LivaNova (LIVN) is making headlines this week after announcing the commercial launch of its Essenz Perfusion System in China, following recent local regulatory approval. For investors, this move represents more than just a product expansion, as it positions LivaNova to enter the world’s second-largest market for heart-lung machines. With China’s extensive cardiac surgery needs and a technology-driven system co-developed with clinicians, this milestone could serve as a meaningful catalyst for future growth.

This news comes as LivaNova’s stock has delivered a return of nearly 20% over the past year and gained 28% in the past month, reflecting a surge in momentum alongside strong revenue and net income growth rates recently reported. While three-year returns are still slightly negative, this year marks a sharp turn, and recent updates such as expanding Essenz availability worldwide help illustrate renewed optimism around the company’s trajectory.

The question for investors now is whether the recent excitement has left room for further upside. Is LivaNova presenting a real buying opportunity, or has the market already priced in this next chapter of growth?

Most Popular Narrative: 13.6% Undervalued

According to community narrative, LivaNova is currently considered undervalued, with analysts projecting meaningful upside based on future earnings and revenue improvements.

Analysts are assuming LivaNova's revenue will grow by 6.4% annually over the next 3 years. Analysts assume that profit margins will increase from -16.1% today to 10.7% in 3 years time.

Curious about why many believe LivaNova's future could surprise the market? This narrative focuses on ambitious growth in both sales and profitability, with the potential for a financial comeback that could attract investor attention. Learning about the specific numbers behind this valuation case, including profit and margin assumptions, could provide a new perspective on the stock’s potential.

Result: Fair Value of $64.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing cost pressures or regulatory setbacks could curb LivaNova’s growth. For this reason, it is important for investors to weigh potential risks carefully.

Find out about the key risks to this LivaNova narrative.Another View: Discounted Cash Flow Perspective

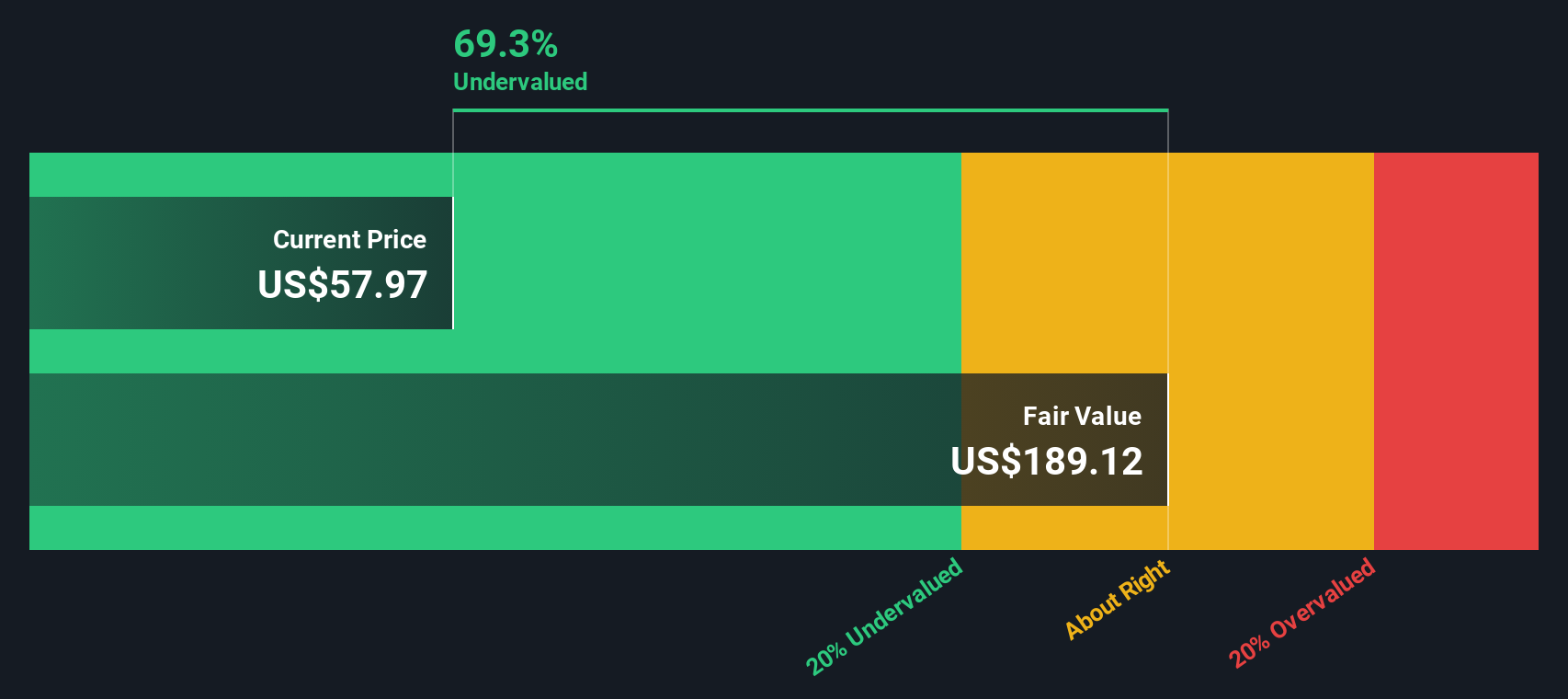

While analysts use future earnings projections to estimate LivaNova’s value, our DCF model provides a different perspective. This approach takes long-term cash flows into account and currently suggests the stock is undervalued. Could the market be overlooking something important in these projections?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own LivaNova Narrative

If you see LivaNova's story differently, or want to dig deeper into the data yourself, you can put together your own view in just a few minutes and do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding LivaNova.

Looking for More Investment Ideas?

Opportunities do not wait. Stay ahead of the market by targeting stocks making real moves in fast-growing sectors or offering resilient returns. Here are three lucrative angles to help you power up your next investment decision:

- Maximize your income potential by targeting companies that offer more than a 3% yield with dividend stocks with yields > 3%.

- Tap into the exciting world of artificial intelligence by picking out leading innovators in health and biotech trends with healthcare AI stocks.

- Spot undervalued gems whose strong cash flows might be missed by others. Accelerate your research with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com