Institutional investors in Kingstone Companies, Inc. (NASDAQ:KINS) lost 12% last week but have reaped the benefits of longer-term growth

Key Insights

- Given the large stake in the stock by institutions, Kingstone Companies' stock price might be vulnerable to their trading decisions

- A total of 24 investors have a majority stake in the company with 51% ownership

- Insiders have been buying lately

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

A look at the shareholders of Kingstone Companies, Inc. (NASDAQ:KINS) can tell us which group is most powerful. With 51% stake, institutions possess the maximum shares in the company. Put another way, the group faces the maximum upside potential (or downside risk).

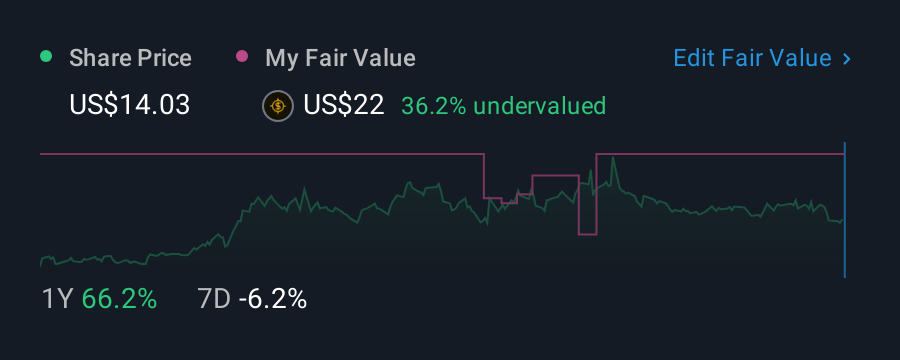

Losing money on investments is something no shareholder enjoys, least of all institutional investors who saw their holdings value drop by 12% last week. However, the 18% one-year return to shareholders might have softened the blow. But they would probably be wary of future losses.

In the chart below, we zoom in on the different ownership groups of Kingstone Companies.

View our latest analysis for Kingstone Companies

What Does The Institutional Ownership Tell Us About Kingstone Companies?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

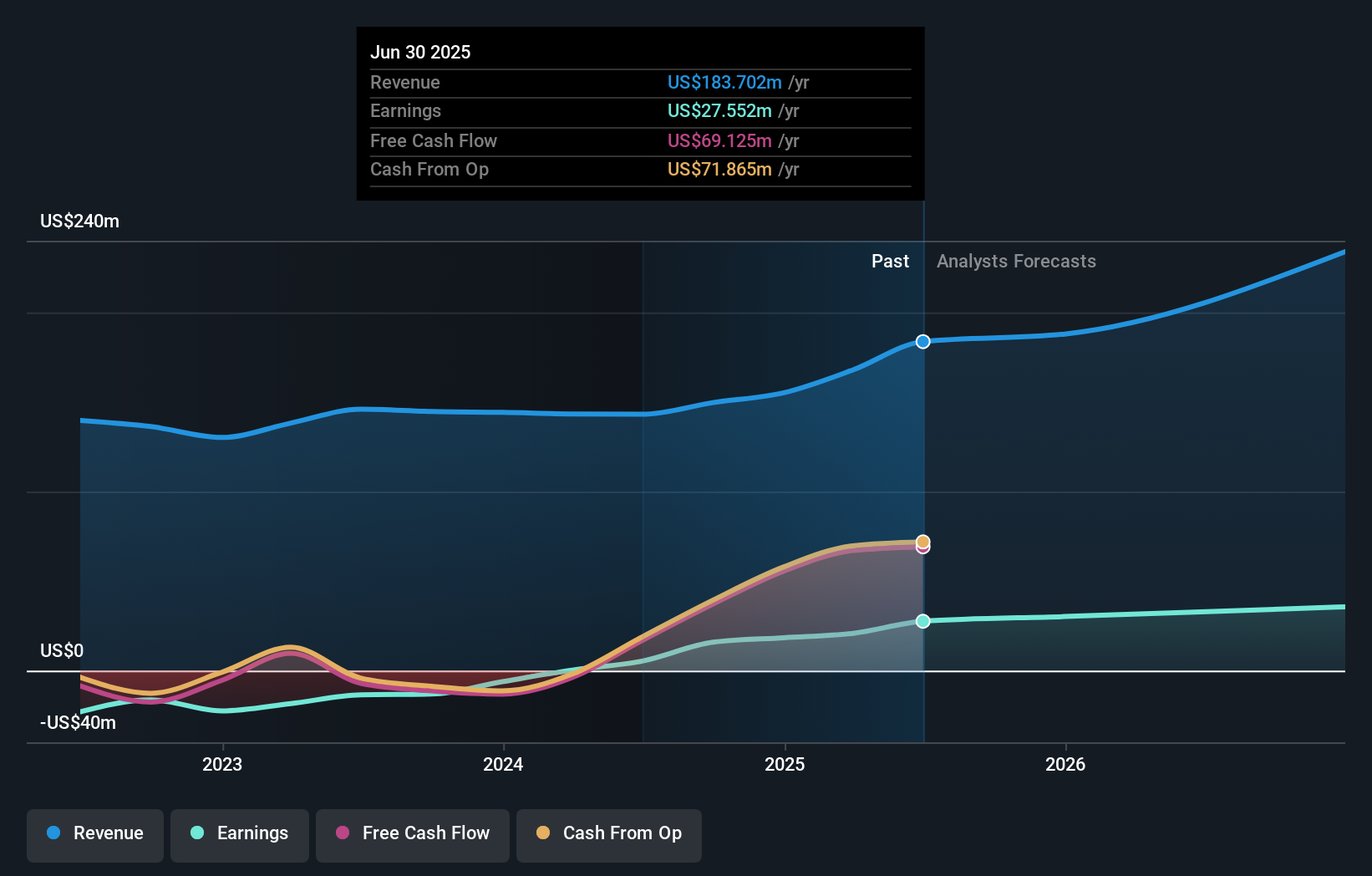

Kingstone Companies already has institutions on the share registry. Indeed, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Kingstone Companies, (below). Of course, keep in mind that there are other factors to consider, too.

Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences. Hedge funds don't have many shares in Kingstone Companies. Barry Goldstein is currently the company's largest shareholder with 6.5% of shares outstanding. BlackRock, Inc. is the second largest shareholder owning 4.0% of common stock, and The Vanguard Group, Inc. holds about 4.0% of the company stock. Furthermore, CEO Meryl Golden is the owner of 1.5% of the company's shares.

A closer look at our ownership figures suggests that the top 24 shareholders have a combined ownership of 51% implying that no single shareholder has a majority.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

Insider Ownership Of Kingstone Companies

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that insiders maintain a significant holding in Kingstone Companies, Inc.. Insiders own US$34m worth of shares in the US$198m company. We would say this shows alignment with shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, who are usually individual investors, hold a 32% stake in Kingstone Companies. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Kingstone Companies you should know about.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if Kingstone Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10