Analysts Just Slashed Their Bicycle Therapeutics plc (NASDAQ:BCYC) EPS Numbers

Market forces rained on the parade of Bicycle Therapeutics plc (NASDAQ:BCYC) shareholders today, when the analysts downgraded their forecasts for this year. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

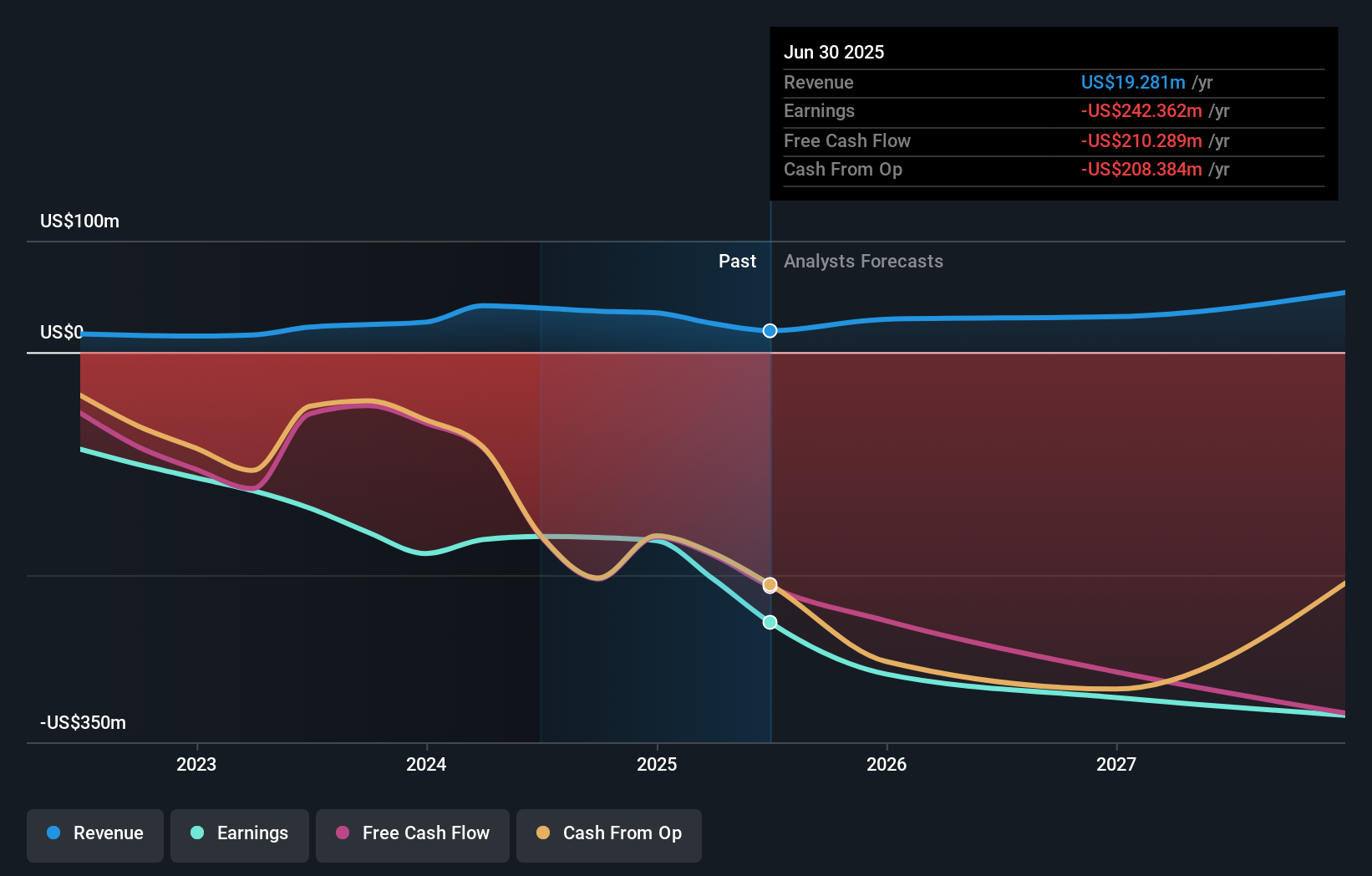

After the downgrade, the 13 analysts covering Bicycle Therapeutics are now predicting revenues of US$30m in 2025. If met, this would reflect a huge 53% improvement in sales compared to the last 12 months. Losses are supposed to balloon 21% to US$4.22 per share. Yet before this consensus update, the analysts had been forecasting revenues of US$37m and losses of US$3.82 per share in 2025. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a serious cut to their revenue forecasts while also expecting losses per share to increase.

See our latest analysis for Bicycle Therapeutics

The consensus price target fell 6.4% to US$23.91, with the analysts clearly concerned about the company following the weaker revenue and earnings outlook.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. The analysts are definitely expecting Bicycle Therapeutics' growth to accelerate, with the forecast 135% annualised growth to the end of 2025 ranking favourably alongside historical growth of 27% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 20% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Bicycle Therapeutics to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that analysts increased their loss per share estimates for this year. Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of Bicycle Therapeutics.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Bicycle Therapeutics analysts - going out to 2027, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Bicycle Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10