The AI Boom Continues: 3 Top AI Stocks to Buy for the Rest of 2025

-

Meta Platforms is seeing increasing user engagement and is nearing AI superintelligence.

-

ASML provides critical equipment for the production of AI chips.

-

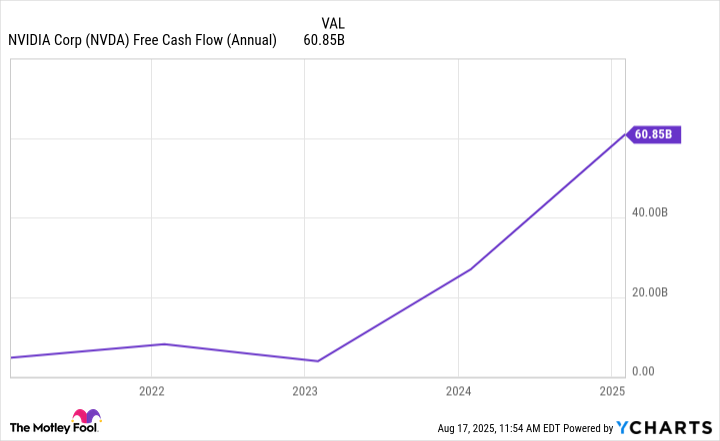

Nvidia continues to generate strong free cash flow thanks to its growing data center business.

Just when you start to see hints indicating the boom of artificial intelligence (AI) stocks is coming to an end, signs that the boom will continue emerge. That has helped AI stocks continue to rocket higher and higher.

Of course, that upward trajectory won't last forever, but that doesn't mean there aren't opportunities to benefit while it does. For investors seeking great long-term exposure to this burgeoning industry, leaders like Meta Platforms (META -2.12%), ASML (ASML -0.44%), and Nvidia (NVDA -3.47%) can provide it. Here's why these three AI stocks are still a buy in 2025.

Image source: Getty Images.

It's not only a great Q2 performance that makes Meta a must for AI investors

The headline figures for Meta's second quarter were undeniably impressive. It crushed analysts' top- and bottom-line expectations in the second quarter, and management forecasted a strong performance in the third quarter, too. Whereas the analysts' consensus forecast for Q3 revenue is $46.3 billion, Meta is guiding for sales in the range of $47.5 billion to $50.5 billion.

What really caught my attention, though, was Mark Zuckerberg's comment on the earnings conference call. The Meta CEO said his company has "begun to see glimpses of our AI systems improving themselves. The improvements are slow for now, but undeniable. Developing superintelligence -- which we define as AI that surpasses human intelligence in every way -- we think is now in sight."

Meta is clearly developing into an AI leader that's leveraging the technology to increase user engagement. Daily active users on Meta products have increased every quarter, from 3.07 billion in Q2 2023 to 3.48 billion in Q2 2025. Monthly active users on Threads, for example, are growing rapidly, rising to over 400 million users from 350 million in April, narrowing the gap between it and X.

The company's progress in developing generative AI (and other AI tools) is no small achievement, and it could go a long way in distinguishing the company from its peers. There's no denying the company's leadership and allure as an AI investment option.

What's in a name? ASML stock smells just as sweet as its more recognizable peers

Forget the fact that you may not recognize its name as readily as AI hardware titans like Nvidia and Broadcom. The fact is that ASML plays a crucial role in the manufacturing of AI-capable semiconductors. As the world's only manufacturer of extreme ultraviolet (EUV) lithography systems, it is in a class by itself. These vital systems are capable of printing features on microchips at smaller sizes and higher densities than any rival's equipment. As such, they are the only lithography systems that can be used to produce the industry's most sophisticated and powerful microchips, such as those used in AI applications.

While ASML has a competitive advantage as the only manufacturer of EUV systems, it's not resting on its laurels. The company continues to innovate, and its newest EUV system, the Twinscan EXE:5200B, is already receiving interest from major chipmakers, including Taiwan Semiconductor Manufacturing and Intel.

Some investors are skittish about ASML's near-term outlook as the rollout of those new systems may extend deeper into 2026. For that reason, shares of ASML are now available at a discount. Whereas its five-year average operating cash flow multiple is 36, shares are now changing hands at 23.1 times operating cash flow. With the stock sitting on the discount rack, now's a great time for investors to act.

Nvidia's a great option for risk-averse AI investors

It seems almost impossible to have a conversation about the AI sector without Nvidia's name popping up. The company invented the graphics processing unit (GPU) and has long dominated that niche of the chip industry. And today, GPUs -- most of them Nvidia designs -- provide the key parallel processing power in the data centers where most AI computing workloads are handled.

The critical role that Nvidia plays is evident in the company's financials. In the first quarter of its fiscal 2026, Nvidia reported revenue of $39.1 billion for its data center business -- a year-over-year increase of 73%.

Because of its dominant position among semiconductor stocks, Nvidia is a great option for investors looking to add an AI position while also keeping their portfolio risk reasonable. The fact that the company effectively prints money makes it even more compelling for risk-averse investors.

Data by YCharts.

Trading at 58 times trailing earnings, Nvidia stock may seem pricey, but the stock often trades at a high multiple. Compared to its five-year average P/E of 69.7, today's valuation looks a lot more palatable -- and perhaps even like a bargain.

Which AI opportunity is right for you?

For a low-risk AI investment option, Nvidia stock is a great option at this point, while those interested in a generative AI leader will want to gobble up Meta stock. But investors who see the appeal of a company that has a monopoly on hardware that's vital to the production of AI chips will want to pick up some shares of ASML.

免责声明:投资有风险,本文并非投资建议,以上内容不应被视为任何金融产品的购买或出售要约、建议或邀请,作者或其他用户的任何相关讨论、评论或帖子也不应被视为此类内容。本文仅供一般参考,不考虑您的个人投资目标、财务状况或需求。TTM对信息的准确性和完整性不承担任何责任或保证,投资者应自行研究并在投资前寻求专业建议。

热议股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10