DocuSign, Inc. (NASDAQ:DOCU) will release earnings results for the second quarter after the closing bell on Thursday, Sept. 4.

Analysts expect the San Francisco, California-based company to report quarterly earnings at 85 cents per share, down from 97 cents per share in the year-ago period. DocuSign projects to report quarterly revenue of $780.59 million, compared to $736.03 million a year earlier, according to data from Benzinga Pro.

On June 5, DocuSign reported first-quarter earnings of 90 cents per share, which beat the analyst consensus estimate of 81 cents. Quarterly revenue came in at $763.7 million, beating the Street estimate of $748.13 million.

DocuSign shares gained 2.5% to close at $75.90 on Wednesday.

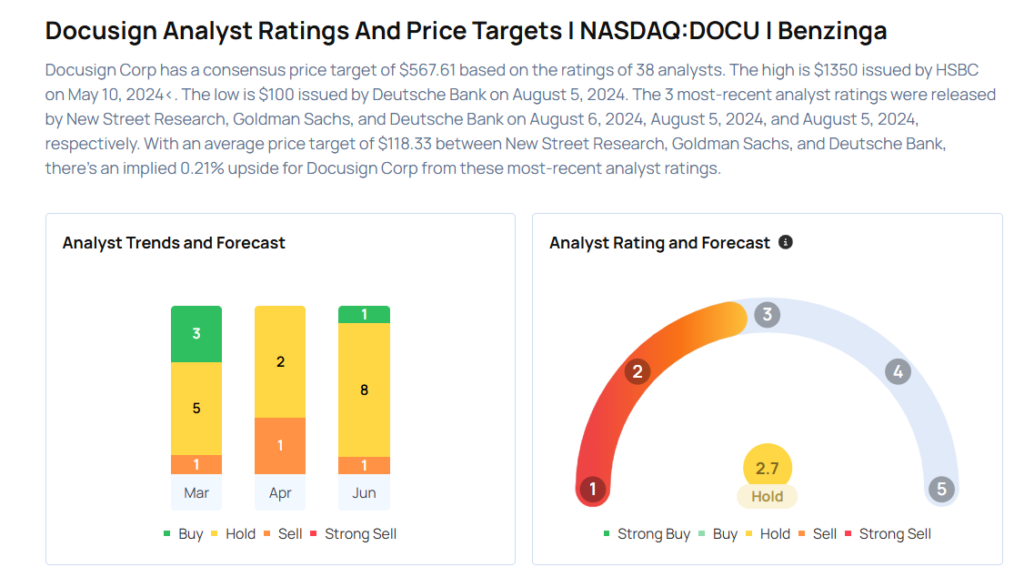

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Wedbush analyst Daniel Ives maintained a Neutral rating and cut the price target from $100 to $85 on June 12, 2025. This analyst has an accuracy rate of 81%.

- Citigroup analyst Tyler Radke maintained a Buy rating and slashed the price target from $115 to $100 on June 9, 2025. This analyst has an accuracy rate of 69%.

- B of A Securities analyst Brad Sills maintained a Neutral rating and cut the price target from $88 to $85 on June 6, 2025. This analyst has an accuracy rate of 67%.

- Morgan Stanley analyst Josh Baer maintained an Equal-Weight rating and slashed the price target from $92 to $86 on June 6, 2025. This analyst has an accuracy rate of 66%.

- JP Morgan analyst Mark Murphy maintained a Neutral rating and cut the price target from $81 to $77 on June 6, 2025. This analyst has an accuracy rate of 74%.

Considering buying DOCU stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Financial Stocks With Over 11% Dividend Yields

Photo via Shutterstock