Okta, Inc. (NASDAQ:OKTA) reported better-than-expected second-quarter financial results and raised its FY26 guidance above estimates on Tuesday.

Okta reported second-quarter revenue of $728 million, beating analyst estimates of $712.01 million, according to Benzinga Pro. The cloud-native cybersecurity company reported second-quarter adjusted earnings of 91 cents per share, beating analyst estimates of 84 cents per share.

"Okta's unified identity platform is winning customers ranging from the world's largest global organizations to massive government agencies," said Todd McKinnon, co-founder and CEO of Okta.

Okta expects third-quarter revenue of $728 million to $730 million versus estimates of $723.55 million. The company anticipates third-quarter adjusted earnings of 74 to 75 cents per share versus estimates of 75 cents per share.

Okta also raised its full-year guidance. The company now expects fiscal 2026 revenue to be in the range of $2.875 billion to $2.885 billion, up from prior guidance of $2.85 billion to $2.86 billion. The company now expects full-year adjusted earnings of $3.33 to $3.38 per share, up from prior guidance of $3.23 to $3.28 per share. Analysts are forecasting full-year revenue of $2.864 billion and full-year earnings of $3.28 per share, per Benzinga Pro.

Okta shares jumped 2.5% to $93.82 on Wednesday.

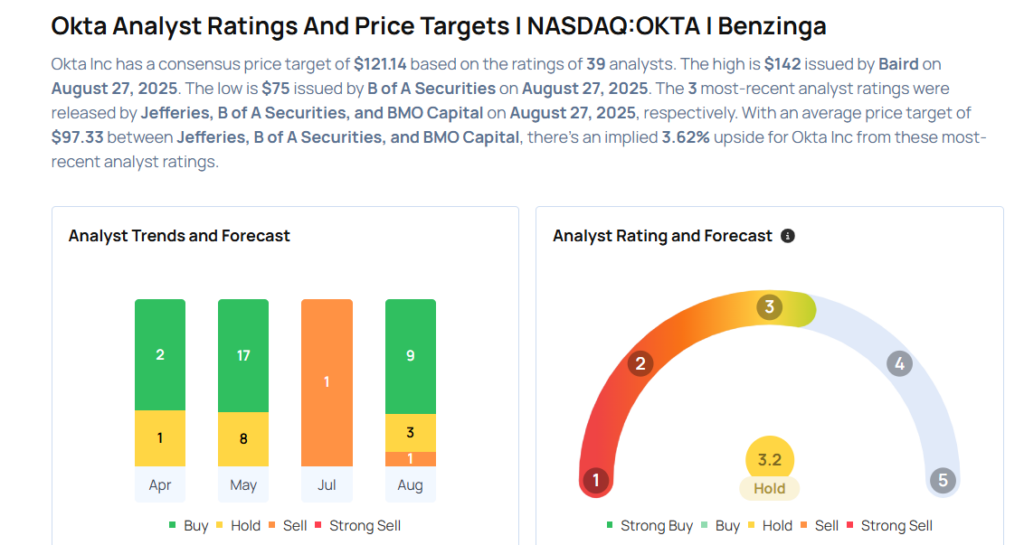

These analysts made changes to their price targets on Okta following earnings announcement.

- RBC Capital analyst Matthew Hedberg maintained Okta with an Outperform rating and raised the price target from $113 to $115.

- Scotiabank analyst Patrick Colville maintained the stock with a Sector Perform and lowered the price target from $115 to $105.

- Baird analyst Shrenik Kothari maintained Okta with an Outperform rating and lowered the price target from $148 to $142.

- BMO Capital analyst Keith Bachman maintained the stock with a Market Perform and lowered the price target from $132 to $112.

- Jefferies analyst Joseph Gallo maintained Okta with a Hold and raised the price target from $100 to $105.

Considering buying OKTA stock? Here’s what analysts think:

Read This Next:

- Top 2 Utilities Stocks That May Fall Off A Cliff In Q3

Photo via Shutterstock