Core & Main, Inc. (NYSE:CNM) reported mixed second-quarter financial results and narrowed its FY25 sales guidance below estimates on Tuesday.

Core & Main reported quarterly earnings of 87 cents per share which beat the analyst consensus estimate of 79 cents per share. The company reported quarterly sales of $2.093 billion which missed the analyst consensus estimate of $2.138 billion.

Core & Main narrowed its FY2025 sales guidance from $7.600 billion-$7.800 billion to $7.600 billion-$7.700 billion.

“I am proud of our associates’ dedication to supporting customers in delivering critical infrastructure projects,” said Mark Witkowski, CEO of Core & Main.

Core & Main shares fell 0.1% to $49.68 in the pre-market trading session.

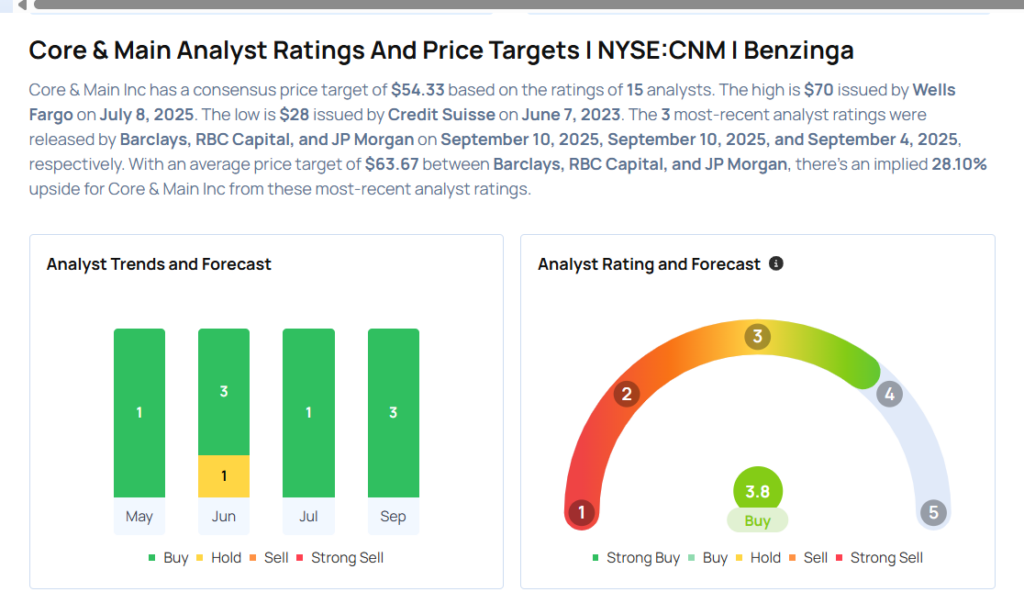

These analysts made changes to their price targets on Core & Main following earnings announcement.

- RBC Capital analyst Mike Dahl maintained Core & Main with an Outperform rating and lowered the price target from $67 to $62.

- Barclays analyst Matthew Bouley maintained the stock with an Overweight rating and cut the price target from $69 to $65.

Considering buying CNM stock? Here’s what analysts think:

Read This Next:

- Oxford Industries Gears Up For Q2 Print; Here Are The Recent Forecast Changes From Wall Street’s Most Accurate Analysts

Photo via Shutterstock