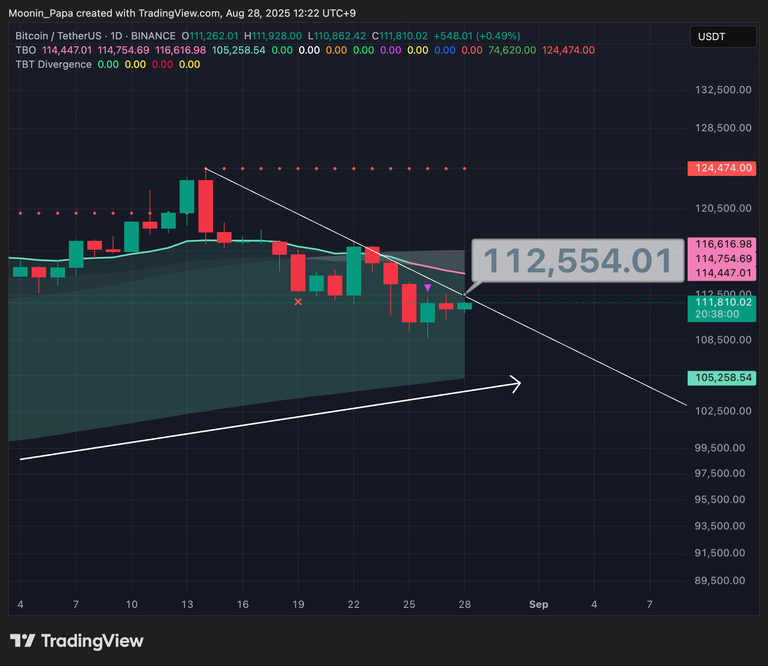

BTC Consolidates, ETH Flashes Bearish Signals

Bitcoin remains stuck inside the daily TBO Cloud, a sign of bearish consolidation. A break above short-term resistance around $112,500 could ignite a broader rally.

However, attention has shifted to ETH, which just printed a TBT Bearish Divergence Cluster—a historically bearish sign. But with the daily TBO Slow line still sloping upward, it might be a false signal. Two new 4h TBO Close Longs for ETH echo the August 16 setup that led to an -8% drop, raising concerns of a similar pullback.

Stablecoin Dominance Hints at Fear, Market Stress

Stablecoin Dominance is flashing warnings again. It has pierced overhead resistance four times in the past four days. A daily close above this level would signal heightened fear and suggest deeper corrections for altcoins. This pressure aligns with ETH’s potential pullback, which could also weaken the ETH/BTC ratio.

SOL Emerging as the New Market Driver

Despite BTC and ETH’s turbulence, SOL has been gaining momentum. Ethereum Dominance remains strong bullish, but Solana’s strength is now impossible to ignore. SOL.D has surged to 2.93%—its highest level since February—while BTC.D remains in a strong bearish posture. If ETH stumbles, SOL could quickly become the new leader for the altcoin market.

TOTALES on the Edge of Breakout

The TOTALES chart is still consolidating within the daily TBO Cloud. Once it breaks above resistance at 3.63T, it could trigger a market-wide breakout. Given SOL’s dominance and upward trajectory, it’s well positioned to lead that breakout when it happens.

Learn my strategies and the tools I use every day by visiting The Complete Cryptocurrency Investor by Mastering Assets.