected at 39.3% annually, outpacing the US market's average. Despite recent insider selling, the company has completed a share buyback worth $31.9 million and authorized an additional $125 million repurchase plan. Earnings for Q2 2025 showed revenue rising to US$131.76 million from US$80.1 million year-over-year, with net income also increasing to US$9.04 million from US$6.4 million, indicating robust financial performance amidst high volatility in share price.

- Get an in-depth perspective on Dave's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Dave's shares may be trading at a premium.

Accelerant Holdings (ARX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Accelerant Holdings operates a data-driven risk exchange linking specialty insurance underwriters with risk capital partners and has a market cap of $6.23 billion.

Operations: The company's revenue segments include $317.10 million from Underwriting, $165.50 million from MGA Operations, and $250.30 million from Exchange Services.

Insider Ownership: 24.9%

Revenue Growth Forecast: 17.5% p.a.

Accelerant Holdings demonstrates strong growth potential with earnings projected to grow significantly at 56.16% per year, surpassing the US market average. Recent IPOs raised substantial capital, including a $723.68 million offering. The company trades 36.9% below estimated fair value and has seen more insider buying than selling recently, though not in large volumes. However, its shares are highly illiquid and recent bylaw changes may deter takeover attempts, potentially affecting shareholder exit opportunities at premium prices.

- Click to explore a detailed breakdown of our findings in Accelerant Holdings' earnings growth report.

- Upon reviewing our latest valuation report, Accelerant Holdings' share price might be too optimistic.

Cloudflare (NET)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cloudflare, Inc. is a cloud services provider offering various solutions to businesses globally, with a market cap of approximately $70.01 billion.

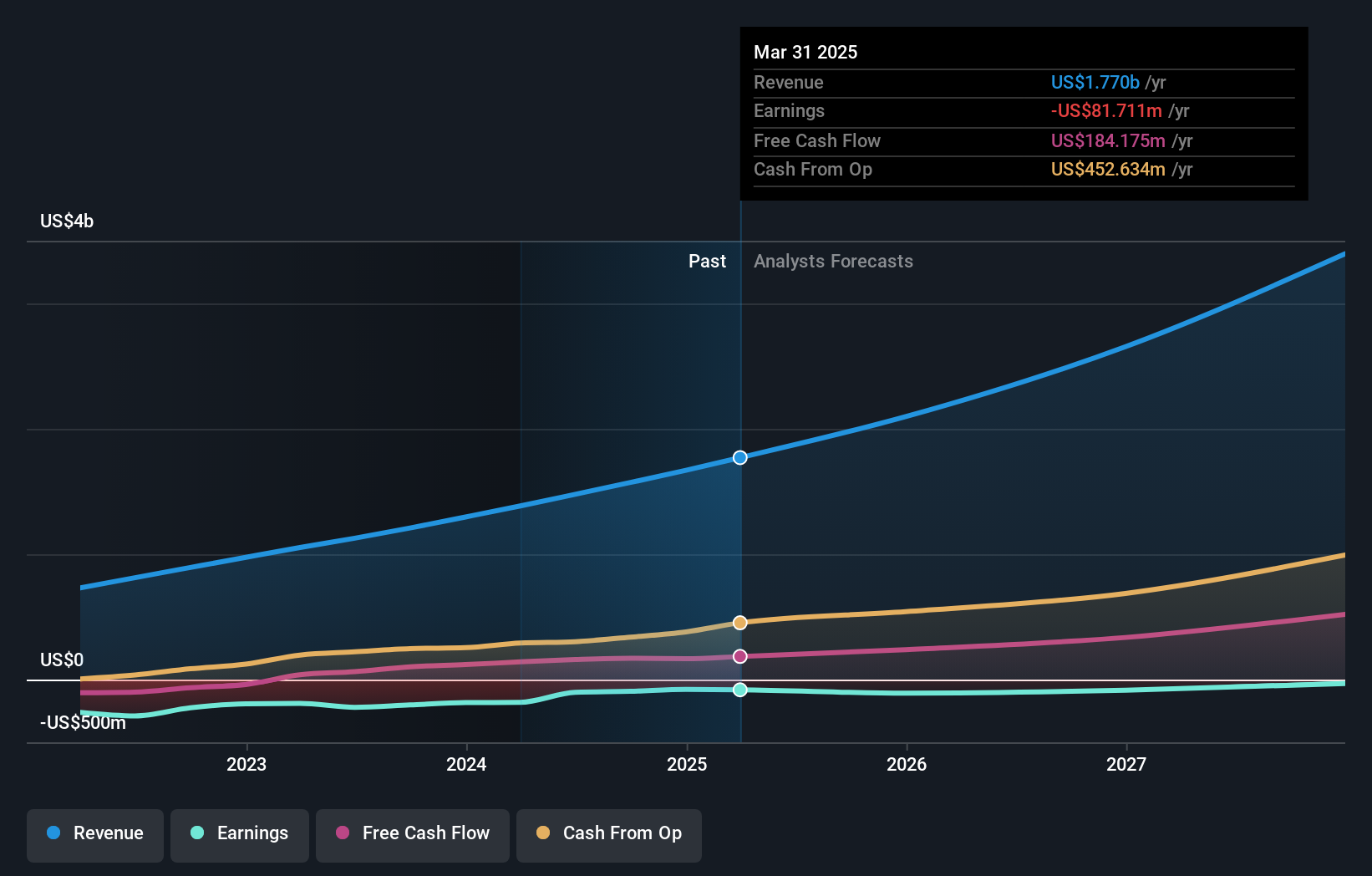

Operations: The company generates revenue from its Internet Telephone segment, which amounts to $1.88 billion.

Insider Ownership: 10.6%

Revenue Growth Forecast: 20.3% p.a.

Cloudflare's revenue is forecast to grow at 20.3% annually, outpacing the US market. Despite a net loss of US$50.45 million in Q2 2025, sales increased to US$512.32 million from the previous year. The company anticipates profitability within three years and boasts a high projected return on equity of 28%. Recent insider activity shows more shares sold than bought over the past three months, which may warrant investor attention regarding insider sentiment.

- Unlock comprehensive insights into our analysis of Cloudflare stock in this growth report.

- Our comprehensive valuation report raises the possibility that Cloudflare is priced higher than what may be justified by its financials.

Summing It All Up

- Gain an insight into the universe of 194 Fast Growing US Companies With High Insider Ownership by clicking here.

- Searching for a Fresh Perspective? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10